| MONEY DAILY | Commentary on Stocks - Bonds - Gold - Silver - Crypto - Oil/Gas and more |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | WILD SIDE | CONTACT | ARCHIVES |

Weekly Survey of Gold and Silver Prices

Single Ounce Silver Market Price Benchmark

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

|

Death of Hollywood?; Stocks on Track for Huge Week; Bank Earnings; Saratoga Opens Friday, July 14, 2023, 9:20 am ET It's tough to make it as an actor without a script, or lines, usually supplied by a capable writer. That's been the Hollywood dilemma since the Writer's Guild of America walked off their jobs on May 2nd. On Thursday, the Screen Actors Guild - American Federation of Television and Radio Artists (SAG-AFTRA) joined the writers on strike, putting American film, TV, and radio entertainment on a knife's edge. SAG-AFTRA represents approximately 160,000 film and television actors, journalists, radio personalities, recording artists, singers, voice actors, internet influencers, fashion models, and other media professionals worldwide. The WGA represents roughly 11,000 writers. This is the first strike by actors against the film and TV industry since 1980, and is also the first time actors and writers have both been on strike at the same time since 1960. Actors Emily Blount and Matt Damon were among the group that walked out of the London premier of the film "Oppenheimer" in which they played starring roles. Fortunately, nobody at Downtown Magazine, Money Daily, or the newly-founded idleguy.com are members of either union, so our work will continue without interruption. The same cannot be said for the likes of companies such as Disney, Comcast, and other big media outfits. Publisher, President, and Chairman of the Board of Downtown Magazine Inc., Fearless Rick Gagliano, issued the following statement in light of the evolving strikes:

We do not support the striking workers of either SAG-AFTRA or WGA. Many of the actors going on strike are overpaid, "woke" zealots whose work, while laudable from a professional aspect, represents a simmering hatred for capitalism and American values. As far as writers are concerned, when most of them learn how to spell and construct grammatically-correct sentences, maybe then they'll deserve respect and good pay. In the meantime, there are plenty of bloggers, content creators, free-lancers, and independent thinkers who will benefit from the self-inflicted wounds writers and actors have delivered to the studios, networks and other media outlets that have routinely betrayed and lied to the people of America and the world. We wish them success in groveling to their overlords. In the meantime, life goes on, and stocks have been on fire with NASDAQ and S&P indices tacking onto recent gains Thursday, at highs for the year at the best levels since early 2022. For the week, through the close Thursday, the Dow is up 660 points, the NASDAQ is ahead by 477, the S&P has added 111 points, and the NYSE Composite is up 435. By all appearances, the main US indices are looking at one of the best weekly gains of the year. Adding to the growing euphoria, earnings are rolling out. Thursday morning, JP Morgan Chase (JPM) reported second quarter earnings of $14.5 billion that were up 67% from a year ago. Revenue of $41 billion was up 34% versus 2Q 2022. Citigroup's (C) profits fell 36%, weighed down by a lack of M&A activity, though their numbers did come in ahead of expectations. Wells Fargo (WFC) was seen higher in pre-market trading, as it beat the Street's consensus forecasts. State Street (STT) reported EPS of $2.17, on net income of $763 million. Shares were trending lower a half hour before the opening bell. BlackRock (BLK) bettered analyst predictions, but the stock was flat-lining before the opening bell. Money Daily will have more on bank earnings and their impact in Sunday's Weekend Wrap. Also, Thursday marked the opening of the summer meet at Saratoga Race Track. Irad Ortiz, America's leading rider, brought home a 14-1 shot in the opening day finale. Be sure to check Fearless Rick's Best Bets for Friday's Saratoga card.

At the Close, Thursday, July 13, 2023:

Thursday, July 13, 2023, 9:28 am ET In the current environment, it doesn't take much to unleash Wall Street's "animal spirits," and Wednesday's reading of a mere three percent year-over-year increase on the CPI was just the ticket to unleash the bulls. The S&P and NASDAQ made new highs for the year and are at their best levels since April of last year, when stocks were moving in the opposite direction. While the 0.2% monthly increase and year-ago numbers were clearly causes to celebrate, more cautious analysis pointed to core CPI - which excludes food and energy - coming in at 4.8%, below expectations of 5.0%, but still a thorn in the side of the inflation-fighting Fed's FOMC. A 25 basis point hike to the federal funds rate at the July meeting (7/25-7/26) remains the working model, as board members are largely in agreement that more work needs to be done to cool the economy sufficiently. A July rise in rates won't have much of a material effect on market sentiment, now that inflation seems to be more subdued than at any time since late 2021. While the Fed may be nearly satisfied, they are certainly not done. Internally, M2, the broadest measure of money supply, continues to slide, keeping pressure on consumer spending. More than a trillion dollars has been liquidated over the past year, but the measure remains elevated following the free-wheeling COVID-era spending which saw money in circulation increase from $15 trillion to nearly $22 trillion in just more than two years (Feb. 2020 - March 2022). Clearly, liquidity is not yet a problem from a supply perspective. There is still an excessive amount of currency and money substitutes sloshing around to say that inflation won't still be a problem three, six or 18 months from now. The Fed will continue tightening the screws on the economy until there is at least some disinflation, meaning CPI numbers will have negative symbols preceding them. That hasn't happened yet, though it must at some point soon. The FOMC isn't the only tool available to the Fed. It will maintain its restrictive policies until it is assured that the economy won't overheat. Judging by the street's reaction to Wednesday's dovish CPI, it's likely the Fed will continue to exercise caution, especially on their balance sheet, by draining reserves at a moderate pace. This morning saw the PPI report for June, which may be even more positive than Wednesday's June CPI. Headlining the release was the index for final demand, on an unadjusted basis, advancing merely 0.1 percent for the 12 months ended in June, the lowest such reading since August 2020. Producer prices have absolutely collapsed over the past year, as the year-over-year reading has fallen from +11.2% in June of 2022 to the nearly flat level for June announced today. On one hand, lower producer prices signal a reduction in pressure from the demand side, a troublsome aspect which may be a precursor to consumers - at the final demand stage - being tapped out due to prevailing prices. Again, cautious minds see disinflation straight ahead with the possibility of a recession looming. With producers now witnessing lower imput costs and the possibility of pricing themselves out, the kneejerk response would be to reduce prices, keeping margins at the status quo or slightly below while maintaining market share. The odds being very good that big corporate consumer goods companies will not lower prices straight away, expectations for a solid third quarter are still fresh. In terms of second quarter results, which commence in earnest today and on Friday, the combined value of the CPI and PPI figures appears to be almost 100% positive for any kind of consumer-leaning company. The morning's reports from Pepsico (PEP) and Delta Airlines (DAL) appear to bear out the "good" second quarter theory forwarded by the inflation reportage. Both beat estimates and are trading higher in the pre-market, with DAL up nearly four percent. Conagra Brands (CAG) was less impressive. Markets Insider reports: The company's bottom line came in at $37.5 million, or $0.08 per share. This compares with $158.9 million, or $0.33 per share, in last year's fourth quarter. The stock is higher pre-market, which speaks volumes on sentiment. Wrapping up, gold and silver were boosted by Wednesday's CPI numbers and continue to hold onto gains. Gold futures rose $25 on Wednesday and are even higher today, at $1958.50, a three-week high. Silver advanced nearly a dollar on Wednesday, rising from $23.15 per ounce to $24.10, and is up another 40 cents today, at $24.50, approaching breakout levels. Overnight, Asian stocks were uniformly higher, and trade in Europe is positive across the board. US stock futures are higher: Dow, +70; NASDAQ, +117; S&P, +17.

At the Close, Wednesday, July 12, 2023:

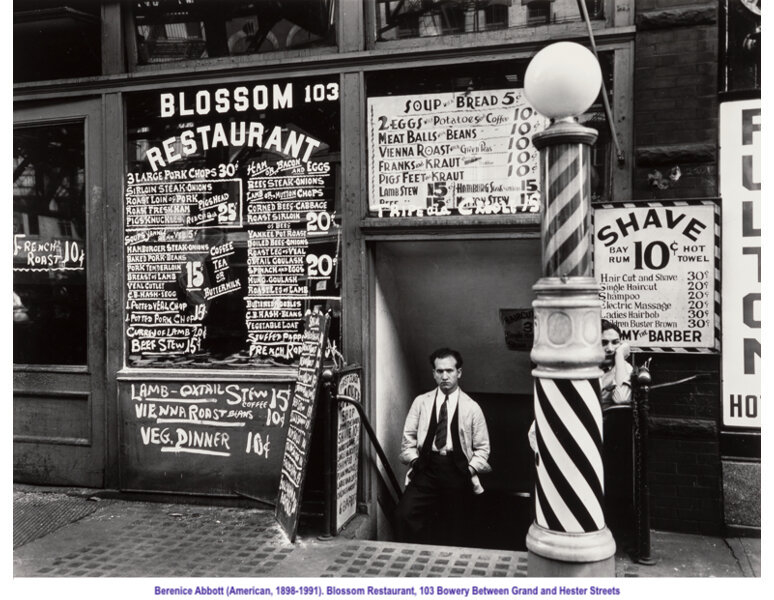

Wednesday, July 12, 2023, 9:25 am ET Wall Street is all excited about this morning's release of June CPI figures from the Bureau of Labor Statistics (BLS), sending stock futures into the stratosphere. Officials at the Federal Reserve are high-fiving all around for a job well done, by first creating insanely high inflation via the handouts during COVID, and then, crushing high prices by incessantly raising interest rates over the past 15 months. The Federal Funds target rate increased from 0.25-0.50 in early 2022 to 5.00-5.25% as of May and last month's pause. Mission accomplished. Everything costs more, average credit card interest is 20%, and a 30-year fixed rate mortgage will run you about 7.07%, plus fees, points, and anything else a banker can add to the total squeeze on American consumers. Just about everything costs 30-50% more than it did two years ago, with prices on some items - especially pre-packaged food - up more than double, except gold, silver, and your paycheck. Awesome. The average monthly payment on new mortgages is over $2,000. A cheeseburger and French fries at a sit-down restaurant is well over $8.00, probably over $10 at most places. Just so Money Daily won't be accused of being a Debbie Downer now that inflation has been brought under control by the Federal Reserve masterminds, here's a 1935 photograph by Berenice Abbott from New York City's Bowery. Check out the prices.

A little inflation won't hurt anyone. Sure.

At the Close, Tuesday, July 11, 2023:

Tuesday, July 11, 2023, 9:42 am ET The short list of reasons to short everything:

At the Close, Monday, July 10, 2023:

Sunday, July 9, 2023, 10:47 am ET Interrupted Tuesday by Independence Day, one of the two shortest trading weeks of the year (Thanksgiving week is always 3 1/2 sessions) has just passed and now comes the first full week of the third quarter and second half. The mood turned rather sour on Thursday and was not relieved Friday, as stocks fell initially on news of 209,000 jobs created in June per the Non-Farm Payroll report via the BLS. After a midday recovery, the majors fell to selling pressure at week's end, only the NYSE Composite escaping losses on the day. Equity losses had a trigger pulled by treasury rates, as the 10-year note surged past four percent along with the 30-year bond while short-term bills continued their inexorable gallop towards six percent. A perception of nearly risk-free gains in high-yielding fixed income instruments is fomenting a mood shift that could have serious ramifications moving forward. Appetites for stocks may wane as the burden of servicing debt becomes an issue for corporates as well as governments. Up to its eyeballs already, the US federal government has borrowed $700 billion since the debt ceiling was suspended in June. Rolling over expiring debt at rates three to five times more expensive is blowing a giant hole in the non-existent federal budget. More than a trillion dollars in interest payments is a problem of unimaginable proportions. The good news is that there's still time to escape. Getting from point A (you are here) to point B (Kazakstan, Uruguay, Malaysia or elsewhere) is likely to be a tricky business.

Stocks took a turn for the worse this week, though it really wasn't all that bad. Considering the effects of the cyclical bull market that began in October, 2022, taking a little off the top had to be an expectation and there are few signs that any kind of panic is forming in the investment community. The major indices remain very close to recent highs, though they are uniformly well below all-time highs made in November 2021 and January 2022, which seem like decades ago rather than just 18 months hence. There is plenty of heavy lifting to be done in order to regain those lofty levels, and no certainty that stocks will continue to outperform the general economy. Whether two of the past three weeks ending in the red becoming a trend remains an unsettled argument. Finance pundits will surely get a boost from Janet Yellen's visit to China, shaping the narrative in a somewhat positive light even though the reality of the situation is anything but. Thursday sees second quarter earnings beginning to develop with Conagra (CAG), PepsiCo (PEP), and Delta Air Lines (DAL) reporting, but Friday is the big session with Citigroup (C), Wells Fargo (WFC), JPMorgan Chase (JPM), State Street (STT), BlackRock (BLK), and United Health Group (UNH) all reporting prior to the open. With banks generally under pressure since March and through most of 2022, credit loss reserves will be just one of the metrics studied. Margins and deposit strength will also be analyzed and dissected. The big banks hold the keys to the economy in more ways than one. Not only are they functional in transmission of the currency, they are also major investors in the bulk of publicly-traded entities. Their health is of primary importance to the structural integrity of the economy and any further deterioration in their leveraged positions could be calamitous to equities in general. Even a glancing look at the banking sector is enough to give the impression that these are not the best of times to be suiting up, taking deposits, and making loans. The biggest banks are still down 15 to 35 percent or more from their 2021-22 highs and it's unlikely that earnings for the second quarter are going to cause people to rush out and buy shares of their stocks. The upcoming week may turn out to be more volatile than the churn recently prevailing .

Rising 0.25% in a week, the 10-year note grabbed the attention of more than just mortgage brokers and active bond traders. Ending the week at 4.06%, it was the first time the 10-year exceeded four percent since March 2nd. Likewise, other than a one-day leap to 4.01% on May 25, the 30-year bond also surpassed the four percent threshold and ended the week its most expensive for 2023 and since November 14, 2022 (4.07%) As has been the case in past excursions into 4+ percent territory, expectations are for the Fed or the market to rein back the rates in short order, though, with another 25 basis point hike looking like a sure thing at the upcoming FOMC meeting (July 25-26), such a move may not have much traction nor be long-lasting. The Fed's fight with inflation is far from over. Interest rates will remain elevated likely for much longer than anybody expected. Those in the "pivot" camp are looking like valid candidates for Darwin awards as they've been calling for the Fed to pull rates lower since July of last year. They remain utterly, unequivocally, wrong, and will remain so well into 2024. Up at the short end of the curve (after all, inversion is all the rage now), 4-month and 6-month yields, darlings of the US Treasury Department continue a slow burn higher, effectively bankrupting the federal government. It's hard to imagine what $32.5 trillion in debt does to one's brain other than fry it to a crisp. What it does to a nation is quite another story. We're witnessing it already. A complete breakdown of government is well-reflected by the antics of congress and the illegitimate administration. The only saving grace is at the Supreme Court, and they're efforts are limited in scope, but hope remains. When interest payments on debt become the single largest expense in any budget, it's a signal that the end is near. Households and businesses have the luxury of bankruptcy. The federal government does not. Its options are default or war, neither of them particularly pleasant experiences, or both. Probably both, within a year. Meanwhile, Treasury Secretary Janet Yellen is over in China insulting their leaders, citing China's "unfair economic practices," simultaneously describing her meetings with Chinese top officials as "direct, substantive and productive." Notably, Yellen was not received by Chairman Xi Jinping, indicating that she was not respected by her hosts. After Secretary of State Antony Blinken's failed trip last month, Yellen, impressionable as a Hobbit with a Moe Howard haircut, achieved little, if anything, substantive outside of idle talk and a few unappealing sound bites for the lapdog media. She's needs to be jettisoned from government with urgent dispatch. Her incompetence approaches that of her boss. Spread on 2s-10s collapsed from -106 to -88 basis points. 1-month out to 30-years was -139 basis points last week, contracting this week to -127. Expert opinion posits that an inverted yield curve is a certain sign of a looming recession, but that the recession doesn't actually manifest itself until the curve dis-inverts, otherwise known as "normal" upward-sloping. Accordingly, any recession that may be developing in the US could be further away than anticipated, though stresses are beginning to develop not just in the government debt balloon, but in the labor market, wages in general, and the length of the current inversion, now well over a year old. July 6 marked the one-year anniversary of 2s-10s inversion; 7s-10s had inverted months prior. While inversion remains a strong signal of generalized chaos, higher rates, for longer, as the Fed has repeatedly promised, continue to wreak havoc on budgets in the household and business sectors with credit card and mortgage interest at multi-year peaks and the refinancing of a large quantity of commercial real estate properties rapidly approaching and developing into a nightmare scenario. Office space, in particular, is in recession, as big city occupancy rates are at decades-old lows. There's clearly trouble ahead. The matter, as usual, is timing.

Crude oil (WTI) finally broke well above $70 this week, finishing in New York at $73.59, up substantially from last Friday's $70.45 a barrel. Putting oil prices in perspective, Friday's price for WTI crude was the highest since... drumroll, please... May 24 ($74.34). On April 12, it was $83.09 and a year ago, a barrel of the same slippery stuff pumped from below was over $90 a pop. With those numbers in the past, speculating to the upside price might be a bit of wishful thinking. There's always ample oil and its derivatives (no gas stations have shut down) and there's little to indicate that the global economy is expanding at a rate justifying prices above $70 or $75 per barrel. Contrary to popular opinion, US output is very strong, at levels close to 2019-2020 highs, a counterbalance to production cuts by the Saudis, Russia and other OPEC+ members. Additionally, Iran is selling directly to China, Russian oil is finding roundabout ways to supply Europe. As in Frank Herbert's novel "Dune", the "spice must flow." So, too, regarding oil. There's no shortages anywhere, only short-sightedness. This week's national average for a gallon of unleaded regular gas remained at last week's level of $3.52. In what was something of a change from normal conditions, the July 4 long holiday weekend didn't exhibit spiking and gouging prices. There was enough gas for everybody and enough profit for the drillers and refiners. Oil and gas futures speculators may be gazing into a crystal ball clouded by international relations, voodoo, or misplaced greedy intentions. Prices have stabilized, though the West coast continues to suffer from extremely overpriced gas at the pump. The Southeast remains the cheapest place to buy gas. For the seventh week running, Mississippi remains the only state averaging under $3.00. At $2.94, the price the price has been generally flat for nearly two months. Louisiana ($3.04), Alabama ($3.07) and Arkansas ($3.07) were also stable through the past five to eight weeks. Oklahoma checks in at $3.10. Texas and Tennessee are both holding steady at $3.11. Washington ($4.95) took the top spot from California, at $4.85, three weeks ago and retains the high spot. Oregon ($4.57) got four cents of relief, while Nevada ($4.21) completes the $4+ club. Arizona ($3.77) and Utah ($3.84) having recently dropped out, continue to experience relief. Prices in Illinois are still elevated at $3.82, but down sharply from the $3.98 high two weeks ago. Outside of Illinois, prices in the Northeast/Midwest region range between Ohio ($3.19) and New York ($3.64).

This week: $30,336.80 Bitcoin is now fully controlled by Wall Street interests, serving as a money laundering operation at the highest levels. It's a mosh pit for fiat currencies.

Silver:Gold Ratio: 82.93; last week: 83.85 Per COMEX continuous contracts:

Gold price 06/09: $1,975.70

Silver price 06/09: $24.40 Precious metals saw some recovery, or, at least a leveling off at or near the low end of recent ranges. In dollar or any other fiat currency terms, gold and silver have fared quite well in the early years of the 21st century, especially gold, which has increased - in dollar terms - by seven-fold. Silver has more than tripled since 2002. Current pricing may not be to the liking of the hordes calling for triple digit silver and $5000 gold, but those types fail to realize that if such prices were to become reality, it wouldn't mean that gold or silver was worth more, but that dollars, yen, euros, et. al. would be worth less. And that's precisely where fiats are headed: to a value of worthlessness, as has every fiat currency in the long, tired history of money and money substitutes. Knowing that fiats have limited lifespans, the argument for owning gold and silver stands tall, COMEX or no COMEX. Precious metals are recognized as money worldwide and will continue to exert influence globally. Talk of a BRICS gold-backed currency being unveiled at their upcoming 15th annual summit has recently been making the rounds, but mostly idle talk. Russia, China, and the ever-increasing number of countries aligning themselves with BRICS have not yet severed ties with the dollar and euro and are not in a condition that would warrant such an earth-shaking, radical move. It's still on the table, but all the pieces aren't yet together. This is complex stuff and takes considerable time to develop. August 22-24, the dates of the BRICS summit in South Africa, will probably offer more and stronger hints about the direction of the BRICS alliance and a competing reserve currency, but likely not a full-blown launch. Here are the most recent prices for common one ounce gold and silver items sold on eBay (numismatics excluded, free shipping included):

The Single Ounce Silver Market Price Benchmark (SOSMPB) gained slightly, to $37.14, an 8 cent increase from the July 2 price of $37.06 per troy ounce.

With second quarter earnings season about to commence, there is likely to be a higher degree of volatility in markets as investors and analysts peruse their portfolios and position themselves for the rest of the year and beyond. Winners of the first half (tech, mostly) may suffer from some profit taking, though the potential for another leg higher in equities - though improbable - is not impossible. What will be revealing is whether investors continue to accept sub-par results (revenues and EPS lower than year-ago comparisons) and continue to bid stocks higher or whether the effect of high interest rates will lure the value-conscious into fixed-income vehicles. That's a trend already well underway, and one which is likely to accelerate, especially if economic data continues to disappoint. The hotly-anticipated recession, which was supposed to happen in the first half of 2023, never fully materialized, and might even be forestalled another few quarters. One thing is certain. Stocks are at extremely high valuations. This does not seem like a good time to be speculating for the upside.

At the Close, Friday, July 7, 2023:

For the Week:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|

|