| MONEY DAILY | Commentary on Stocks - Bonds - Gold - Silver - Crypto - Oil/Gas and more |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | WILD SIDE | CONTACT | ARCHIVES |

Weekly Survey of Gold and Silver Prices

Single Ounce Silver Market Price Benchmark

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

|

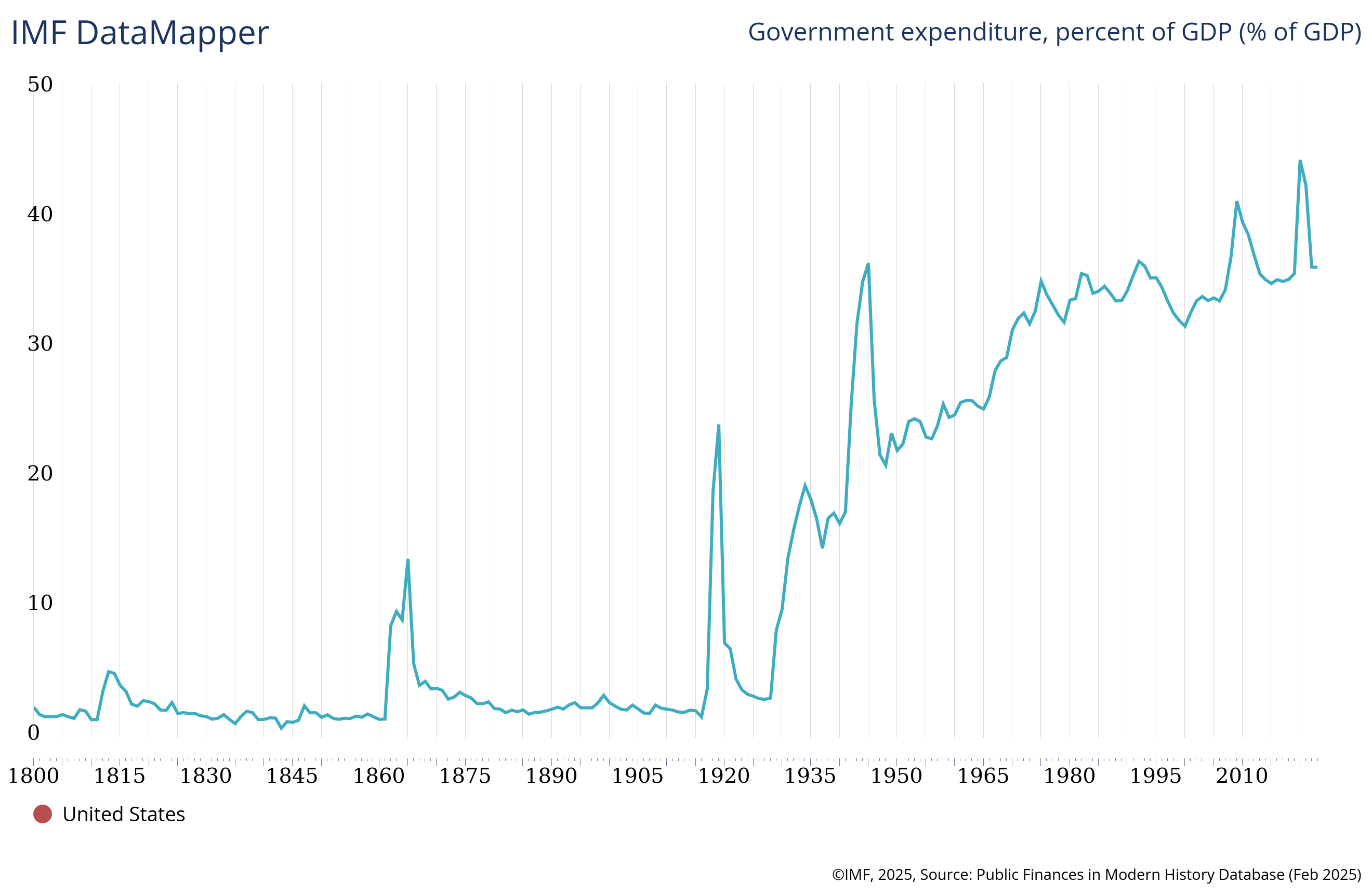

Friday, June 27, 2025, 9:18 am ET Continuing to look at just how fake the U.S. economy is today, one need go no further than the GDP numbers released on Thursday to understand what comprises the so-called U.S. $30 Trillion economic juggernaut. Right off the bat, one needs to deduct at least 30% of total GDP from whatever figure one is using because that is the percentage of GDP that is government spending, which produces nothing and accounts for $200 toilet seats, $57 screwdrivers and other absurd excesses. The chart below, from the IMF, shows how government's contribution to GDP has grown over the years, from about two percent before the 1930s Great Depression to well above 30% since around 1970. So, GDP, being vastly overstated, is a complete canard, and a horrible measure of a nation's productivity.

One would have to reach back and re-jigger all the data, stripping out government expenditures, from the 1920s forward, to even get anything that somewhat resembles a true picture of the U.S. economy. With the government's greedy hands in everything from lemonade stands to B-2 bombers, it's hard to imagine any economy - much less that of the bloated U.S. - that doesn't include purchases by the government to boost its attractiveness to worldly-wise investors. Beyond the obvious overhyped nature of the U.S. GDP, what's interesting about this latest estimate (3rd revision), is that it shows the PCE Index - which is, as has been mentioned ad nauseum over the past few years - the Fed's favorite inflation reading, ramping up to 3.7%. If the Fed's target for inflation is two percent and their BFF indicator is at 3.7% it doesn't take a genius to figure out that they haven't beaten inflation, as they claim they have. It also explains why stocks have been soaring. Precisely because inflation continues to ravage consumers, Wall Street sees this trend as extremely positive toward the Fed cutting interest rates, possibly as soon as their July FOMC meeting in another five weeks (July 29-30). By then, the S&P might be approaching 7,000 and the Dow over 45,000. But, that's not all. The BEA also reported that consumer spending fell 0.1% in May, which stands to reason. People tend to spend less when prices are too high. But, that's enough about the fake U.S. economy. Taking a look at the recent stock market upswing, it's clear that Wall Street has joined hands with Washington and the mainstream media in claiming victory over Iran with the bombing runs this past Saturday. Stocks have roared over the following days, with the S&P making a new all-time high on Thursday, which is not only fake, but also something else, that we're not allowed to speak of in the politically correct matrix in which we reside. So far this week, stocks are banging up hard. The Dow is up 1180 points through Thursday's close. NASDAQ has tacked on some 720 points and appears to be not done yet. The S&P is up 173 points the past four sessions, so, apparently, the world is safe for democracy once again and Trump's tariffs don't matter now that our spectacular military has utterly demolished Iran's ability to enrich uranium to weapons-grade levels, which is all well and good, except that it's not true. As the world lurches into the last weekend before the fourth of July, stock futures are once again registering to the upside, while gold is down another $64 this morning, to $3,283. Silver is also lower, at $36.15, which is, relatively speaking, not all that underpriced. Gold peaked at $3,407 on Monday, so it's down just $124, which, after the gains made the past two years, isn't really much. But, who needs pet rocks when you've got the Fed, the media, the military, the President, and congress all singing from the same hymn book?

At the Close, Thursday, June 26, 2025:

Thursday, June 26, 2025, 9:20 am ET One item that was left out of Wednesday's screed about the near-complete falsity of American politics and media was the mighty U.S. dollar, that, since 1944, has been regarded as the world's reserve currency. Sadly, even the U.S. substitute for money is as fake as the proverbial three-dollar bill. Whereas a single greenback might have bought an entire breakfast back in the 1960s and early 1970s, today's dollar will barely cover the retail cost of two raw eggs. The Federal Reserve Notes that circulate across the country and around the world have been issued is such magnificent volume that the value of the "buck" or "Fedbuck" has fallen precipitously, especially since President Richard M. Nixon ended the convertibility of dollars into gold back in August of 1971. Consider, for a moment, that a single slim dime, made of 90% silver, could have purchased an entire candy bar, possibly two, prior to 1965, but today will only cover the cost of one fifth or less of a Fifth Avenue or Mars or Baby Ruth bar. Of course, today's dime is 91.67% copper, 8.33% nickel, according to coinflation.com. It has no - as in zero - silver content. An ounce of silver prior to it being demonetized and all U.S. silver coins taken out of circulation as of 1965, was about $1.35, or five silver quarters and a silver dime. The idea that an ounce of silver on spot markets is over $35 today illustrates the absolute decimation of the U.S. currency. It's that way because the cost of printing up a $100 bill is about three cents, and it gets even worse as the Federal Reserve doesn't even bother printing new bills these days, they just type in digits on one of their computers and send the fake dough out to one of their primary dealers (mostly big banks, like JP Morgan, Bank of America, etc.). The money supply has increased astronomically over time. In 1960, the U.S. money supply was about $400 billion. Today it's $21,942 billion, or, nearly $22 TRILLION.

Now certainly, the population of the United States has increased substantially over that 60-year period, but the roughly doubling of the population comes nowhere close to the 5,485% increase in the supply of fake, counterfeit Federal Reserve Notes or their equivalents. The United States' exceptional privilege of having the most-valued, highly-respected reserve currency is coming to a hasty conclusion and American citizens are paying an enormous price for the hubris of government and the profligate spending of congress, enabled by the Federal Reserve, which issues debt to the government in the form of treasury bills, notes, and bonds, which the same government is likely never going to be able to repay. While its easy to blame the Federal Reserve for the massive inflation and loss of purchasing power of the currency, it's the government that should shoulder most of the blame. They are the ones that have run up debt of over $37 trillion, effectively increasing the money supply to unforgivable levels. People elected by U.S. citizens themselves have betrayed the trust of the populace for far too many years and there appears to be no inclination that they intend to stop. The current "big, beautiful bill" before the Senate virtually guarantees a deficit of more than $1.5 trillion in fiscal 2026. Voting for Donald J. Trump las November was supposed to at least slow the roll of the spendthrifts in congress, but, apparently, not even the Orange Don can be trusted to do the right thing. At this point in time, most Americans cannot afford to buy a home. The median existing home price rose 1.3% from a year earlier to $422,800 in May, the National Association of Realtors (NAR) reported Monday. That puts the monthly mortgage payment in excess of $2,000, a number that a two-earner family making $100,000 pre-tax total, would be stretching to make, and that's before PMI, taxes, and insurance. It's just beyond ridiculous. Rents are even more extreme. Food prices aren't coming down any time soon, so the numbers on welfare continue to grow. Americans have been sold out and are facing very tough choices in the coming months and years. An hour before the opening bell, the BEA announced its third estimate of first quarter GDP, figuring a contraction of 0.5% for the three months ended March 31. The previous estimate was 0.2%, though most of the decline is being blamed on imports, as businesses rushed to purchase inventory from foreigners prior to President Trump's proposed tariffs. That's a flat-out lie. The U.S. economy is toast and the government will do anything and everything in its power - including sending the stock market to all-time highs - to keep that information hidden from the American people, and, maybe more importantly, from foreign investors. Stock futures are up, but off their morning highs. Go figure.

At the Close, Wednesday, June 25, 2025:

Wednesday, June 25, 2025, 9:00 am ET Just about everything that comes out of Washington, D.C. or Wall Street is complete and utter nonsense. All fake, all lies, all the time. Nothing they do benefits the citizens of the United States and hasn't for years, probably decades. Everything is done to protect the status quo, which consists of - in no particular order - grifting by congress off the bloated federal "budget" (What a joke. The U.S. government hasn't had a proper budget since the 1980s), paying interest to the Federal Reserve, protecting and supporting Israel and Ukraine, lining their pockets with contributions (Washington) and retail investor funds (Wall Street). In the matter of President Trump's gloating over the recent strikes on Iran, it was all for show, designed to get Israel out of a bad situation. Don't believe me. Do some research. Start with the substack by Simplicious and this ZeroHedge article authored by Pepe Escobar. As far as Wall Street is concerned, it's all run on algorithms that operate off of mainstream media news headlines with little to no human input. Eventually, Bloomberg, CNBC, and Fox Business will just write headlines that please the algorithms, whether they are true or not. If New York got nuked, Bloomberg might pen a headline like, "Massive redevelopment underway in Manhattan with Russian assistance." That's just how the little midget who thought he might be president some day rolls. Mike Bloomberg is a rich guy who could care less about the country in which he lives and made his fortune. Anyhow, stocks just keep going up. What's not to like? Maybe the purchasing power of the dollar? Same buck, buys less every day. Those of us in our senior years probably remember our parents or grandparents complaining about the price of a candy bar or some other item. They'd say, "it used to be a penny when I was a kid." We laughed, and thought, oh, these old folks. Now, we're the ones looking at a Fifth Avenue or Baby Ruth at the candy counter, remarking that the 50-cent candy bar used to be a nickel or a dime when we were kids (1950s and 1960s) and, they were BIGGER. We're not delusional, nor senile, yet. Everything was much, much less expensive 50, 60, 70 years ago. But, that's progress! Yes, if one defines progress as obliterating the middle class through inflation while putting everybody into debt slavery and the U.S. government $37 trillion in debt and paying over A TRILLION DOLLARS A YEAR in interest on that ungodly amount of debt. A new car in the early 1970s cost somewhere between $1500 and $3000. Teenagers were able to buy their first used car for a couple hundred bucks. The median price of an existing home was, well, orders of magnitude cheaper than today, and, back then, homes were built with good lumber, concrete, bricks, etc. Trump's Big Beuatiful Bill is going to be a train wreck after the Senate gets through with it and sends it back to the Hosue. It's loaded with pork and earmarks and loads of helping hands to big corporations with nothing for small business. Nothing outside the extension of the 2017 tax breaks and maybe the funding for more border control are any good. As it was originally written, it would produce a $2 trillion deficit, so why bother promoting it as some kind of magic pill for Americans? Trump and others in the MAGA crusade use the term, "America First" to describe their basic intent. What Americans need is a government that supports "Americans First." There's a big difference. And, what ever happened to the hundreds of billions in waste, fraud, and abuse that Elon Musk and his DOGE team unearthed? Congress has managed to cut that down to about $9.2 billion in savings. Originally, Musk and Vivek Ramaswamy were supposed to have been working at the Department of Government Efficiency (DOGE) until July 4, 2026. Well, Ramaswamy left early on to run for governor of Ohio, but Musk carried on and did exceptional work, but it's not even July 4, 2025, and he's already gone (and disgusted with government). So much for fixing the broken federal government. The powers that be, the status quo, aren't interested in fixing anything, besides, well, elections. If there's any hope at all, maybe the BBB will blow up in congress and the government will shut down on October 1. Don't count on it, though. What's more likely to happen is what always happens, they (the Uniparty) will reach a compromise on another three or six-month continuing resolution and move on to the next crisis. Under the current leadership, despite Trump's best efforts, thwarted at every turn, America is burnt toast, with Wall Street and Washington requesting theirs be buttered on both sides. Meanwhile, Fed Chairman Jerome Powell gave his semi-annual testimony on monetary policy to the Committee on Financial Services in the House on Tuesday. Did anybody even notice? He's scheduled to spew before the Committee on Banking, Housing, and Urban Affairs in the U.S. Senate, Wednesday. Nobody gives a damn what he has to say, mostly because it's all fake or gibberish, or both. Prepare for more fakery, because, at this point, it's all they've got.

At the Close, Tuesday, June 24, 2025:

Tuesday, June 24, 2025, 9:27 am ET "Political power grows out of the barrel of a gun." - Mao Tse Tung U.S. foreign policy used to be described as "gunboat diplomacy," wherein the U.S. Navy would sit off the coastline of the opposition and shell them into agreement on any demands the U.S. might be seeking. It wasn't new. Other countries such as France and Great Britain, used the tactic to great success in the 19th century. The U.S. experience was made by presidents Teddy Roosevelt and Woodrow Wilson. Nowadays, the U.S. doesn't just use the threat of violence to get what it wants, it actually uses violence - as demonstrated over the weekend by the bombing of Iranian nuclear facilities - to achieve its ends. While some tomahawk missile strikes were made from submarines in the Persian Gulf, the bulk of the action was carried out by B-2 Stealth bombers with bunker-busters and other ordnance. The strike on Iran and Monday's "cease fire" initiated by President Trump to end the conflict between Israel and Iran are being hailed as a big success in the military and political community. Wall Street loves it as well, sending stocks higher Monday with futures soaring Tuesday morning. With the ability to strike virtually anywhere on the planet, Trump's "B-2 Diplomacy" resonates with Roosevelt's, "walk softly and carry a big stick," foreign policy. As far as the effectiveness of the policy is concerned, that remains to be seen. While the initial objective of crippling Iran's nuclear ambitions seems to have been achieved, the "cease fire" is nothing other than a pause in the Middle East miasma that's been going on for centuries. Iran isn't going away, nor is Israel. For now, there's a break in the military action. There's no peace agreement, so the conflict will alsmost certainly go hot at some time in the future. Until then, Wall Street can focus on the President's "Big Beautiful Bill" and reaching for all-time highs on the various U.S. indices.

It won't take much to push stocks up, up, and away. Here are the all-time high targets with their respective dates: Given the MAGA theme and economic data suggesting a muddled business environment, a couple percentage points on the majors shouldn't be a problem. After all, stocks remain in one of the biggest bubbles in the history of the world. The Shiller PE, closed yesterday at 36.72, short of the recent high from October, 2021, 38.58. Meanwhile, just because Israel and Iran stopped shelling each other and the "threat" of a nuclear-armed Iran has been softened, gold is no longer as valuable as some might have hoped, at $3,329.00, down $66 this morning. Silver is back below $36. Money Daily was dead on in the Weekend Wrap this past Sunday, saying:

Iran has threatened to close the Strait of Hormuz, which is laughable, since all Iranian oil flows through there with China as the destination 90% of the time. Because Iran presumably would not cut off its own revenue stream, oil remains only slightly elevated instead of stupidly high. Fact of the matter is that there's still a global glut and will be until either Russia, Saudi Arabia, or the U.S. is shut off, shut down, or the regular flow somehow curtailed, which is, naturally, very, very unlikely to occur. Oil got crushed Monday, with WTI crude dropping more than $10, from a high of $75.29 to a low of $64.83. Buy stocks. Be happy.

At the Close, Monday, June 23, 2025:

Sunday, June 22, 2025, 10:40 am ET Wars are always the province of politicians or bankers, often both. For the most part, Russians, Iranians, Israelis, Ukrainians, and Americans would find common ground and get along just fine without trying to kill each other, steal others' resources, or generally cause havoc. Most of the world is actually peaceful. Given that people have allowed power-hungry sociopaths to make the rules, people will arm up, kill, or die in the quest for conquest. That seems to be the common cause through most of recorded history, so, here we are again. Once the conflict in the Middle East gained traction (Thursday, June 12), markets reacted negatively on Friday, the 13th, but then rebounded the following Monday. After that, it's been a downhill grind, even with Juneteenth forcing U.S. markets to take a day off. Bottom line, most markets are back where they began, almost as though not a single missile was fired, not a single threat made, no bombs dropped, drones exploded. It's like a dreamscape to the money masters. That was the condition until Saturday, when the U.S. struck three suspected nuclear sites at Fordow, Natanz, And Esfahan in Iran with bunker-buster bombs dropped from B-2s and Tomahawk cruise missiles fired from submarines. President Trump, in a brief televised statement Saturday evening, announced the successful operations, warning Iranian leadership against any continued aggression. Markets are likely to view this action positively come Monday.

The most consequential moves of the week just past were on the NYSE Composite (-112.71, -0.56%) and the Dow Transports (+79.24, +0.54%). Other than those minor movements, pfft! Hardly worth reporting at all. The week ahead, in the aftermath of the U.S. strikes on Iran, should be more impactful. Wednesday's FOMC policy decision (no change) was a bomb of another kind, an empty vessel, the Fed. It would serve the planet better if they were dissolved. Even though the bulk of earnings season is well past, there are a few companies still reporting first quarter or fiscal quarter earnings this week: Monday: (before open) Factset (FDS); (after close) KB Home (KBH) Tuesday: (before open) Carnival Cruise Lines (CCL); (after close) FedEx (FDX) Wednesday: (before open) Paychex (PAYX), Winnebago (WGO), General Mills (GIS); (after close) H.B. Fuller (FUL), Micron (MU) Thursday: (before open) Walgreens Boots Alliance (WBA), McCormick (MKC); (after close) Nike (NIKE), American Outdoor Brands (AOUT). On Monday, May Existing Home Sales will be the key data in focus, along with S&P flash Purchasing Managers Index (PMI) for June. Fed Chairman will be before both houses of congress this week, giving his semi-annual testimony on monetary policy to the Committee on Financial Services in the House, on Tuesday, and to the Committee on Banking, Housing, and Urban Affairs in the U.S. Senate, Wednesday. Also on Wednesday, May New Home Sales. The third (and final) estimate of first quarter GDP will be released by the BEA on Thursday along with Durable Goods Orders for May. The Personal Consumption Index (PCI) result for May is out Friday before the bell. The Fed will also be releasing the results of its annual big bank stress tests Friday.

Federal Reserve governors, district presidents, et. al. are among the most worthless people alive. They produce a lot of reports, charts, and white papers, make speeches, issue policies, mostly amounting to little more than excess pain imposed upon the general public. While the Bible tells us the root of all evil is the love of money, those who purport to control whatever is used as currency may not necessarily be mendacious or mercenary. More likely, they are simply misguided. There was an FOMC meeting last week (June 17-18) which amounted to little more than idle speculation, and not much of it at that. The Federal Reserve has become so distant from market realities, its existence should be brought into question. Sadly, there aren't enough politicians to actually challenge their authority, so, as history has proven time and again, individuals will take it upon themselves to find ways out of the monetary morass. The Fed's dot-plots suggested two rate cuts this week, and, while the EU and many other countries are stimulating their economies by lowering rates, the U.S. position remains unmoved. According to their various voices, Fed officials are waiting to see the effects of tariffs and President Trump's big, beautiful bill, the monstrosity in motion. Oddly enough, the Fed saw fit to lower interest rates by a full percentage point late last year. Now, they are content to sit upon their tiny hands. As shown in the table above, rates didn't move much, the largest being six basis points on two-and-five-year notes. Spreads widened further with 2s-10s at +48, up three basis points, and full spectrum at +69, matching the high from two weeks ago. Spreads:

2s-10s

Full Spectrum (30-days - 30-years) Oil/Gas $74.04 was the closing price of WTI crude oil in New York on Friday, after closing at $71.53 the prior week (6/13). Israel and Iran have each attacked energy depots in the opposing country with drones and missiles. Iran has threatened to close the Strait of Hormuz, which is laughable, since all Iranian oil flows through there with China as the destination 90% of the time. Because Iran presumably would not cut off its own revenue stream, oil remains only slightly elevated instead of stupidly high. Fact of the matter is that there's still a global glut and will be until either Russia, Saudi Arabia, or the U.S. is shut off, shut down, or the regular flow somehow curtailed, which is, naturally, very, very unlikely to occur. The oil price may take a hit lower after the U.S. strikes, or, if Iran retaliates, it could go higher, though the odds are for a calming in the market. It didn't take long for gas prices to reflect higher oil prices, largely the result of the Israel-Iran tiff. Merchants and their corporate overlords were reluctant to lower prices when WTI crude was in the $50s, but they wasted little time hiking them as the "travel season" gets underway, just like the good old days, when ExxonMobil and Chevron were raking in excess - often described as "windfall" - profits on the back of OPEC embargoes and squeezes and presidents with the last name Bush or Clinton. Gasbuddy.com is reporting the national average for a gallon of unleaded regular gas at the pump at $3.21, up a solid nine cents from last week. $3.30-3.45 by the 4th of July is probably not out of the question, maybe even higher, depending on the narrative and extent of blowback after the U.S. assault on Iran. The highest prices in the country remained California's, at $4.64, up three cents on the week. Mississippi is still the low spot at $2.71, though that is six cents higher than a week ago and up 12 cents over the past two weeks. Every other state in the Southeast is at $2.80 or above as of Sunday morning. Oklahoma is at $2.80, Louisiana at $2.81. Arkansas and Tennessee are both quoted at $2.84, nearly 20 cents higher than the past few weeks. Texas and Alabama are both $2.85, with South Carolina at $2.86 and Georgia and North Carolina both $2.93. Florida jumped 18 cents, from $2.90 to $3.08. The Northeast continues to be led by Pennsylvania ($3.38), up eighteen cents the past two weeks. All other New England and East coast states are all back above $3,00, ranging from $3.03 (New Hampshire) to $3.18 (Maryland). Prices were higher across the region. Midwest states are led by Illinois ($3.43), the price even with last week. Kentucky is the lowest in the region, at $2.87, followed by Kansas and Missouri ($2.90). The remainder of the Midwest ranges from $2.95 (North Dakota) to $3.28 in Michigan. Along with California, Washington was the only state above $4.00 for months, but is now joined by Oregon at $4.02, with Washington up eight cents to $4.43. Nevada ($3.77) was up just three cents. Arizona ($3.27), even though it was up only slightly, is still priced at a premium to neighboring New Mexico, a relative bargain, at $2.91. Idaho jumped nine cents to $3.35, with neighboring Utah up just three, at $3.27. Sub-$3.00 gas can be found in eight fewer states this week than last, with only 17 under the line. Lower gas prices for American looks to be a fading reality, though calmer conditions in the Middle East might bring gas prices lower. It's all geo-political now.

This week: $102,703.00 Bitcoin got as high as $107,602 on Tuesday, and, similarly to stocks, declined for the remainder of the week and into the weekend, dropping below $103,000 on Friday. Various millionaire morons in the Senate overwhelmingly passed the GENIUS act after voiding any and all amendments which had been holding up a final floor vote. The bill, which supposedly will allow the increasingly worthless U.S. dollar to be used in trade as stablecoin (pegged to the paper fiat currency), now moves to the House and eventually to the President's desk, where it will allegedly be signed into law with a virtual pen. Meanwhile, President Trump calls Fed Chairman Jerome Powell all kinds of names - including "stupid" - for not lowering interest rates, as if that actually mattered at all. With crypto, nobody needs interest rates or loans or credit. Just whip up the money out of thin air (sounds like a familiar, popular plan).

Gold:Silver Ratio: 94.14; last week: 94.93 Per COMEX continuous contracts:

Gold price 5/23: $3,357.70

Silver price 5/23: $33.64 Unsurprisingly, there was quite a bit of give-back on the COMEX in both gold and silver futures. Sure enough, with two proxy wars, nothing to worry about. Gold, an ancient relic. Silver, no longer a monetary metal. Just keep believing that as U.S. government debt exceeds $37 trillion. Worldwide, it's much worse. According to the usual, unreliable sources like the UN, IMF, or World Bank, total global debt - public, private, corporate - exceeded either $250 trillion or $300 trillion. Since it's all fiat (aka FAKE, substitute currencies), does it really matter who owes how much and to whom? Probably not. Keep stacking, especially silver. Even in case the gold:silver ratio (GSR) drops to a still-unreasonable 50, silver would be $67.69, nearly double the current price. Just for kicks, at the oft-quoted historical norm of 16:1, silver would be $211.53 today. Worth considering in the current, ongoing (and getting worse) age of delusion. Here are the most recent prices for common one ounce gold and silver items sold on eBay (numismatics excluded, free shipping):

The Single Ounce Silver Market Price Benchmark (SOSMPB) fell for a second straight week, to $42.50, a $1.64 decline from the June 15 price of $44.14 per troy ounce. Prices in the Sunday eBay survey indicate that buying is still very brisk with premia remaining enhanced. The price of silver apparently still has significant upside ahead and the prospect of a wider war in the Middle East adds to the safe haven value of gold in particular. Buying of finished silver in small denominations above $40 and even $45 per ounce has become commonplace, while gold bars and coins have remained above $3,500. WEEKEND WRAP This week on Wall Street put new meaning to the phrase, nothin' doin'. As of Saturday night, that is probably about to change.

At the Close, Friday, June 20, 2025:

For the Week:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|