| MONEY DAILY | Commentary on Stocks - Bonds - Gold - Silver - Crypto - Oil/Gas and more |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | WILD SIDE | CONTACT | ARCHIVES |

Weekly Survey of Gold and Silver Prices

Single Ounce Silver Market Price Benchmark

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

|

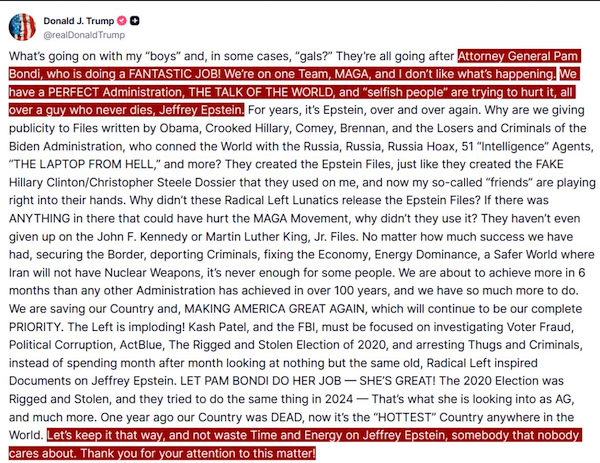

Friday, July 18, 2025, 9:20 am ET The circus continues. Now, days after calling anything and everything Epstein-related a "hoax", comparing to Russia-gate and Hunter Biden's "Russian disinformation" laptop, President Trump is calling on AG Pam Bondi to release more information, including sealed grand jury testimony. This new approach appears after the venerable Wall Street Journal reported late Thursday that it had unearthed a bawdy birthday letter from Trump to Epstein with a drawing of a naked woman, an acknowledgement that the two "have certain things in common," and a wish for "every day [to] be another wonderful secret." Trump has responded by threatening to sue the newspaper, saying that he never wrote the letter in question.

“This is not me. This is a fake thing. It’s a fake Wall Street Journal story. I never wrote a picture in my life. I don’t draw pictures of women. It’s not my language. It’s not my words.” This latest revelation begins to suggest that this entire chapter of American politics has been planned and rehearsed, designed to confuse the American public and destroy confidence in the president while stripping away his MAGA support. When all is said and done, including Epstein's procurer of young ladies, Ghislaine Maxwell, testifying to congress, nothing will come of it. There are too many careers at stake among the rich, powerful, and politically-connected for the information to be revealed fully to the unwashed masses. Jeffrey Epstein was almost certainly an intelligence asset of either MI6, the CIA, or Israel's Mossad, or even all three. The current disclosures, Trump's denial of involvement, congress seeking transparency is all more cheap theater and the elites that control the U.S. government and large swathes of the economy. The likelihood of anything substantial being released is close to zero. Meanwhile, Wall Street ignores the issue completely and has charged higher during the week, with the S&P and NASDAQ making new all-time highs again on Thursday, with the Dow lagging, still 530 points from its record close on December 4, 2025, at 45,014.04. As of Thursday's close, the Dow was ahead by 113 points for the week. NASDAQ is up 298, with the S&P sporting a gain of 37 points. The first week of second quarter earnings season featured generally-positive results from big banks, some disappointment and also some strong showings in the chip sector. Friday morning featured earnings reports from Huntington Bank (HBAN), Truist Financial (TFC), American Express (AXP), Ally Bank (ALLY), 3M (MMM), Regions Bank (RF), Charles Schwab (SCHW), and Comerica (CMA), helping futures maintain a positive footing, though marginal. It's been a trying week for the president and his associates, though they're showing few signs of stress. Retail sales were up for June. Gold and silver are on the move Friday morning, with gold at $3,366 and silver threatening $39 again, at $38.78, sloe to the high of the week. Crude oil continues to languish in the nid-60s. WTI is quoted at $67.10 just after 9:00 am ET.

At the Close, Thursday, July 17, 2025:

Thursday, July 17, 2025, 9:11 am ET

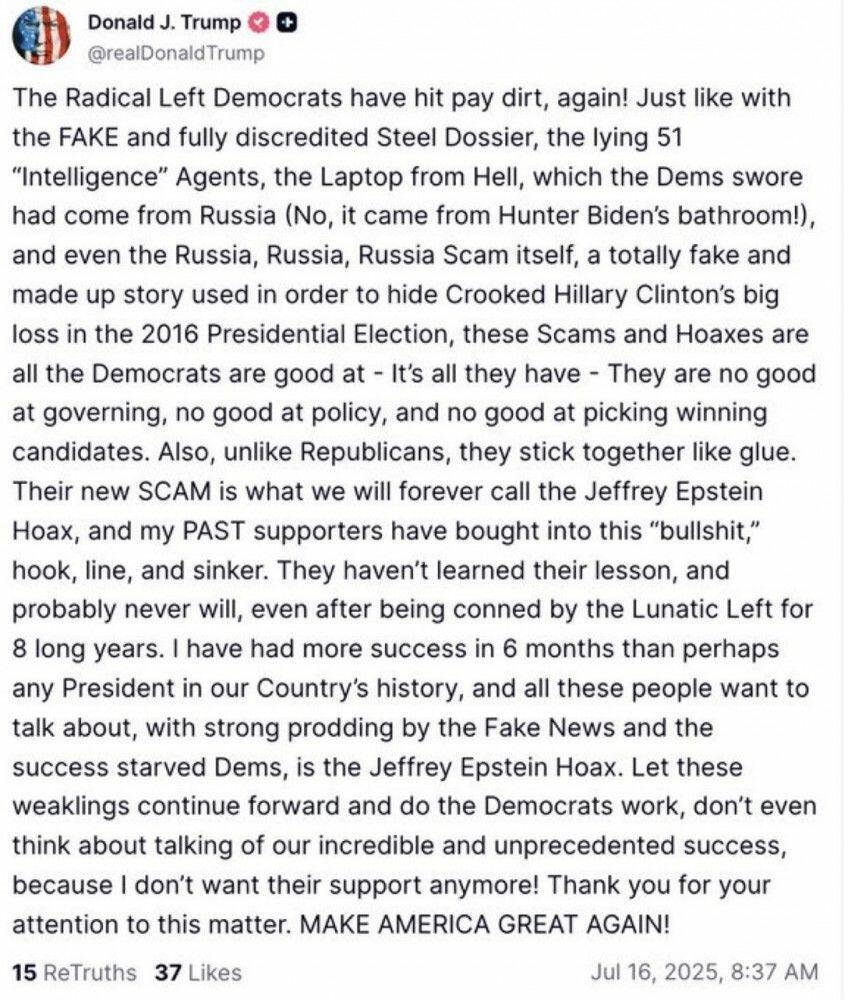

Fearless Rick reporting. Above is the latest - and extremely lame and insulting - "truth" from President Trump concerning the Epstein matter, which, for whatever reason, he would like to simply disappear into some vast voided chasm, never to be seen or heard again. Unfortunately for the president who campaigned on releasing the "Epstein files" on numerous occasions, this story will not go away, despite his protestations. The worst part of the president's latest rambling, nearly-incoherent message on the topic is his purposeful abandonment of his base, the people who supported him, who elected him. This is a slap in the face of millions of proud, patriotic Americans, many of whom will not take it, including myself. I supported Donald Trump from the very moment he rode down the Trump Tower elevator and announced his candidacy in 2015. I like to say, "I voted for him all three times he won," sarcastically supporting the fact that the 2020 election was stolen from him. NO MORE. My message to President Trump is a simple one. If you no longer want my support, fine with me. You're on your own. Best of luck. And, by the way, go F--- yourself. Thank you for your attention to this matter. Honestly, I don't know what happened to Mr. Trump, but I do know this: Whatever is in those files is so important, so revealing, so dreadful, people more powerful than Trump do not want them released to the public. Like the JFK files. Like 9-11. Like all the other disturbing, disgusting things the U.S. government has done over the years and hidden from the general public. I am an American. I will remain an American. I can handle the truth. Apparently, Mr. Trump, you cannot, which is extremely un-American. I have long been convinced that the current "leadership" in the United States is the most corrupt ever to wield power in the history of the world. The depth of their depravity is profound and deeply disturbing. At this point, does it matter to anybody whether stocks go up or down, whether or not Amazon beats the street? While Americans will likely never know the truth, because even though Ghislaine Maxwell is purportedly agreeing to testify to congress, how does anybody know whether whatever she has to say is truthful? There is a multitude of reasons why she would be willing to testify, very few of them involve spilling the actual beans. The coverup will continue. America, maybe not. We're all sick and tired of the lies. One final caveat: There's a very good chance that the sick, twisted, neocon tribe that has control of the country would like nothing more than a civil war or violent revolution, which would give them free reign to impose martial law and continue ramping up their efforts to "thin the herd." Don't fall for it. The fight is not left versus right or Democrat versus Republican. The fight is the people against the government. Never forget that.

At the Close, Wednesday, July 16, 2025:

Wednesday, July 16, 2025, 3:25 pm ET It's likely to be a rude shock when Americans finally realize that the world’s ”indispensable nation" is actually completely disposable. The world doesn't need the United States any more than it needs Israel, endless wars, constant in-fighting and bickering over political turf and censored, compliant media propaganda. The U.S. consumes more than its fair share of resources, with which it starts a lot of wars, spreads loads of propaganda and meddle in everyone's business, but actually produces little that anyone, or any country, really needs. With President Trump's tariff tactics now almost perfectly aligned with neocon-inspired sanctions against just about every nation associated with Russia, China, or Iran, the tariff regime is likely to fail just as badly as have the sanctions. Eventually, many countries will see doing business with the United States as unnecessary and costly. The 50% tariffs imposed recently are a case in point. America actually has a trade surplus with Brazil, so imposing high tariffs on the country - purportedly to meddle in their judicial matter of Trump's friend, Jair Bolsonaro - is tantamount to shooting oneself in the foot. Brazilian president Lula’s response has been measured, but firm: “Brazil’s trade with the U.S. makes up just 1.7% of our GDP. You can’t call these figures vital. We will look for other partners.“ In other words, Lula essentially told Trump to shove his tariffs where the sun don't shine. Other countries are likely to do the same. No country is totally reliant upon the U.S. for export revenue. If trading with other, friendlier countries is better for business, the U.S. will become a pariah, shut out of international trade altogether. An example of how this works in practice can be compared to how electric utility companies bill their customers a monthly "customer charge" ranging from $25 to $50 a month. No wattage is delivered for that money spent. It's only a fee charged for the privilege of being a "customer" of the utility. That's all well and good when electricity is difficult to produce on one's own, but take it from the growing number of off-grid preppers who derive all of their electricity from solar, wind, small hydro, or propane-driven generators. If the utility is charging $40 a month, that comes to $480 a year. Taken over the life of solar panels - roughly 15-20 years - it adds up quickly. And that's just the customer charge. It doesn't take a math whiz to understand that if one can provide one's own electricity for an initial investment of $10,000 or less (actually a lot less for small households) and the system will be operational at almost no continuing cost for at least 10 years, saying bye-bye to the utility company is not a flight of fancy. Many off-gridders have already done the math and live well without a monthly utility bill. The same is true for wood-burning or coal-burning stoves for heat. Who needs natural gas when all the logs out in the woods can heat a home just as well. The United States, via its proposed tariffs of 10%, 20%, 30% and more, will be viewed as excessive by many businesses located in countries from which they are exporting. Many will cease exporting to the United States. Those that continue, and pay the tariffs, are likely to pass the added cost along in higher prices or sub-standard goods. Either way, the American public is going to pay while the government collects. It's as if the federal government sees taxpayers as dollar mules, useful only to fund the rapacious, capricious wishes of the almighty federal government of "we the people." It's not going to work. While the government may collect more revenue, does anybody expect them to stop overspending and balance their own budget? Not in this lifetime. The government, from the President and Congress down to the massive bureaucracy is not about to downsize itself. Anybody thinking that Trump's campaign promises - most of which he's already broken - are going to be upheld by congress and the deep state is simply naive. The ultimate disaster of runaway hyper-inflation, followed by a deep depression, is bearing down upon the American people, most of whom cannot or refuse to see it coming. As far as today's economic events are concerned, transporter J.B. Hunt (JBHT) saw earnings per share of $1.31 and revenue of $2.93 billion in its 2Q report delivered after the bell Tuesday. While roughly flat from a year ago ($1.32, $2.83 billion), both were a bit higher than anticipated and the stock is higher by about 1.5% mid-afternoon. Pinnacle Financial (PNFP), reported $2.00 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.91 by $0.09. Shares are up more than one percent on Wednesday. Financial giants Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS) reported before the open. Bank of America missed on the bottom line, the stock down slightly. Goldman Sachs (GS) unsurprisingly said they made a ton of money on their trading desks, and the stock is rallying, though up only a half percent. Morgan Stanley (MS) had a solid second quarter, but is being punished, down two percent, as expectations may have been too high. Johnson & Johnson (JNJ) non-GAAP EPS of $2.77 beat by $0.09; revenue of $23.7B beat by $840M, but it was their forward guidance and hefty dividend that has led to a massive six percent spike on the day, helping to lift the Dow Industrials. ASML (ASML), the Dutch chip-making equipment manufacturer delivered a solid quarter but its guidance has left Wall Street agape. The stock is trading down more than eight percent mid-afternoon Wednesday, as tariff issues cloud future growth potential. PPI was largely a non-event prior to the open. In June, a 0.3-percent advance in prices for final demand goods offset a 0.1-percent decrease in the index for final demand services. After all, these are American producers being gauged, a group which has little to nothing to do with tariff policies. If anything, input costs should be rising as tariffs become more prevalent. Inability to source materials at reasonable prices may become more difficult as tariffs take their tolls on foreign providers. Look for PPI to rise over coming months, fueling even more inflationary fears. Stocks are doing their usual melt-up on nothing, because there’s so much money just sloshing around within the financial community.

At the Close, Tuesday, July 15, 2025:

Tuesday, July 15, 2025, 9:15 am ET Why do American politicians want to go to war with China? Possibly, part of the answer lays in just how badly Chinese technology is beating U.S. technology, especially when it comes to infrastructure. Bear in mind that in November, 2021, Joe Biden signed into law a $1.2 trillion infrastructure bill, the Infrastructure Investment and Jobs Act. Faster trains? Better roads? High speed rural broadband access? Rebuilt bridges? Mostly no. Excessive graft, kickbacks, and congress lining their own pockets? Yep. In China, travelers can ride a the world's fastest train from Beijing to Shanghai (or vice versa) at speeds of up to and beyond 350 km/h (217 mph), making the 1,302 km (809 mi) trip in roughly four-and-a-half hours, at a cost of $135 - $150. Comparably, a train trip of nearly 800 miles - New York City to Chicago, Illinois - takes about 20 hours by train (usually more) and costs over $300. So, should we bomb China just for being so much more technologically advanced and cheaper? Not really. If anything, the U.S. should copy their successes, but that would run counter to the usual political argument that they're evil commies. Seriously, U.S. politicians have sold out their constituents to special interests with bribes, kickbacks, and worse, otherwise known as campaign contributions. This kind of comparison is something that should trouble all Americans, and there are certainly many more, and not just with China. Many other countries - mostly in Asia or the Pacific Rim - have better infrastructure than the United States, by far. From cheap, fast broadband in Malaysia to bullet trains in Japan, the U.S. fails on many levels, yet Americans are told by politicians and the mainstream media that they live in the best, most-advanced, most free country in the world. The level of hubris and propaganda is disturbing, to say the least. Tuesday morning in America brings second quarter earnings reports from some of the nation's biggest banks including JP Morgan Chase (JPM), Citigroup (C), Wells Fargo (WFC), BlackRock (BLK), State Street (STT), and Bank of New York Mellon (BK). Also reporting Tuesday morning are chain grocer, Albertsons (ACI), and electronics firm, Ericsson (ERIC). Analysts are mixed on JP Morgan's results. Excluding one-off costs, JP Morgan earned $4.96 per share, compared with the $4.48 per share that analysts were expecting, according to estimates compiled by LSEG. Provision for credit losses was $2.85 billion, compared with $3.05 billion a year earlier. There should be little argument about the direction of this company. Year-ago EPS was $6.12. First quarter EPS was $5.07. FAIL. Citigroup (C) reported 2Q earnings of $1.96, against last quarter's $1.99 and year-ago, $1.57. Shares are marginally higher, up less than one percent. Wells Fargo reported earnings, excluding one-time costs, of $1.54 per share on revenue of $20.8 billion for the second quarter, beating Wall Street estimates for profit of $1.41 and revenue of $20.7 billion. Comparisons to year-ago ($1.34) and prior quarter ($1.28) were positive, but the stock is lower by more than two percent before the bell due to reducing its provision for credit losses to $1.01 billion in the quarter from $1.24 billion a year ago, which aided the earnings number. BlackRock (BLK) reported record AUM of $12.53 trillion, but missed on the top line (revenue). Despite glowing media reports, shares are lower heading toward the open. State Street (STT) showed non-GAAP 2Q EPS of $2.53, topping estimates of $2.36. Year-ago was $2.15. Prior quarter EPS was $2.04. Shares are flat. Bank of New York Mellon (BK) non-GAAP EPS was $1.94. EPS from 2024 2Q was $1.51. First quarter EPS, $1.58, but those figures, like State Street's were GAAP-compliant. Why are two of the largest funding banks in the country using non-GAAP accounting, usually reserved for startups and penny stocks? Obviously, there's something wrong there. BK is down three percent in pre-market trading. Albertson's and Ericsson are both lower in pre-market trading. All of these earnings reports preceded the release of June CPI from the BLS. Their press release was sobering:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in June, after rising 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment. As Money Daily anticipated, June CPI showed inflation re-emerging. Anybody who shops for food or dines out knows that prices have been increasing again, which is on top of the high price hikes from 2023 and 2024. With this information in hand, there's little chance of the Federal Reserve cutting interest rates at their next meeting, July 29-30. Will President Trump still be haranguing Chairman Powell to cut rates? He may, because, for all his education and training in economics (Wharton), he's committed to Keynesian policies and getting bad advice from his economic team. Despite headline CPI year-over-year the hottest since February, stock futures shot higher on the release. Apparently, monthly core CPI printing below expectations (+0.1% vs. +0.2% MoM expected) is a win, as opposed to the year-over-year rise of +2.9%. Once the initial knee-jerk higher response on stock futures was in the books, they began to come down, though the S&P and NASDAQ were still positive at 9:00 am ET. As some are asking, Is it just me or does 2.9% sound a whole lot more like 3 than 2? While the Fed might want everybody to believe they've completely wiped out inflation, there's absolutely no truth to that statement. Inflation is nowhere near their target of two percent annually. It has remained closer to three percent since they stopped raising rates in July 2023 at 5.25-5.50%, then lowered them a full percent in September, November, and December 2024 with cuts of 0.50%, 0.25%. and 0.25%, respectively. In case anybody hasn't noticed. Prices most most things - and especially food and energy - have not come down much in the past year. Defeating inflation should be represented by CPI in the red on a monthly basis, not these piddling +0.1, +0.2, +0.3 percent gains that have become common. At two percent inflation, the purchasing power is halved in 30 years. At three percent, it's cut in half in just 20. Anybody who has the capability should be looking to move to other countries, preferably ones that aren't run by central bank and political sociopaths. America is doomed and its failings have become obvious to the rest of the world. Prepare for hyper-inflation within two years. Weimar America is within reach!

At the Close, Monday, July 14, 2025:

Sunday, July 13, 2025, 11:48 am ET Three things happened over the past week that are likely to have ongoing impacts to finances.

The first was the Trump administration abruptly ending the investigation of Jeffrey Epstein. Above is a post by President Trump from Saturday, urging his MAGA followers to just forget about the whole, sordid, mess of pedophilia and human trafficking and move on. Ain't gonna happen. Shutting down the investigation with no findings of blackmail, no lists of clients, and the absurd contention that Epstein committed suicide in prison is going to stick with this administration - and Mr. Trump in particular - for the rest of his term. Support for the America First agenda, MAGA, and all th patriotic bullshit is fading rapidly. If the administration doesn't come clean on this, nobody will ever trust them again. After four years of Biden idiocy, the American public is in no mood to bear more lies and deflections from the federal government. People are fed up with government in general and many - in and out of the MAGA movement, on the right and the left - are quietly disengaging. The government is too deeply intertwined into people's lives and there are actions being taken by individuals at various levels of engagement to free themselves from what they consider to be a rogue, criminal operation, run by a uniparty with hidden agendas. Stonewalling the Epstein affair pushes the truly patriotic followers further away from Trump, who has broken promises made during the campaign, and the government in general. People on the left and the right are now in agreement on many issues. The potential for widespread civil disobedience, civil war, or outright revolution is growing. It's possible that the government would like nothing more than civil war or rebellion, which would give them all the more rationale to impose martial law and stomp the population into jackboot submission. Smart Americans are unlikely to give them that opportunity, preferring quiet actions over violence. Number two on the week's big events is actually a combination of two disparate occurrences: the BRICS Summit in Brazil and Trump tariffs, round two. They dovetail because Trump threatened BRICS countries with addition 10% tariffs, and also socked Brazil with a destructive, mendacious 50% tariff. Tariffs will prove to be the ruin of the U.S. economy. The government will prosper at the expense of consumers, who will see either higher prices (already happening), lower quality products from exporters to the U.S., or empty shelves if enough countries disengage from U.S. trade. Meanwhile, BRICS are moving on, promoting international trade using their own currencies, bypassing the U.S. dollar completely. BRICS countries and those aligned with them will eventually isolate the United States as the bi-polar East-West split accelerates. Third, and maybe the most important development, was the rapid price advance of silver, which over the course of just two days - Thursday and Friday - posted a gain of 6.5%, from $36.69 to $39.08 on the COMEX. Gains like that don't happen in a vacuum. They are part and parcel of bigger agendas, larger trends and developments. Silver is a key industrial element and has thousands of years of history as money. Recent gains - outpacing every asset except the phony blockchain Ponzi scheme of bitcoin and other crypto frauds - are part of a larger movement, freeing silver and gold from the fiat currency monopoly. Notice that none of these events have anything to do with stocks or bonds, the paper promises promoted by Western governments that are not only wildly overvalued, but ultimately subject to extreme volatility and manipulation. Every market is manipulated, but none as severely as stocks and fixed income (bonds). The world is moving away from U.S. dominance toward a more free, equitable, honest future. The time is short.

All of the majors ended the week on the downside, with the exception of the 20 stocks comprising the Dow Jones Transportation Average, which was up 1.01% for the week. As the week just past offered little in the way of economic data or earnings, the upcoming week will be loaded, and especially front-loaded with bank and financial stocks, with a liberal dose of Dow components added in for flavor. Stocks reporting second quarter earnings this week: Monday (before open) Fastenal (FAST); (after close) FirstBank (FBK) Tuesday (before open) JP Morgan Chase (JPM), Citigroup (C), Wells Fargo (WFC), BlackRock (BLK), State Street (STT), Bank of New York Mellon (BK) Albertsons (ACI), Ericsson (ERIC); (after close) J.B. Hunt (JBHT), Pinnacle Financial (PNFP) Wednesday (before open) Bank of America (BAC), Goldman Sachs (GS), Morgan Stanley (MS), Johnson & Johnson (JNJ), PNC Bank (PNC, ASML (ASML); (after close) Synovus (SNV), Alcoa (AA), Kinder Morgan (KMI), United Airlines (UAL) Thursday (before open) Taiwan Semi (TSMC), Cintas (CTAS), US Bancorp (USB), Fifth Third Bank (FITB), Travelers (TRV), Abbot Labs (ABT), Pepsico (PEP); (after close) Simmons Bank (SFNC), Bank of the Ozarks (OZK), Netflix (NFLX), Interactive Brokers (IBKR) Friday (before open) Huntington Bank (HBAN), Truist Financial (TFC), American Express (AXP), Ally Bank (ALLY), 3M (MMM), Regions Bank (RF), Charles Schwab (SCHW), Comerica (CMA). Highlighting the data front will be June CPI and PPI, Tuesday and Wednesday, respectively. Capacity Utilization and Industrial Production for June is also out on Wednesday. June Retail Sales appear Thursday morning, along with the Philly Fed and the NAHB Housing Market Index. If you think June's CPI data being released on the same morning as second quarter earnings from JP Morgan Chase, Citigroup, Wells Fargo, BlackRock, State Street, and Bank of New York Mellon, is just a coincidence, you just don't get it. Look for the banks to report massive profits and the CPI to edge up slightly, so "investors" will focus on bank stocks and ignore the re-ignition of inflation.

Notice how interest rates crept up on the week, with the bulk of yield gain coming on Friday, the same day stocks were down. In other words, instead of rushing into the safety of fixed income as stocks were being somewhat clobbered (especially the DOW), bonds were being sold off as well. Where did the money go? Cash, gold, silver. The 10-year note was up eight basis points and the 30-year bond up 10 on Friday. This is no coincidence. This is an early warning sign of an upcoming financial crisis. Everybody knows that a financial crisis will occur - it's only a matter of time - the question is when and what will be the cause. Speculation is that the repo market will explode again or that some banks might be found to be undercapitalized and overly aggressive in their treasury distribution. The current narrative that inflation is under control, approaching two percent (meaning your money devalues by half in 30 years, instead of 20 years at three percent) annually, is about to change. Inflation has never been under control. Prices have been rising, especially lately, as in the past few months. Those who do grocery shopping understand this all too well. Instead of cutting rates, the Fed should be raising them. Will they? Probably not. They are more likely to cut rates to stave off a recession (can't have those!) than raise them to shut down inflation. Full spectrum spread fom 30 days out to 30 years remains elevated at +59. 2s-10s are back to April highs, at +53. Be on guard for the 30-year bond to hit five percent and higher, and the 10-year note to exceed a yield of 4.5%. The Treasury market is under severe stress, from lack of foreign buying to unease over economic conditions caused by continuing deficits and lack of capital formation. Spreads:

2s-10s

Full Spectrum (30-days - 30-years) Oil/Gas WTI crude oil closed out the week at $67.35, a $2.20 increase from last Friday's $65.15. The gain was largely synthetic, with traders adjusting after the major downdraft at the end of June. Call it a knee-jerk reaction to much lower pricing which will probably prove to be both short-lived and wrong-footed. Gas prices have followed oil's path lower in general. Gasbuddy.com is reporting the national average for a gallon of unleaded regular gas at the pump at $3.13, a two-cent gain from last week, mostly insignificant. The highest prices in the country were in California, as usual, at $4.50, down four cents on the week. Prices at the traditional low end have settled, but were mostly higher, led by Mississippi ($2.68), Oklahoma ($2.71), Alabama and Louisiana ($2.75). Other states in the Southeast are all between $2.76 (South Carolina, Texas) and $2.79 (Arkansas), with the notable exceptions of Georgia ($2.87), North Carolina ($2.88), and Florida ($2.91). 12 states under the 42nd parallel are below $3.00, including New Mexico. The Northeast continues to be led on the high side by Pennsylvania ($3.25), down six cents. All other New England and East coast states remained above $3.00, ranging from Massachusetts at $3.02 to New York at $3.15, except for New Hampshire ($2.98). Midwest states are topped by Illinois ($3.47), the price up six cents on the week. Nebraska ($2.82)is lowest in the region, followed by Kansas ($2.87), North Dakota ($2.88), and Missouri ($2.89). Along with Illinois, Wisconsin ($3.01), Ohio ($3.05), Indiana and Minnesota ($3.06), and Michigan ($3.27) are all back above $3.00. Along with California, Washington ($4.40) is the only other one above $4, as Oregon checks in at $3.98. Nevada ($3.70) dropped two cents. Arizona ($3.17) is still priced at a premium to neighboring New Mexico, a relative bargain, at $2.84. Idaho ($3.44) was up a nickel, and Utah ($3.27) was unchanged. Sub-$3.00 gas can be found in one fewer state this week than last, with now 21 making the grade. Prices could go either way. It's political.

This week: $119,022.00 New highs. Bitcoin is the gateway drug to controllable, programmable, government digital currency, CBDC, so good luck with your crypto fantasy.

Gold:Silver Ratio: 86.24; last week: 90.13 Per COMEX continuous contracts:

Gold price 6/13: $3,452.60

Silver price 6/13: $36.37 Both gold and silver were bid on the week, but the big story was silver, closing above $39.00 an ounce on the COMEX, with spot at $38.34. What triggered silver's rise was likely related to U.S. President Trump calling for a 50% tariff on copper. A good portion of silver mined around the world is as a by-product of other mining, copper being prominent. The gains on silver, which many believe to be long overdue come at a time when there are more than ample numbers of catalysts, main among them being the silver shortfall in production, mining not keeping pace with demand for what appears to be a fifth straight year, according to the Silver Institute. On a more technical level, the recent gold:silver ratio bounding over 100 was a certain buy signal for metals dealers, stackers, and investors. It was so far out of whack that it prompted silver sales to outpace supplies and now, the restocking of inventory is pushing the price even higher, so much so that the GSR checks in this week at a more rational 86.24. As always, when gold rises, silver usually catches up and then exceeds in percentage terms, which is now the case. Gold is up 27.38% year-to-date, while silver has passed it by, up 33.24%. On a five-year scale, silver is up 97.17%, gold, 85.86%, These are the kinds of numbers that should put some of the whining about silver's poor performance to rest. It's even outpacing the S&P 500 over the past five years (94.12%). Not bad for an assets without counter-party risk that has been accepted as MONEY for millennia. The narrative promoted by central banks since the so-called "Crime of '73" when the U.S. demonetized the metal, disallowing the U.S. Mint from turning citizen silver into silver coinage. In 1965, silver was taken further out of circulation with the Coinage Act of 1965, eliminating silver dimes and quarters and reducing the content of silver in the half dollar from 90% to 40% (Kennedy halves). Readers of Money Daily are likely to be acutely aware of silver's constitutional status as money in the United States. Sooner or later, there's going to be a crisis that will force the hand of government to default on the Federal Reserve's fiat currency. Whether it restores the U.S. to honest money remains a mystery, but, rest assured, the rest of the world is not going to wait around for the United States. Central banks around the world have been buying up gold hand over fist, and now some are going to be looking seriously at silver as a strategic asset and possibly a basis for currency. Peru and Mexico would be prime candidates for a re-monetizing of silver as both countries mine massive amounts of it a year. In 2024, again, using Silver Institute figures, four of the top five silver-producing countries are in South America and five of the top 10. Here's the breakdown for 2024 production in millions of ounces:

Mexico: 185.7 Also of note, Russia formally announced adding silver to its central bank holdings more than a year ago, and China's position at #2 in terms of production adds more speculation towards silver's role in the BRICS and the emerging global, multi-polar financial framework. Simply put, gold could be the vehicle for trade settlement between nations; silver the choice for individuals and small businesses. Could happen, but probably not overnight. In the meantime, keep stacking. Here are the most recent prices for common one ounce gold and silver items sold on eBay (numismatics excluded, free shipping):

The Single Ounce Silver Market Price Benchmark (SOSMPB) rose dramatically this week, to $45.17, an improvement of $1.61 from the June 29 price of $43.56 per troy ounce. WEEKEND WRAP Money Daily is gradually moving toward a non-U.S.-centric approach to coverage of the global economy. While it's clear that enormous changes are underway, they are generally very slow to develop. The U.S. and the West are not becoming irrelevant, it's just that the systems they employ have broken down and their governments and central bankers execute a daily ongoing scramble to keep those systems operational. On the other side of the ledger, so to speak, are BRICS and countries aligned to them, which are in the process of building what they propose as a better system. Ultimately, the use of gold as backing for currencies will be essential, but not without a lot of pain and suffering - mostly by innocent people - first. Sound financial management is moving West to East. South America and Africa are likely to be key battlegrounds in economics over the coming years.

At the Close, Friday, July 11, 2025:

For the Week:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|