| MONEY DAILY | Commentary on Stocks - Bonds - Gold - Silver - Crypto - Oil/Gas and more |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | WILD SIDE | CONTACT | ARCHIVES |

Weekly Survey of Gold and Silver Prices

Single Ounce Silver Market Price Benchmark

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

|

Stocks Ravaged Since FOMC Decision; Bond yields Spiking as United States Faces Funding Crisis Friday, September 22, 2023, 8:38 am ET Some concerning technical damage was done to stocks over the past two trading sessions. Each of the major indices fell closer to their respective 200-day moving averages. The 50-day moving average for the S&P 500 turned downward, indicating souring sentiment. On Thursday, the S&P also closed at a three-month low (June 26, 4328.82). The NYSE Composite finished in the red for the fifth straight session, closing right at its 200-day moving average and just above its 40-week weekly average. On the week the Dow is down some 547 points, the NASDAQ -484, S&P 500 -120, and the NYSE Composite -372. Unless some equity miracle occurs on Friday, the S&P and NASDAQ will be down for the third straight week. The Dow Jones Transportation Index has been steadily falling since a peak on July 28 of 16,695.32. It closed Thursday at 15,058.04, a seven-month low. The deal UPS made with its drivers, bankruptcy filing by Yellow Corp., and the escalating UAW strike all play into an unstable condition on the Transportation Index. At 15,025 this index would be in correction territory, down 10%, and that's just for openers. The transports will begin to drag down the rest of the indices shortly, though the NASDAQ, S&P, and Dow have issues of their own, not the least of which will be revealed on Friday, October 6, when September Non-Farm Payroll data is released. It could be the first instance of job losses in this series since the plandemic collapse.

As the chart clearly indicates, these numbers have been in steady, albeit choppy, decline since January 2022, and it appears about to flatline and go negative within months and possibly even this month. What kept stocks flying high for the past year has been a steady drumbeat from the White House and its lapdog mainstream media that the economy is "fine" and that Bidenomics is a is of such genius quality that it keeps stocks offering dividend yields in the 2-3% range elevated well beyond the four to five percent returns available in the treasury market, a nearly risk free return. Not being able to distinguish a market in serious need of a correction can have deleterious consequences to portfolios and mental health. Stock investors are holding their collective breaths, hoping the second shoe doesn't drop, though it appears to be in vain. While dividend-paying stocks on the Dow have been somewhat resilient, they are already down a collective 1560 points since July 31. The correction line in the sand is 32,067 for the Dow. As of Thursday's close, it has another 2,000 points to shed. Anybody willing to bet that it gets there by Christmas? Interest rates have been flying higher, especially in long-dated maturities. While yield on two-year notes held steady at 5.12%, the 10-year jumped 14 basis points to 4.49% and the 30-year leapt 16 basis points, to 4.56. These are 16-year highs. Even more troubling is that yields will continue to ratchet higher as the US desperately neds foreign investors and it is attempting to attract them with extraordinarily-high yields. The chart below emphasizes this point rather clearly. The problem is that since expropriating some half-trillion dollars worth of Russian reserves back in February 2021, a fair share of foreign investors aren't exactly keen on holding US treasury bonds, exerting further upside pressure on yields and downward pressure on bond prices. Furthermore, the US congress don't appear to be capable at arriving at a compromise to its funding miasma. A small contingent of hard-line Republicans in the House have made issue with funding for Ukraine along with issues relating to the open US southern border (as in, CLOSE IT!). They remain steadfast in their demands to defund Ukraine, halt arms shipments to the failed despot, Zelensky, who was on Capitol Hill yesterday begging for more money even as Poland has already declared that they will no longer fund Ukraine. The NATo/EU/US/UK alliance is being shattered. The breaking point on Ukraine, the border, and the myriad issues foisted by the resident-in-chief and his nefarious allies is soon to come. Without a funding bill - even a short-term, 30-day, short-term joke which is currently under debate - the government will shut down October 1, and most Americans will cheer that happening. Even so, does anybody believe congress can resolve these issues in another month? Doubtful. All the excesses since January, 2021 are beginning to become serious problems. Oil continues to rise, in excess of $90/barrel for WTI crude, pushing prices at the pump to unacceptable levels in the US, the national average now $3.83 per gallon. Although almost nobody wishes to admit it, yields are going higher, bond prices and stocks, lower, Americans, poorer. For those seeking an escape hatch, gold and silver remain relative bargains, though signs point to possible explosive upside moves, led by silver, which is back above $24/ounce on the COMEX continuous contract this morning. Gold is almost right at support, $1,946 per ounce, but is appreciating at a more rapid pace in other currencies, especially in Eastern BRICS-aligned countries and even in Japan. With the opening bell approaching in the US this morning, futures are singing an upbeat tune called "Dead Cat Bounce." It's an oldie but goodie, which most of us are tired of hearing. Day-to-day moves in stocks are about as useful as COVID vaccinations. Trends, which all seem to be negative, tell the real story and are essential for productive future outlooks.

At the close, Thursday, September 21, 2023:

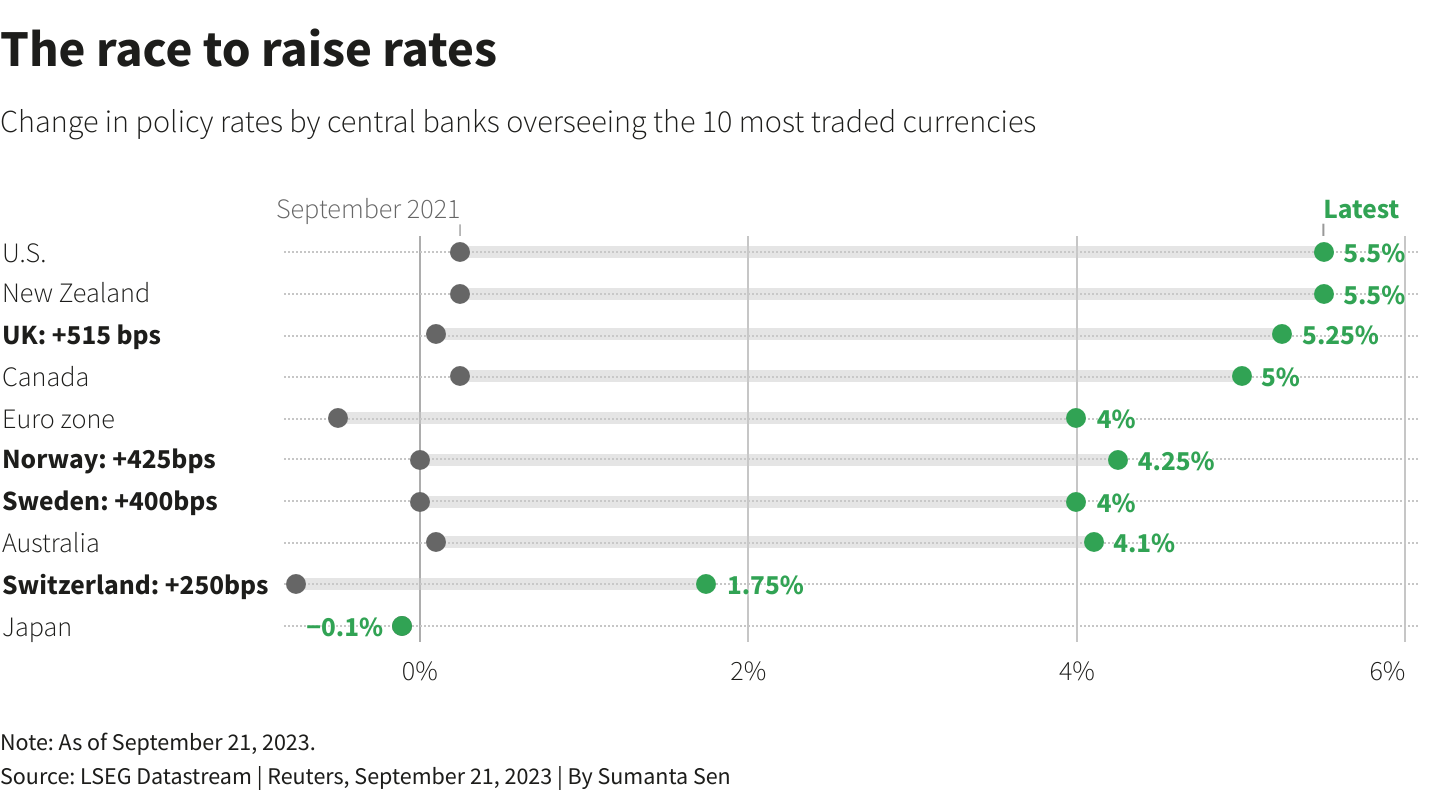

Thursday, September 21, 2023, 9:20 am ET On Wednesday afternoon, the FOMC delivered some bad news for stock-holders and Americans in general. It wasn't that they kept the federal funds target rate at 5.25-5.50%, but that they removed some dots in 2024 from their infamous "dot plot", which forecasts the outlook for interest rates into the future. Twelve of the 19 voting members on the FOMC are in favor of another interest rate hike in November and do not project cutting rates substantially in 2024. Naturally, their projections will turn out to be fantasies, as they are not sages nor soothsayers, but humans and very prone to error.

The Federal Reserve's latest Summary of Economic Projections, published Wednesday, delivered a message that was remarkably optimistic and fairly clear: Fed officials forecast that interest rates will stay above 5% through the end of next year, while unemployment will be lower and economic growth will be higher than previously expected. The above is the official take on what the Fed is forecasting. Unofficially, according to people with actual skin n the game and a more realistic economic outlook than the dunderheads at the Fed, interest rates are going to stay elevated, probably won't come down soon, and, just in case the US economy doesn't fall into a deep recession, inflation has not and probably will not be slayed. Prices of goods and services will continue to rise, possibly at a slower rate than previously, but they will still rise when what's needed is for them to go in the opposite direction. By first over-saturating the US with stimulus in 2020 and 2021, and then hiking interest rates at the fastest pace in the Fed's 110-year history in 2022 and much of 2023, the Fed created the inflation they had so desperately sought since 2009 when ZIRP and QE became the norms and then tried to keep it from causing rampant inflation. Essentially, the Fed has failed on both accounts, adding far too much money into the system and doing little to cool demand with their rate hikes. What they've managed to do is create an environment in which money costs more to borrow and bankers are able to swell their books with high-interest loans, credit cards, and mortgages. Traditional thinking on raising interest rates a la Paul Volker in the 1970s and early 1980s was to make money so expensive nobody would borrow. It actually worked back then because Americans were not so dependent on debt for survival. It's a different story today, where individuals and business enterprises are forced into debt in order to either maintain a standard of living or keep their companies out of bankruptcy court. Economic conditions today are vastly different than they were in the 1970s. Banking was just beginning to be deregulated, starting with expansion of bank branches across state lines, the elimination of usury laws, and the establishment of Certificates of Deposit and Money Market Mutual Funds, adding layers of complexity to the monetary system. The S&L crisis in the 1980s and 1990s was the first casualty of deregulation of banking laws. From 1985 to 1996, over 1,000 savings and loan institutions failed due mostly to lax regulation, greed, and various banking schemes, mostly involving real estate loans. In 1978, a Supreme Court case called Marquette National Bank v. First of Omaha Service Corporation effectively nullified many usury laws. The Court held that states could not impose interest rate caps on national banks that are headquartered in other states, leading the way for mega-banks like Bank of America, Citigroup, JP Morgan Chase and others to initiate the debt slavery of the nation via credit cards and personal loans at formerly usurious rates. Finally, the Glass-Steagall Act, which kept banks from engaging in risky investment practices, was partially repealed in 1999 as part of the Gramm-Leach-Bliley Act. This further deregulation of banking practices contributed in no small part to the 199-2001 NASDAQ dotcom boom and bust and the 2008-09 great financial crisis (GFC). Banks were allowed to leverage up assets to unforgivable levels, some as high as 35:1, making risky investments with little regard to shareholder interests. Back in the 1970s, banking was still a pretty solid, staid, unexciting business. Local banks made mortgage loans to local customers. Mega-banks were just beginning to spread across the country. Usury laws were still largely in place and most people either didn't even have a credit card or were wary of running up too large a credit debt. Nowadays, if you don't have three or four credit cards, you're considered "old fashioned." Saving is discouraged in favor of investing, and interest rates are at their highest levels in 22 years, but nobody cares. Big corporations are still able to borrow at five or six percent, and though that's higher than it has been in a long time, it's not life-threatening, except for the multitude of zombie corporations which have to borrow to remain solvent, and that includes a good number of regional banks. Currently, the average credit card interest rate is over 20 percent. A 30-year fixed rate mortgage is over seven percent, after roughly 20 years of mortgage interest hovering around 3.0-4.0%. Bottom line, increasing the cost of money is adding to inflation, not turning it down, because the Fed has been too slow in responding and their solution may not be a solution at all. What will turn down inflation are recession, unemployment, business failures, and, while those are far from desirable outcomes, they are what's needed and what the Fed has set up for the nation. Meanwhile, the federal government continues to run excessive deficits, the national debt has hop-scotched over $33 trillion, unions are striking for higher wages. Just how the confluence of these events will help contain inflation is a mystery, one about which the Fed refuses to address. The end result of the usually-wrong Fed outlook are either, a) a recession or depression; b) hyperinflation, or c) a combination of both. But, first, stocks have to become more reasonably priced, and they're already on their way. Since July 31, the decline has been notable in all the main indices. Wednesday, slash and burn is likely to be followed by a semi-panic on Thursday. Stock futures have been sliding all morning: Dow: -160; NASDAQ: -180; S&P: -35. More downside for stocks and higher rates on all treasuries two years or longer in duration will play out through the remainder of the month, which has only seven trading sessions left. The fourth quarter may be one of the ugliest on record. Have at it!

At the Close, Wednesday, September 20, 2023:

Wednesday, September 20, 2023, 8:33 am ET Astute followers of US equity markets will surely take note of the trading patterns the days prior to Wednesday's FOMC meeting, keeping in mind that Friday of last week was something of a watershed session, as options expired on a quad witching day, sending stocks down heavily. Monday's flat-line was preceded by dip-buying and bottom-fishing. On Tuesday, the flavor was keen on the sell side, with all of the major indices taking on deeper losses before ramping higher in the afternoon, ending with the net result of across-the-board losses, albeit minor ones. The tenor of current trading suggests that the FOMC policy decision at 2:00 pm ET will produce even more "distribution", otherwise known by its more onerous name, "selling", as has been the overriding theme since the end of July. This would be especially true if the committee decides to hike the federal funds target rate by a quarter point, which remains a possibility, though not one taken with much commitment by analysts covering the Fed. A more likely scenario would be another pause in the advancing regime, with the caveat of another 25 basis points added at the October 31 - November 1 meeting, signaling that the Fed is done and rates would likely remain stable through the end of the year and into early months of 2024. Not to get too deep into the Federal Reserve weeds, but the Fed would likely be happy with a moderate recession in the first half of next year, even keeping the possibility of a declining GDP in the fourth quarter of this year. What looks promising is an FOMC policy calling for no rate movement followed by a stern lecture to the pundits by Mr. Chairman, Jerome (don't call me Jay) Powell about the dangers of inflation and the need for the Fed to remain vigilant. That would permit the institutional stock vomiters to continue their stealthy distribution, shedding excessive positions well in advance of an eventual market breakdown. A market collapse is a near-certainty at this juncture, the trick being, as usual, the timing of such event. Macro indicators have been dull to horrific over the past year, and the spread between the yields on 5-year and 10-year notes and the average S&P stock dividend widening, an irrational condition that can only worsen should stocks move higher and the proximate reason why they can't and probably won't. With all markets under extreme pressure, the "probably won't" is the key takeaway. Meddling and price-fixing has become so common in the age of delusion that one can never take for granted a prolonged period of irrational exuberance (h/t to Alan Greenspan). As John Maynard Keynes so aptly noted, "markets can remain irrational longer than you can remain solvent." That remains the dilemma for short-side bears, thus, the slow decline witnessed of late. The selling should continue in fits and starts and may not even be noticeable to most market participants, but the shedding of assets will likely continue into the fall (Saturday, September 23, 2023 at 2:50 am EDT), which is only a prelude to winter, which figures to be harsh as usual, despite the shrieking claims of Climate Change chaos clowns. Some selling may occur today, but Thursday is likely to be a loser, as has been the case in the aftermath of most FOMC dates the past 18 months. Wall Street has a kind of delayed fuse that functions erratically when the Fed is involved. Those on bended knees in awe of the Eccles Building's finance gods dearly want to believe, but their faith is shaken by earthly reason. Today's policy rate decision isn't likely to be one of earth-shattering importance. External events, like the ongoing funding theater in DC, or the slow train wreck that is the progressive UAW strike, or the Ukraine situation, or the BRICS de-dollarization efforts, or... well, you get the idea. There are plenty of potential pitfalls and potholes that leave the US and world economies in dangerous positions. Stock markets in the US won't open for another hour or so, but futures are pointing higher, well off overnight lows. Asian stocks were mixed, but mostly lower. European equities are higher across the board in anticipation that the Fed isn't going to pull away the punch bowl just yet. Party on!

At the Close, Tuesday, September 19, 2023:

Tuesday, September 19, 2023, 9:25 am ET When the biggest move of the day was a loss of 0.13% on the NYSE Composite, you can rest assured it was a dull day on Wall Street. How dull was it? It was so dull, Peter Schiff had no comment. It was so dull, Nvidia was up less than a point. It was so dull, AI became sentient and turned itself off. Actually, the NASDAQ traded in a range of less than 90 points for the entire session and NYSE Tape A volume was a quarter of Friday's option-expiration-inspired trading. The lack of excitement was a combination of a hangover from the quad-witching on Friday and apprehension over what appears to be setting up for a "no change" in rates by the FOMC, which will announce their policy decision Wednesday afternoon. After cashing out last week, there is limited impetus to open fresh positions. Tuesday's trading may be a repeat performance of Monday's flat-lined vacuity. While stocks languish, commodities have picked up the slack, especially in the oil market. All grades of crude continue to price higher and higher. On August 23rd, WTI was just below $79/barrel. This Tuesday morning it's pricing at $91.90, a 14 percent move in just under a month, and that's on top of a 16 percent move from late June, making oil 25 percent more expensive than it was just three months ago. Gasoline prices at the pump are the highest ever for this time of year, the post-summer space usually a period in which the price of fuel drops. Clearly, all the effort put into keeping Russia in check and the price of oil down has not worked out as planned and is not a sustainable condition with the US and European economies creaking and cracking. Gold has caught a bid recently, up from $1,923 per ounce last Thursday to the current $1,957 on the COMEX continuous contract. Silver has tagged along, rising from $22.71/ounce to $23.60 prior to the opening bell. Indications from stock futures are for a lower open, with the Dow off 65 points, NASDAQ down 45, and S&P lower by nine points. With the Fed widely expected to do nothing on Wednesday - a net positive for stocks - will the response be positive or is this a case of (not) buying the rumor and selling the news?

At the Close, Monday, September 18, 2023:

Sunday, September 17, 2023, 10:00 am ET Key data this week came in the form of CPI and PPI each up for the month of August, with CPI gaining 0.6% for the month and the annual rate of retail/consumer inflation measured at 3.7%. Thursday's reveal of PPI rising at the hottest rate since June 2022, up 0.7% on a monthly basis, and 1.6% higher year-over-year. Just a few months ago, such numbers would have had analysts shrieking about the Fed raising rates even higher at the next FOMC meeting, but, this time, Wall Street took the sanguine point of view and saw nothing at all alarming over a resurgence in inflation trends. That seemed a bit odd, and it is, suggesting that insiders already are aware of what the Fed will do at the conclusion of their two-day confab Tuesday and Wednesday, September 19 and 20. They will keep the federal funds target rate right where it is, at 5.25-5.50% because that will be net positive for stocks, which is really all they care about, short term. Longer term, the Fed has to be focused on either the economy or the currency. From the looks of things, they're not very concerned about the currency, which they've managed to destroy by 98% since 1913. One has to give the long string of Fed personnel credit due. Managed to destroy a currency by inflation at roughly a rate of 0.9% per year is a pretty neat trick. Eliminating the final two percent of purchasing power of the US dollar shouldn't pose much difficulty. After all, they've had 110 years of practice. So, the Fed will turn its attention to the US economy. In other words, they will make stocks go higher. They may not do this right away, but soon enough, probably in the first and definitely by the second quarter of 2024, they will begin to lower interest rates. One can't have risk-free returns of five percent or higher in treasuries competing with the 2-4% dividends offered on blue chip stocks or growth companies. It's bad for business. The Fed's rationale will come from declining standards of living, otherwise known as a recession. Europe is already in one; the US either is in recession already or about to enter into one. Real wages haven't kept pace with inflation for over two years, and that trend doesn't seem likely to reverse despite the best striking efforts of the UAW and writers and actors in Hollywood. Clearly, the message is to lose your job and buy stocks. How can that not work out well?

Stocks were split last week, with the Dow and NYSE Composite posting modest gains, but the NASDAQ and S&P drifting lower, thanks to Friday's option-expiration blood-letting. Don't worry. Lots of money was made by the usual suspects. The coming week will be all about the FOMC and their lack of interest in raising rates. Dow Transports gained 131 points on the week, but are still down five of the last seven, stuck midway between the 50 and 200-day moving averages. All of the majors finished the week just below their respective 50-day moving averages, which would seem to indicate some weakness, though, like everything else over the past five trading days, was really all about making money on expiring options Friday. Bear in mind, despite your personal experience and those of friends, relatives, and the occasional neighbor, everything is just hunky-dory. If the Fed does raise the target rate by 25 basis points, to 5.50-5.75%, stocks will be pummeled like a New Jersey clob boxer, but, that's not high on the probability scale. They'll choose to stand pat, keep rates where they are and hope nobody notices that everybody's credit cards are maxed out, nobody wants a 7.5% mortgage, and, come October 1, about 40 million people are going to have to start paying back their student loans after a three-year hiatus. Not that everybody will. Many of these debt slaves will simply continue to default and hope for the best. Student loans, being non-dischargeable in bankruptcy, are truly one of the biggest scams ever foisted on the American public. For decades, the government touted the theme that everybody deserved to get a college education. Well, now that bachelor and master's degrees have become as common as paper towels, it turns out that many of them aren't worth the sheepskin they're printed on, though the money borrowed to get one still has to be repaid. Kids and parents got fooled by the very institutions funding and passing out the papers. Who could have guessed? The federal government, led by those lazy morons in congress, could fix all of this if they so desired. But, like the border crisis, they want to keep student loans free from bankruptcy discharge in much the same manner as they like the Southern US border wide open. Oh, well... stocks should keep going higher near term.

Keeping abreast of the rate condition in treasuries, it's apparent that the Fed's slow-walking over the past six months has led inexorably to an elevated curve overall. Over the past five five months, specifically when one-month bills magically leapt 106 basis points in one day, May 4th (4.70% to 5.76%), bills, once aligned, have stagnated in a range between 5.40% and 5.60%, while longer-dated notes and bonds have been selling off, to a point at which the yield on two-year notes is about to hold over five percent and the 10-year benchmark continues a zig-zagging path higher, closing out the last week at 4.33%, exceeded only by the rise to 4.34%, August 21-22. Indications, if prognosticators have made the correct call on the FOMC's move Wednesday to stand pat, are for longer-maturities to plateau for a while before moving higher. The momentum toward higher long-term yields comes from BRICS and rest-of-world abandonment of dollars, already affecting short-term yields, commencing toward an end-game wherein fewer international buyers need nor want dollars, a process which will play out over a longer time span of years, not months. Think 2028 for US$ purchasing power to collapse in a heap of worthless Federal Reserve Notes (FRNs). For spreads, the full spectrum (30-days out to 30-years) ended the week at -109, an improvement from last week's -119, and -122 two weeks ago, as inversion continues creeping toward normalization. 2s-10s finished at -69 after closing out at -72 (apologies for incorrectly noting -62 last week, our error) last week, also trending gradually toward normal, i.e., un-inverted. It's assumed that a yield north of 4.50% would result in recession. That calculation may be accurate. Job growth is fast becoming job loss. Between the nascent rise of AI and inept, clownish, destructive government policies, a recession within six to nine months (or sooner) is pretty much a stone-cold lock.

WTI crude oil advanced again, to $90.40 at the close of trading Friday in New York, from last week's price of $87.23, now a ten-month high (early November 2022). Higher oil prices have begun to bleed over into prices at the pump. The US national average for a gallon of unleaded regular gasoline rose by six cents over the course of the past week, to $3.86. According to gasbuddy.com, Mississippi still has the lowest price for fuel at the pump, $3.28, though that's up four cents from the prior week. Following are Goergia ($3.36), Louisiana ($3.37), South Carolina ($3.40), and Alabama ($3.41) Tennessee and Texas were both higher by eight cents ($3.43). Florida's price drop was temporary, now back up to $3.64 from last week's $3.57. California stayed in the top spot, with gas up a whipping 18 cents in just a week, to $5.59 a gallon. Elsewhere, prices eased a bit with Washington ($5.03) and Oregon ($4.68) down a few cents. Nevada ($4.76, up 17 cents) and Arizona ($4.53, + 18 cents) were higher over the week, along with Utah ($4.29, + 5 cents), while Idaho ($4.12) was unchanged. Prices continue ramping higher in Montana, up another eight cents, to $4.19 this week. Those eight Western states comprise the $4.00+ club. In the Northeast the highest gas prices remain in Pennsylvania ($3.90) and New York ($3.88), both marginally higher. The lowest prices in the region can be found in Kentucky ($3.52) and Virginia ($3.59). Illinois was unseated as most pricey in the Midwest, with North Dakota the new king, at $3.96, followed by Minnesota ($3.95). Illinois checks in a #3, at $3.93. Colorado is holding just below $4.00, at $3.98. With price hikes in oil already in place, $4.00/gallon should become standard within weeks.

This week: $26,582.80 Anybody see a pattern? Didn't think so.

Gold:Silver Ratio: 83.47; last week: 83.77 Per COMEX continuous contracts:

Gold price 08/18: $1,887.90

Silver price 08/18: $22.80 Gold and silver were up ever-so-slightly the past week, seemingly on hold until Wednesday's FOMC meeting along with stocks. The rabid pace of buying has been somewhat shunted by basic consumer economics. Despite lower prices, which may be the result of slackening demand, the price suppression tactics appear to have worked their magic once more, keeping holders of precious metals frustrated and would-be buyers suspicious and skeptical. The metals remain in bargain buying territory, though even lower prices may be needed to encourage more buying. True believers continue to hoard as much as possible while those with less nerve and/or faith may be selling into the recent declines, exacerbating the already dour condition. Nobody wiht a solid understanding of precious metals as tradable money is sweating any of it. Rather, they are scooping up even more and adding to reserves. That would include groups as diverse as individual buyers, home offices, sovereign funds, national treasuries, and central banks. Here are the most recent prices for common one ounce gold and silver items sold on eBay (numismatics excluded, free shipping included):

The Single Ounce Silver Market Price Benchmark (SOSMPB) continued to decline, down 64 cents over the course of the week, to $34.96, from the September 10 price of $35.60 per troy ounce. While silver continues to hold steady in a range above $33 and below $37 in open one-ounce markets like eBay, dealers are offering one-ounce bars and coins at prices ranging from just $1.50 to $2.00 over spot, for prices of $24.50 to $27.00 in quantity for lower-tier coins, with bars slightly higher. This disparity in pricing is likely due to eBay's oppressive 15-25% fees and charges, though sales remain brisk as long as reputable dealers use the online auction and fixed price giant as a customer acquisition platform. Notably, offerings of one-ounce ungraded gold coins were sparse, a logical condition due to the lower pricing of gold in the rigged COMEX futures market and LBMA price-fixing, though gold bars can be had in abundance at premiums about $30 lower than those available for gold coins. The current $100+ premium for gold coins on eBay is roughly double what dealers offer on-site. A similar ratio applies to gold bars in small quantities. This regime of price-rigging continues to encourage consumers to buy and hoard at what can easily be perceived as bargain offers. It won't be long, however, that prices in places like Japan, China, and Middle East countries become comparatively higher, as BRICS+ countries continue to move away from Western standards. Like the Roman Christianity schism of 1054, the same will be seen in currencies, commodities, and trade between East and West, eventually leading to a multi-polar planet, as fiat competes with hard money and goods. The West, fraught with sanctions, will become more and more expensive until living under a tyrannical fiat regime becomes unbearable, as is currently the case in some South American nations, specifically, Venezuela and Argentina, both suffering the ravages of hyperinflation, which will soon enough infect all major nations in the UK, US, and EU.

Even though signals for higher inflation were plain to see, the usual overlording controllers didn't see it that way as every analyst from Goldman Sachs to Morgan Stanley to Merrill Lynch all chimed in on the "pause" chorus. One would assume, given the CPI and PPI data from the past week, that the Fed might like to "pump the brakes" a bit and commit to a 24 basis point hike. Apparently, that does not appear to be the case, as they may see any further rate increases as a recession trigger, given the already-tapped-out American consumer. While the Fed boneheads may believe they've managed inflation well enough despite recent data, the laggard effects of their rate hikes have still not been realized, but they will be, which is something of which they're probably already aware. While they profess to not wanting to cause a recession, preferring the so-called "soft-landing", external events, like impeaching the imposter president or a vicious fight over spending in congress, may take precedence. What comes in the fast-approaching fourth quarter is a guessing game, though indications continue to point to a general downturn. There are more than a few potential pitfalls along the way.

At the CLose, Friday, September 15, 2023:

For the Week:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|

|