| MONEY DAILY | Commentary on Stocks - Bonds - Gold - Silver - Crypto - Oil/Gas and more |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | WILD SIDE | CONTACT | ARCHIVES |

Weekly Survey of Gold and Silver Prices Single Ounce Silver Market Price Benchmark Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

| Friday, October 10, 2025, 9:11 am ET As the partial shutdown of the United States Incorporated Municipal Government Shutdown (refer to the Money Daily post of Friday, October 3, 2025 for more detail.) enters Day 10, it should be apparent to just about anyone that whatever the cabal in the District of Columbia are up to, it isn't having much effect anywhere, except, possibly, in financial markets, which yesterday received a wake-up call courtesy of the price of gold, silver, mining stocks, and backwardation in silver futures versus spot price. As far as can be discerned, spot silver spiked to an all-time high of $51.24 at 9:10 am ET on Thursday, October 9. Precisely at 9:30 am ET, when the opening bell sounded on Wall Street, the futures price, which was already -$1.60 in backwardation at $49.64, began to plummet, eventually reaching an intraday low of $47.22 by midnight, and then falling to as low as $47.09 at 12:30 am on October 10. Those lows coincided with spot prices just after midnight (October 9-10) at $48.99. Thus, backwardation had not be corrected (the normal alignment is called contango, with futures prices higher than spot.) and actually extended to -$1.90. This condition should not persist, because futures are generally assumed to be a cost-plus proposition, with buyers willing to pay more for a commodity for future delivery. Time, storage, interest, etc. all go into calculating that future price, which is generally higher the longer out the contract is extended. For instance, the futures chain for gold, which is relatively consistent, has spot gold around $3,994, with the nearest futures contract at $4,010.90. As the futures chain progresses further out, the price rises, so that March, 2026, is $4,050, and June, 2026, is $4,099. That is normal, orderly contango. Silver futures are below spot all the way out to September 2026 and they are all over the map. February, 2026 futures are at a laughable $47.88. July futures are a tad more realistic at $48.97, but, still well below spot. To put this into perspective, ask yourself, if you just bought a 10-ounce bar of silver for $500, and a friend (and not a very good one, at that) came by and offered to buy that very same bar for $478.80 and pay you in February, what would you do? That is apparently the current condition in the silver market. Vince Lanci explained this in a video on Thursday, suggesting that London vaults have been running dry and the backwardation encourages U.S. vault custodians to sell to London at spot and pocket the arbitraged difference between the futures price and spot, which could be very lucrative at $1.20-$1.60 or more per ounce. If the arbitrage is $1.50 profit, 100 of standard 1000-ounce bars would net out $150,000. However, as Lanci explains, the bullion banks in the U.S. aren't biting. They're holding onto their silver. It doesn't make any sense if the futures are saying your silver will be worth less in the futures, unless the real signal from silver backwardation is telling the world that a recession is imminent. Otherwise, it's just more manipulation by big money players, generally assumed to be agents of the Federal Reserve or the federal government, most likely at the Exchange Stabilization Fund (ESF), which is, according to information on their own website: The Exchange Stabilization Fund (ESF) consists of three types of assets: U.S. dollars, foreign currencies, and Special Drawing Rights (SDRs), which is an international reserve asset created by the International Monetary Fund. The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury ("the Secretary"). Nobody would be the least bit surprised if "the Secretary", Scott Bessent, was instructing his minions at the ESF to do anything and everything they can to keep the price of silver below $50, which might include buying US$ to send the Dollar Index higher, which has an inverse effect on the prices of gold and silver. Of course, that's just speculation. There could be any number of nefarious actors employed by Western central banks, the World Bank, IMF, etc. Central banks have generally favored gold over silver since 1873, when silver was essentially de-monetized via the Coinage Act of 1873, often referred to as "the Crime of '73". In the larger scheme of things, bankers and big business interests love gold; individuals and small businesses prefer silver. This debate has been ongoing, behind the scenes, for decades, but, since the government caters to banks and big business (Wall Street), gold is the preferred standard, even though silver is plentiful and was used as currency (coins) as recently as 1964. So, another question to ask yourself: If silver was MONEY back in 1964, why can't it be MONEY again in 2025? Well, the obvious answer is because the government won't allow it. They want people to use PAPER in the form of Federal Reserve Notes, issued by the Fed, and basically unconstitutional, granted the power to create U.S. currency out of thin air by the U.S. congress. But, upon further review, there is absolutely no reason why silver cannot be used as money, other than the government frowns upon the practice. It is going to happen, has already happened, and will continue to happen so long as the government and banking interests insist upon their fiat standards and perform magic tricks in financial markets like they do routinely with silver. In a word, bankers HATE silver. Absolutely despise it, because it allows ordinary people to have and hold wealth without counter-party risk or obligation. Once an individual has silver in his or her hands, it is theirs and theirs alone and the government, which wants to track every human movement, especially those concerning financial transactions, can't track it. Those are some of the reasons why silver isn't money. But, other than the government's insistence on keeping it an industrial metal only, there's no reason silver cannot be money. The United States may be a whole lot different than it was in 1964, but the people from 1964, compared to people in 2025, are essentially the same. They breathe air, eat food, walk, talk, and appreciate freedom, social, political, economic, and otherwise. Without silver in circulation as money - and the denial or partial stripping away of other basic rights - they're not economically free, which is why bitcoin has become so popular. Fair warning, however: the current administration, with the full support of congress, has accepted crypto-currency as "the future" of money, via the recently-passed GENIUS Act. The warning is that if the government supports something, it's probably not to your benefit. There are many issues facing the United States these days, yet the federal government seems interested only in promoting foreign wars, strategically buying up shares of companies (essentially, fascism in real time), and keeping secrets from the American public, which, increasingly, is distrustful of its own government and seeks alternatives. It's not a good look. The wild action in silver markets offer a sliver of the inner operations of the federal government, which has grown to gargantuan proportions, and today acts like it can do whatever it desires (despite being "shut down"), including imposing its will on states by sending in national guard troops, bailing out other countries, as it did Argentina this week, while prompting war with others, like Venezuela, all without the approval of the American public. The public is just supposed to go to work, pay their bills and taxes and shut the hell up. Let the government, who knows better about everything, just do what it pleases. Sadly, that's the current attitude, but it's not what made the United States the greatest, most free country in the history of the world. People, not governments, nor presidents, nor bankers, made the United States a great country, and they will again, once silver exceeds $50 an ounce, and is freed from the constraints of government intervention, COMEX price suppression, and the LBMA. It's a tall order, but, those institutions appear to be creaking and cracking under pressure from the physical market and BRICS, especially China. The physical market is best represented by eBay, which operates a vast open bazaar for bullion, coins, bars, and other valuables. Prices on ebay have fully disregarded the COMEX futures and are following spot prices, though, in reality, the market on eBay is becoming a price-setting mechanism that rivals anything else because it is a physical market with few constraints, those being the fees eBay collects on every transaction. It's a marvelous business. eBay is one of the best-performing stocks of this year, up 45%, despite being down 10% recently. In effect, because of fees which can range from 10-15% or higher, prices paid on eBay actually support higher silver prices. The sellers have to pay those fees, so, at $50, the seller is only netting out $45 or less. It's the cost of doing business. It's doubtful any sellers, especially those which also operate their own online retail, like Scottsdale Mint, Bullion Exchanges, Apmex, Pinehurst, Ayden, Liberty, and many others, are losing money. Dealers on eBay - and, on their own sites - are selling silver above $50 an ounce, often well above for quality items, and nowhere near the futures prices of $48 or $49. The COMEX stranglehold on gold and silver pricing is being broken by retailers, individual sellers, and buyers who understand value as opposed to price, and foreign exchanges outside of the London and the U.S.. In a nutshell, that's what ails America. The government wants control; the citizenry wants freedom. Logically, since the citizenry far outnumbers the government and supposedly elects the people who represent them in congress and the presidency, will vote with their wallets and purses, rejecting the slavery of debt-based currency in favor of honest money, gold and silver. The government will have no choice in the matter, though the possibility of confiscation, as they did in 1933 with gold, remains a final option for them. Price suppression of gold and silver will no longer work. This time is different. Well, as if the government shutdown wasn't already a major boondoggle, Rep. Jennifer Kiggans (R-VA) introduced, on September 16 (two weeks before the shutdown) The Pay Our Troops Act of 2026, which guarantees pay and allowances for: Active-duty servicemembers, including members of the Coast Guard and Reserve Components; Civilian personnel at the Department of Defense and Department of Homeland Security (for the Coast Guard) who directly support servicemembers; and Contractors providing mission-essential support to servicemembers. This figures to be a contentious issue, unless members of the Senate realize that they will be demonized as anti-American if they don't support this measure and make sure all military personnel - uniformed and civilian - get their paychecks on October 15. This is yet another reminder that the "shutdown" is completely fake, contrived, and previously agreed-to by Democrats and Republicans alike. The real kicker here is that civilians will get paid if the bill is passed in its current form. That is likely to result in loud protests from the federal employee unions, and possibly trigger a mass walk-out by the 750,000 or so federal employees working without pay. Sir Walter Scott reminds us, "Oh what a tangled web we weave, when first we practice to deceive," (Marmion: A Tale of Flodden Field). Whatever their purpose, all of institutional Washington D.C. is fully behind the shutdown and whatever results stem from it. In the meantime, the government apparently has enough money on hand to buy $20 billion worth of falling Argenitina pesos, ensuring that the hedge funds and billionaires who bought Argentina's bonds get paid. MAGA may now stand for "Make Argentina Grift Again.” With the unusually buoyant stock markets set to open on Friday to close out the week, stock futures are higher (big surprise), bitcoin, gold, and silver are, for lack of a better term, "meh," and WTI crude is about to head down into the $50s, just before 9:00 am ET, at $60.12 and reeling. While superficially - which is all the government and media have to offer - everything appears to be functioning normally, behind the scenes is chaos and rising levels of anxiety. The first ten days of the shutdown haven't caused any major disruptions. Next week, when federal employees don't get paid, things may begin to get more interesting. Finally, and in as kindly a tone as possible, to all governments, just three words: "please go away." At the Close, Thursday, October 9, 2025:Dow: 46,358.42, -243.36 (-0.52%) NASDAQ: 23,024.62, -18.75 (-0.08%) S&P 500: 6,735.11, -18.61 (-0.28%) NYSE Composite: 21,548.26, -177.55 (-0.82%) Thursday, October 9, 2025, 9:12 am ET As if they weren't deserving to be permanently removed as government employees, the IRS announced that roughly half of their staff - about 34,000 people - began to be furloughed on Wednesday. The temporary layoffs mostly affect call center workers, IT employees and HQ paper-pushers. The more relevant agents, auditors, and accountants will be working without pay, for now. Serves them right. Other than the usual grumblings at airports, nothing has really changed in Washington, D.C., as it's difficult to tell whether the government is actually functioning or not these days. For the most part, when the federal government is officially "open", their roles are usually to point fingers at each other, cause headaches and paperwork for American citizens, jam up whatever business people are trying to run with endless regulations, and skim as much as possible without drawing fire from individuals and businesses while they spend far more than they receive in taxes. For what it's worth, the federal government should be severely downsized at the vary least. President Trump tried to do that at the beginning of his second term, tasking Elon Musk with the job of running DOGE, the Department of Government Efficiency. In the beginning, it sounded great and Musk took the task seriously, but various courts overruled many of Trump's decisions to terminate employees and Musk quit after just a few months, completely disgusted with the process. It's a sad state of affairs when a billionaire, one known for his business savvy and ability to run private companies with minimal staff, works for free and can't get around the red tape and the courts to complete his work. While the government is technically shot down - actually just lacking funding through November 21 - President Trump has mumbled about permanently firing laid off workers or not paying them for time worked or not worked during the shutdown. It amounts to mostly bluster and hot air, Trump's specialty. On the other hand, he's promised to pay the military during the shutdown, though that would require a separate bill and the House won't be back in session until Friday at the earliest, so it will probably be Monday to see if any action is taken on that proposal. Paying the military might be a political football, as anybody voting against it would almost certainly be labeled unpatriotic. However, members of the military, who mostly hang around bases in far-flung locations or right in the United States aren't actively doing much fighting and might be considered by some to be "non-essential." If congress does pass legislation to pay them during the shutdown, it would amount to a slap in the face to the non-military employees who are working without pay. In terms of scoring points, it depends largely on which team is doing the scoring or threatening the other side. From a practical perspective, it's a double-edged sword. From the public's perspective, it's just more nonsense. A government that can't balance its own books and can't agree to how much money they're grifting and borrowing from the public, isn't worth supporting anyway. Rather than strutting around like prized peacocks, the congress and the president should all be ashamed of themselves. They've managed to overspend to the tune of $37 trillion and now are threatening to shut down various government departments because they don't have enough money. If the plan was to shame themselves into defaulting on loan obligations and disbanding, that would be one thing, but it's obviously too much to hope for. The elected congress is shameless. Maybe when a few of them can't catch a flight because there are no air-traffic controllers, they might come to their senses. Since the shutdown is being viewed by Wall Street as simply theater of the absurd, stocks haven't shown any signs of stress. Actually, in most business circles, company executives are the most happy and productive when the government leaves them alone, so, a positive reaction, shuch as has been prevalent since the shutdown began last Wednesday, might not be wrong at all. Getting the government out of the way of doing business would probably add significantly to profit margins and help promote a competitive marketplace. Imagine not having to file endless, useless reports, or paying 15-30% off the top to Uncle Sugar. As the shutdown continues, Wall Street shrugs along, with the S&P and NASDAQ setting new all-time highs on Wednesday after a slight pullback Tuesday. The SHiller PE (CAPE) closed out at 40.32 Wednesday, chasing the record of 44.19 from the dotcom craze in December 1999 (peak clown world). Gold crossed the $4,000 Rubicon on Wednesday and has remained above it. Over at the COMEX rigging maching, silver still can't seem to find its way past $49 or $50, though silver is in backwardation presently with futures prices below spot. Normally, in contango, it's the other way around. It's an explosive condition, as the physical market is racing ahead of the controlled futures short-selling gambit that's dominated for the past 50 years. The only fools still shorting silver and gold are the Federal Reserve via their proxies at the bullion banks. They're being ruined on a minute-by-minute basis for resisting the obvious. Neither gold nor silver is going to retreat any time soon. Perhaps, if the government re-opens, there might be a slight pullback in pricing, but as long as the Fed keeps pumping out fiat paper and the federal government keeps running $2 trillion deficits, the only way precious metals prices are going is up. How high they go depends on the level of emergency printing of money from thin air the Fed deems necessary to keep their 112-year old Ponzi scheme going. With. a little more than a hlf hour to the opening bell, stock futures are flat-lining, gold has held above $4,000, bouncing around $4,060, with silver gaining, closing in on $49.00. $50 silver is inevitable. Standard sales of one-ounce silver bars and coins on eBay and online retailers are already in excess of $50. American Silver Eagles (ASE) are routinely selling for $52-55 and higher, depending on the mintage and condition. Numismatics are soaring. A return to honest money seems to be accelerating, but the currency in place - yen, pounds, francs, euros, dollars - has to be almost completely debased before the people on the street demand something better. Until then, expect gold and silver to continue to higher, and probably, much higher, levels. People who were promoting $10,000 gold and triple-digit silver don't seem so extreme right now and they'll be much less reviled over the next few years. Because fiat currencies are backed by nothing, their comparison to gold and silver knows no upward bound. The more that is printed, the more precious metals will cost. Until it all goes bust. Like the man asked how it's going, falling from a 100-story skyscraper, "so far, so good." At the Close, Wednesday, October 8, 2025:Dow: 46,601.78, -1.20 (-0.00%) NASDAQ: 23,043.38, +255.01 (+1.12%) S&P 500: 6,753.72, +39.13 (+0.58%) NYSE Composite: 21,725.81, +62.71 (+0.29%) Wednesday, October 7, 2025, 9:17 am ET Of the few visible effects from the federal government shutdown - now in Day 8 - none stand out as prominently as flight delays and cancellations at airports across the United States, where air traffic controllers have been in short supply. Already facing a long-standing shortage of controllers, the FAA continues to monitor the situation as workers call in sick rather than work without pay. It was the air traffic controllers who were responsible for ending the 2018-19 shutdown, when numbers of them began calling in sick as the government standoff reached its fifth week. This time, having learned from the previous experience, the controllers may be taking swifter action. On Monday, Hollywood Burbank Airport was without any air traffic controllers for six hours. Reports continue to detail flight delays in airports across the country. Newark, Denver, Dallas, Houston, Orlando, Boston, Chicago, Philadelphia, Nashville and elsewhere. Thus far, neither the Republicans nor Democrats in the Senate have budged, nor has the president. The House remains in recess until March 14 as the airline industry begins to creak. Almost always operating at razor-thin margins, companies such as Delta, United, and Southwest can hardly afford disruptions, especially if the shutdown begins to be measured in weeks instead of days. For now, there hasn't been much movement in airline stocks, though they began moving lower mid-September. They have enjoyed enormous gains in 2025, with United (UAL) up 72% year-to-date, Delta (DAL) up 57%, and even downtrodden American up 28% for the year. On Tuesday, investors got a little reminder of just how overvalued stocks are, with all the major indices shedding some froth, though by the session's end, the losses had been minimized. At the same time, gold breached the $4,000 mark early Tuesday and continued to ramp higher, hitting a high of $4,071 early Wednesday morning. Silver continues to follow dutifully along, reaching $48.83 overnight. Silver stackers are eager for a breakout above $50, though the riggers at the COMEX seem to have other ideas. There are some theories being shopped around that silver cannot be allowed to break though $50, the long-standing psychological high point set by the LBMA, COMEX, and others of the nefarious cult of fiat endorsers. Suggesting that major banking interests and derivative plays are in danger of being triggered by a silver move above $50. It's probably not as big a deal as some are making it out to be, but the resistance dates back to 1979-80 and 2011, when silver approached the magic number and then fell precipitously from the highs by as much as 80%. The betting is that this time is different, though only those with a cynical attitude toward real money oppose that view. As far back as 1873 silver there has been a sustained effort to demonetize silver and classify it as only and industrial metal with no monetary value. Obviously, that is not the case. Already on ebay and at online precious metals retailers, it's nearly impossible to purchase silver in any quantity at a price below $50 per ounce. The physical market is making a mockery of the COMEX manipulation and, like a coiled spring, once silver breaches $50 to the upside, there may be no turning back. Just a week into the shutdown, it's beginning to get interesting. There appears to be much more excitement in markets dead ahead. After all, it is October. At the Close, Tuesday, October 7, 2025:Dow: 46,602.98, -91.99 (-0.20%) NASDAQ: 22,788.36, -153.31 (-0.67%) S&P 500: 6,714.59, -25.69 (-0.38%) NYSE Composite: 21,663.10, -101.90 (-0.47%) Tuesday, October 7, 2025, 9:21 am ET The federal government shutdown that began on October 1 enters its seventh day on Tuesday, a week without work or pay for up to 750,000 laid-off, laid-back federal employees and a week of working without pay for the rest of the government's roughly two million employees deemed exempt or essential including members of the military and air traffic controllers. The Senate failed to pass either of the bills that would continue funding the government until November 21 again on Monday. It was the fifth time the chamber voted on competing bills forwarded by Republican and Democrat leadership. The Republican bill remains in the framework of the bill passed by the House more than two weeks ago. The Democrat version adds in funding for health care. Neither are close to reaching the 60 votes needed for passage and neither side is making concessions or changes to their legislation. Across the chamber, the House of Representatives isn't expected to return to session until October 14. House Speaker Mike Johnson insists that the House has done its job by passing funding legislation and is only awaiting their colleagues in the Senate to get their act together and send a bill to President Trump's desk for his signature. None of that appears to be any closer to reality than it was a week ago, despite Trump's comments Monday that progress was being made in the Senate. Negotiations, according to most reliable sources, are not taking place. Finger-pointing and the usual useless rhetoric are in season as the shutdown becomes a political football and begins to be weaponized by the White House. The latest rumblings are coming from airlines and airports, where air traffic controllers are operating as skeleton crews. On Monday, Burbank Airport in California was without any air traffic controllers for about six hours due to shutdown-related scheduling. Should air traffic controllers slow down operations or report sick en masse, as they have done in other shutdown situations, the standoff between the politicians might reach a compromise sooner. However, airlines are still seeing only minor delays without much disruption. The situation has not reached anywhere near critical, so the shutdown is expected to last at least another week. Wall Street remains ambivalent towards its Washington counterparts. Stocks gained again on Monday, with the S&P and NASDAQ making all-time highs again. The Shiller PE (CAPE) continues to rise, ending Monday at 40.23. Gold and silver continue along an inexorable path twoard $4,000 and $50.00, respectively. WTI Crude Oil finished higher on Monday, counter to the longer term bearish trend. Stock futures point to another higher open. Conditions have not grown serious enough to warrant selling of stocks, yet. At the Close, Monday, October 6, 2025:Dow: 46,694.97, -63.31 (-0.14%) NASDAQ: 22,941.67, +161.16 (+0.71%) S&P 500: 6,740.28, +24.49 (+0.36%) NYSE Composite: 21,765.00, +39.60 (+0.18%) Sunday, October 5, 2025, 11:34 am ET

Like all other government promises and projections, that one is likely to never come to fruition, but that's a discussion for another day. Presently, there isn't much that would indicate that anything has gone awry. It's probably going to take a statement from Treasury Secretary Bessent for anybody to notice the cracks widening in the economy because many of the usual benchmark data releases are not going to happen while various agencies are on furlough. In essence, markets are flying blind, keeping up hopes that the political hacks in D.C. will come to their senses and make a deal - even if it's only good for six weeks - to fund their operations. That sentiment is not going to last much beyond a few more weeks if the shutdown persists. While stocks continued to make new highs, there has been some leakage of money flows into fixed income, and, more importantly, to gold, silver, and bitcoin. Stocks The NASDAQ's 230-point drop from the high to the low on Friday may have been a warning shot fired. Similarly, the S&P shedding 45 points before finishing up less than 0.02% for the day, served notice that conditions are worsening, or, to put it in more mundane parlance, "things are getting a bit dicey." Stocks took the government shutdown with the usual whistle past the graveyard. The rally off the April tariff lows remains in place, but the failure of the Dow Transports to confirm the move to record highs on the Industrials has Dow Theorists losing some sleep, not that anybody has time nor patience for fundamental analysis anymore. One of the variants of the government shutdown was that the BLS wasn't around to fool everybody with phony employment numbers from September. In stepped ADP on Wednesday, announcing that the private sector lost 32,000 jobs over the month and August was revised down by 43,000. Adding in the 600-750,000 government employees taking time off via the shutdown, the number of job losses since the end of July is closing in on a million, and that's not including the government contractors who will be putting some - if not all - workers on leave shortly. The longer the government keeps the "out of order" signs posted, the worse the already weak employment sector of the economy is going to become. That's usually something Wall Street can redefine as a positive because when private companies do it, it lowers expenses and boosts the bottom line. This time may be different, though it's to be expected that the Big Kahunas of finance won't come right out and say so. The week ahead, outside of the shutdown dynamics, offers the first glimpses of third quarter earnings from a number of key companies. The week following will see earnings season kick into high gear, starting with the banks, but let's not get too far ahead of the game. Here are some items of interest looking forward: Monday, October 6: Constellation Brands (STZ) reports, OpenAI's DevDay developer conference kicks off. Tuesday, October 7: McCormick (MKC) reports 3Q earnings. Consumer credit (August), Federal Reserve's Atlanta President Raphael Bostic, Vice Chair Michelle Bowman, Governor Stephen Miran and Minneapolis FedRes President Neel Kashkari all have speaking engagements. Amazon's (AMZN) Prime Big Deal Days Begin. U.S. August trade deficit delayed, not reporting. Wednesday, October 8: Bassett Furniture (BSET) reports 3Q earnings; FOMC Minutes from September meeting; Fed Officials, including Fed Governor Michael Barr, St. Louis Fed President Alberto Musalem speak. Thursday, October 9: PepsiCo (PEP), Delta Air Lines (DAL), Levi Strauss (LEVI), Applied Digital (APLD), Helen of Troy (HELE) report 3Q earnings. Initial jobless claims (Week ending 10/4), Wholesale Inventories for August will not be reported. Fed Chairman Jerome Powell, Treasury Secretary Scott Bessent, and Fed Vice Chair for Supervision Michelle Bowman are all expected to speak at Fed’s Community Bank Conference. Friday, October 10: University of Michigan Consumer sentiment for October will be reported; Monthly U.S. federal budget for September may not be (still in doubt). Chicago Fed President Austan Goolsbee, St. Louis Fed President Alberto Musalem have speaking engagements. The Shiller PE (CAPE) closed out the week at 40.08, a 25 year high (since the dotcom bubble) Treasury Yield Curve Rates

Yields on notes and bonds fell this week, with the bulk of the moves happening Monday, as the market correctly sensed the government shutdown and fled risk assets for the safety of treasuries. Of course, the moves in bonds were dwarfed by those in the gold and silver markets, which are becoming increasingly explosive. There's some irony here, as treasury notes and bonds, being government obligations, saw buying just as the government itself begins to run out of funding. The longer the government remains in "partial shutdown" mode, the riskier these obligations become, bringing into play the ages-old dilemma of promises for return ON one's money becoming a question of return OF one's money. Sooner or later - and the odds seem to favor sooner - a major Western government is going to formally default and $$ trillions will be lost in a matter of hours or days. Once that genie leaves the bottle, there will be no turning back and the fiat currency regime that has now reached an advanced age of 54 years (1971-2025) will embark upon the final collapse. In the meantime, whichever government is in control in the United States or The United States, still appears to be capable of compromise, to end the shutdown and get back to the business of wheedling away at the wealth of the nation. It's beginning to look like this is going to drag on a few more weeks at least, and that the drama hasn't really yet begun. Spreads were compressed over the week, with full spectrum down from +55 to +47, and 2s-10s retreating 12 basis points, from +57 to +45, tying for the lowest since the tariff tantrum in April of this year. If spreads continue to decline, banks will no longer have healthy lending margins, which always leads to a liquidity crisis. A lot has been said recently about "Curve Control" policies being implemented by the Fed in order to maintain market stability. That would invlove more purchases at treasuries at lower yields, which would go straight to its balance sheet, which has been reduced from nearly $9 trillion down to near $6.5 trillion over the past three years. If the Fed has to begin making more purchases - and bear in mind that they're technically bankrupt already - they will be doing so with "magic money" created out of thin air, something of which global markets have had a belly full in recent years. Spreads: 2s-10s Full Spectrum (30-days - 30-years) Oil/Gas WTI crude oil closed out the week at $60.36, down sharply from the close on 9/26 at $65.19. While the decline was "unexpected" to some people in the business of tracking oil prices, it was no surprise to those following technical analysis. Oil, from Brent to WTI to Russian oil sold to India, China, and elsewhere, remains in a long term bear market, dating back to June 2022, when it peaked at $118/barrel, and more recently, in September, 2023, reaching a peak of $90.79. Simple math says WTI crude is down a third from two years ago with no end to the price decline or a bottoming evidenced anywhere. The lower price for crude oil, running counter-cyclical to inflation, may be indicating something deeper and darker than the otherwise bubbling stock market is telling. The suggestion is that the global economy - which, despite protestations from climate change true believers, still runs on coal, oli, and natural gas - has been slowing for the better part of two years. There's evidence in Europe, to be sure, though one wouldn't see the same structure. European oil prices have been rising steadily and only recently stabilized, since the outbreak of the conflict in Ukraine in February, 2022. European economies in the largest countries - Germany France, Italy, England - are on the brink of economic collapse. Energy prices in those countries have nowhere to go but lower, as people essentially go broke just trying to fund everyday needs. While lower prices for crude oil and petrol may offer some relief, it's on the back of a manufacturing slowdown of depression-era proportions. U.S. gas prices were moderately higher over the course of the week, the national average at $3.12 Sunday morning, according to Gasbuddy.com. State-by-state numbers show California remaining on top, steady at $4.65 per gallon, followed by Washington ($4.51), which was six cents lower and joined in the $4 club by Oregon ($4.12), also down. The lowest prices remain in the Southeast, with Oklahoma ($2.55) ranging in a multi-month low, followed by Mississippi ($2.66), Louisiana ($2.70) and Arkansas. The Northeast remained, as a bloc, above $3.00, though Delaware ($2.96) and New Hampshire ($2.98), breaking below. Virginia ($2.97), West Virginia ($2.94), and Kentucky ($2.81) remained lower, though Ohio surged slightly to $3.00. Indiana ($3.01), Michigan ($3.08), and Illinois ($3.30) are the only midwest states above $3. All midewest states from Wisconsin, Minnesota, and North Dakota south to Missouri, Kansas, and Colorado are below $3/gallon. Sub-$3.00 gas can be found in 26 states, up one from last week, concentrated in the South and Midwest with Ohio and Florida back above the line, but Wyoming, New Hampshire and Delaware dropping below. The entire Southeast, out to New Mexico ($2.88) is under $3.00 a gallon. Gas in next door neighbor New Mexico is $3.54, making border hops appealing to cost-conscious drivers, though the gap has narrowed by 11 cents from last week. Bitcoin Early Sunday morning, bitcoin reached a new all-time high of $125,178.70. It has backed off some $2000+ dollars since. This week: $122,985.87 Money will flow to bitcoin if there's some trouble in stocks. However, should there be margin calls on a severe market break, bitcoin will be one of the first assets sold, ahead of gold and silver, which are more likely, this time around, to be held onto by speculators and anybody with functioning brains. Precious Metals Gold:Silver Ratio: 81.55; last week: 81.73 Per COMEX continuous contracts: Gold price 9/5: $3,639.80 Silver price 9/5: $41.51 Money Daily's weekly survey on eBay and a quick price hunt on a number of online dealers revealed that silver cannot be purchased, except in large quantities or under unusual circumstances, for less than $50 per ounce, nor can gold be had under $4,000. The confluence of events, including a shortage in silver bullion, the government shutdown, recent and ongoing efforts by China, via the Shanghai Metals Exchange and vaulting facilities being readied in Hong Kong, Dubai and elsewhere, have turned the tables on the London price fixes, LBMA, and COMEX operations. Increasingly, gold, silver, platinum, and palladium price are being set elsewhere, reflecting a fundamental shift in global economies. Silver, especially, has been making record highs in just about every country except for the United States, which continues to maintain short positions, costing billions of dollars. Eventually, the U.S. is going to have to stop their foolish suppression games or pay severe consequences. Prices continue to rise, and now that investment advisors are recommending 15-25% allocation to precious metals to their high net worth clients, prices will, almost without a doubt, skyrocket. There have been no pullbacks and nothing short of a major war or stock market crash can cause any. Even then, gold and silver might actually explode even higher as safe-haven assets. Those who have been patiently stacking and hoarding are soon to experience great financial rewards. Here are the most recent prices for common one ounce gold and silver items sold on eBay (free shipping included, numismatics excluded):

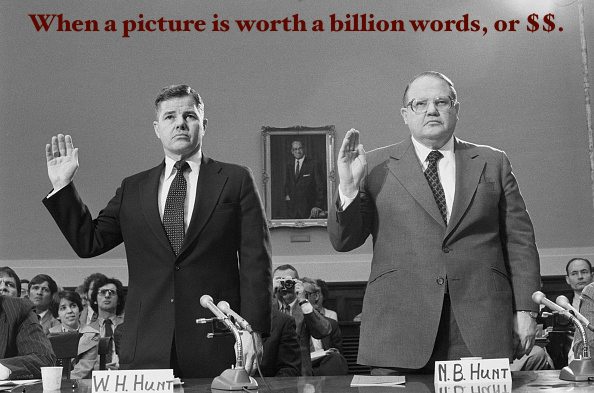

The Single Ounce Silver Market Price Benchmark (SOSMPB) made another new record high since Money Daily began recording in 2020, of $53.38, a healthy gain of $1.34 from the September 28 price of $52.04 per troy ounce. Gold and silver continued to move higher, with silver leading the way over the near term. Year-to-date, gold is up 48.01%; silver, 64.06%, both up six weeks running as of Friday closes on the COMEX. Speaking of the COMEX, silver is currently, and has been for a few weeks, in backwardation, a condition where the spot price is higher than the futures price. It was reported on Saturday that there is not a single out of silver available to short on the market, a condition, for all intents and purposes, has never occurred before. Additionally, the criminals at the COMEX raised margin requirements for all gold and silver contracts, but apparently not enough to slow down price gains. The CME and COMEX may have to resort to tactics last deployed in early 1980, as a response to the attempt by brothers Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt (collectively known as the Hunt Brothers) to corner the silver market. As the story goes, on January 7, 1980, the COMEX board of governors announced that it would cap the size of silver futures exposure to 3 million ounces. Those in excess of the cap (Bunker was long on 45 million ounces; Herbert held contracts for 20 million) were given until the following month to bring themselves into compliance. That was too long a wait for the Chicago Board of Trade exchange, which suspended the issue of any new silver futures on January 21. Silver futures traders would only be allowed to square up old contracts. Silver contracts were "sell only." WEEKEND WRAP When everything blows up again, because it always does and this bubble bursting should be spectacular, maybe somebody like Elon Musk, Jeff Bezos, Bill Gates or Mark Zuckerberg will say, "a trillion dollars isn't what it used to be," an object lesson for us all, proceeding through the age of delusion. At the Close, Friday, October 3, 2025: For the Week:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|

The federal government's game of musical chairs, combined with finger-pointing, grandstanding, and bluffing, will be a week old by Tuesday, but that's still probably too soon for financial markets to begin pondering outcomes. For now, life in the U.S.A. continues on without a hitch. President Trump has been calling in some markers, withholding funds from states, especially those earmarked for green energy projects, the most prominent being New York, which pledged to its "woke" constituency back when Andrew Cuomo was still governor, that it would be fully "green" by 2030.

The federal government's game of musical chairs, combined with finger-pointing, grandstanding, and bluffing, will be a week old by Tuesday, but that's still probably too soon for financial markets to begin pondering outcomes. For now, life in the U.S.A. continues on without a hitch. President Trump has been calling in some markers, withholding funds from states, especially those earmarked for green energy projects, the most prominent being New York, which pledged to its "woke" constituency back when Andrew Cuomo was still governor, that it would be fully "green" by 2030.