| MONEY |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | NEWS/UPDATES | WILD SIDE | CONTACT | ARCHIVES |

Weekly People's Gold and Silver Prices

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

10/4-10/10/2020

Downtown Magazine appreciates your support. If you find the information here helpful, please consider showing your support. PayPal, debit or credit cards accepted.

|

The Crash That Wasn't: Thursday's Rally Explained Friday, October 16, 2020, 9:24 am ET

At the Close, Thursday, October 15, 2020: This morning, the normal "at the close" piece attached to every Money Daily post has been moved to the top of the page instead of its normal position at the bottom to illustrate, clearly, what happened on Thursday, when futures suggested a major selloff in the cash market. Let's take a look at the lows of the day:

At the LOWS, Thursday, October 15, 2020: Yes, the major indices were down roughly 1 1/2 percent at the lows. What happened? First, understand that those lows were made - on each market, in unison - within minutes of the opening bell. Conversely, on the other side of the daily chart, the highs of the day were reached roughly 10-15 minutes before the close. In other words, "you got played." Not that this is an isolated incident. As a matter of fact, erasure of losses happens all the time on US stock exchanges, and has been occurring repeatedly since then-President Reagan signed executive order 12631, on March 18, 1988, establishing the Working Group on Financial Markets, commonly referred to as the Plunge Protection Team, or PPT. The PPT was established in the aftermath of the 1987 crash, a one-day global sell-off that happened on October 19. That date is referenced around Wall Street as "Black Monday." The Dow Jones Industrial Average lost nearly 22% on that day; the S&P was also down more than 20%. For many years, mere mention of the "Working Group" or PPT would elicit jeers and laughter as its existence was considered high humor and conspiracy theory. It wasn't until February 23, 1997, when a Washington Post staff writer, Brett D Fromson, coined the term "Plunge Protection Team" as the headline of an article in the Washington Post detailing how the "Working Group" was designed to function. New York Post financial writer John Crudele, former congressman Ron Paul, among others, have used the term openly and frequently since then. It's now common knowledge that the PPT exists and that it prevents market crashes by buying futures contracts.

Apparently, the PPT sprang into action right at the opening bell Thursday, as markets were crashing, not because negotiations on a stimulus bill were stalled out or that coronavirus cases have been rising. Those stories have been used as scapegoats for every market slip since July. Thursday's crash was set off by the New York Post story detailing some of the contents of one of Hunter Biden's - son of presidential candidate, Joe Biden - computers, and the swift censorship of same by Twitter and Facebook. If the wheels were coming off the great "blue wave" Democrat sweep narrative because it's figurehead, Biden, was being exposed as a crook, liar, bribe-taking dirty dealer, then the Deep State's dream of a new world order might be coming to a quick and premature end. Once the market opened and the social media giants made it clear that the story would not be allowed to circulate through their platforms, the PPT had its marching orders or really, really smart money started buying and kept buying all day as it became clear that Facebook, Twitter and the mainstream media would not make mention of the article or any of the subsequent articles from the Post (which had its twitter account locked) or mentions of it by President Trump's campaign team (ditto) or anybody else. So, there you have it. Americans are being played, not just by the media or lying politicians, but Wall Street hucksters who make their plays in the futures market and move money in the cash market. It's like an elaborate game of three-card monte in which the brokerages owned by the biggest banks are the dealers and the general public are the marks. The scheme relies upon computer algorithms that respond to headlines promulgated by their allies in the mainstream media. Some of it works automatically, to make markets and individual stocks go in whichever direction they please, despite fundamentals, earnings, p/e ratios and tools like that which used to help determine stock prices and real value. No more. Those days are over. Today's stock markets are controlled by unseen forces beyond the ken of most wizened traders or analysts. It's a new ball game. The PPT is part of it. The meida is another cog in the wheel, and in the end, nothing happens without the whirring sounds of computer fans at server farms in New York and New Jersey pushing HFTs (High Frequency Trading) through the system formerly know as "markets." These aren't markets any more. They haven't been markets in any traditional sense for a long time, at least since the GFC of '08-09 and likely earlier. These are control mechanisms, deep state constructs designed to influence public behavior, stifle awareness and shunt free thought. Think you can beat the market? Do you have trillions of dollars available at a moment's notice from the central bank? They do, and you can't possibly win unless you play their game. The alternative is to not play at all, a position that's becoming increasingly popular as institutions become monolithic oligarchies and individual freedoms are beaten to the curb. It's not for everybody, but it's at least an option.

Thursday, October 15, 2020, 7:40 am ET Like it or not, the American public, the sleazy politicians in Washington DC, the corrupt media are going to get four more years of Donald J. Trump shoved down their throats starting November 3rd. This is thanks to the careless, feckless, cavalier attitude of the Democrat opponent, Joe Biden, his campaign handlers and especially his son Hunter, whose clumsiness allowed sensitive communications to fall into the hands of a computer repair shop owner, because he was too reckless or thoughtless to remember to pick up the three computers he dropped off months earlier. Brought to light by none other than America's Mayor, Rudy Giuliani, the exclusive by the New York Post, the story of the Bidens is one so rich in irony and scandal that those bastions of unfree speech and censorship, Facebook and Twitter, chose to try to hide it from the peering eyes of the public. Their efforts to suppress the truth - possibly the most egregious display of censorship ever witnessed in the United States - served as clear and conclusive evidence that Big Tech companies that manage the information flow of the country have been in the bag for the Democrats and Joe Biden throughout the election process. It is not the duty nor the intent of this blog to convey the entire story, but only to point readers seeking the truth in the correct directions, providing a cursory overview of a saga that is only going to grow more astounding over the coming days and weeks leading up to the election. The Biden exposÚ is too deep and too broad to be adequately conveyed in one post, or even a series. Money Daily likes to stick to financial affairs, not affairs of state. We'll leave it to others in the alt-media universe to inflict appropriate damage. In a nutshell, the story of Joe and Hunter Biden and their dealings with Ukranian officials and the Burisma energy company signal the death knell for the Biden-Harris ticket. The election is now essentially over because it's become so glaringly obvious that former Vice President Biden, like his chief, former president Obama, is nothing more than a pay-for-play, corrupt politician straight out of the Hillary Clinton model. Anybody even considering casting a ballot for this nefarious criminal is now required to check their morality at the polling station door. If nothing else, these revelations - along with other misdeeds so rabidly suppressed by the social and mainstream media for years - will drive Democratic voters away from the polls and away from the party. All other Democrat candidates are guilty by association, automatically. Biden's gaffes, slack mental acuity, criminal activity, and slip-shod laziness is not only going to cost him the election, but it offers the real possibility of swinging the Senate and House races to the Republicans. With less than three weeks to the election, with early voting already underway, this story is not going away and a massive Trump landslide victory is all but assured, despite the worst efforts by the mainstream and social media - and the pollsters - to swing opinion to the Democrat side. This story, which broke only yesterday, will have ramifications for the election and well beyond. Even at the first glance, markets on Wednesday began to slide. On Yahoo Finance, the headline blamed the decline on a quip from Treasury Secretary Mnuchin, who opined for the umpteenth time that a stimulus bill was unlikely before the election. Behind the scenes, editorial effort was being made to hide the effect of the Biden revelations, even as early as 10:00 am, when the sell-off became pronounced. The 'Blue Wave' theory that had been bandied about by slack-jawed internet media had crashed upon the shoals of corruption and scandal. A Biden presidency, which was supposedly going to be great for the economy and Wall Street, had been exposed as as yet another fraud from wishful-thinking hack journalists who support higher taxes, socialism, hand-outs, corruption and criminal behavior which is endemic, not only in politics, but in finance, as has been evidenced over the years. Even this Thursday morning, as stock futures are collapsing, Yahoo Finance headlines put the blame on Mnuchin and the coronavirus. They can't mention the Biden revelations because they can't handle the truth, but that's what's really tanking the markets and is likely to continue doing so. The "Blue Wave," resurrected from Clinton's failed 2016 campaign is just another liberal fantasy designed to make people think Democrats are leading in the (oversampled and about to be proven wrong again) polls and are good for the future of America. The truth is that there is no blue wave, there never was one in 2016, and any investment pundits or advisors pushing this narrative are prevaricators of the highest order, stealing money and minds with their baseless investment theories. Wednesday's smallish losses were just the appetizers. The main course will be served Thursday, after it's revealed that another 800,000+ people filed initial unemployment claims and the Biden cover-up continues unraveling into the weekend. By the time Meet the Press airs Sunday morning, there's either going to be a pronounced denial and cover-up by the media or a full-blown manic conspiracy theory denial. Neither will work. And the COVID scare, in which a not-so-deadly virus shut down the global economy for months and is doing so again in Europe at the behest of wrong-thinking socialist leaders over there is also failing to pass the smell test, the PCR test, the false positive test. Exposing Joe Biden as a criminal bribe dealer and threat to the security of the United States is only the tip of the iceberg. That these stories are coming out now is no accident. Donald Trump's strategy to expose the swamp creatures in the Democrat and Republican parties is just getting started, which is why the effort to censor and suppress this information is so magnified. Four more years of a Donald Trump presidency may put many corrupt politicians and businesspeople out to pasture and maybe behind bars. The following are sources by which readers may discover the truth for themselves. The mainstream media isn't going to do anything but offer denials and call everything "conspiracy theory" because they are counting on American voters to be blind to the truth as voting gets underway. This blog can only lead readers to the fountain of truth. It cannot make them drink from it. That's a choice each individual must make.

New York Post Here's Rudy Giuliani laying out more damning details, promising more to come.

Giuliani, a former prosecutor who used RICO statutes to bring down crime families in New York and New Jersey, knows the terrain and will be like a rabid pit bull with expose┤s right up to the election and hopefully, beyond. Lastly, here's Tucker Carlson laying out the details of Twitter and Facebook's censorship:

Here comes the second wave. Not of the virus, but of stock market chaos.

At the Close, Wednesday, October 14, 2020:

Wednesday, October 14, 2020, 8:30 am ET About the only thing certain about equity markets recently is uncertainty. Nobody knows who's going to be president in three weeks time, nor can anybody adequately discern whether Democrats or Republicans will hold majorities in the House and Senate. Will protests re-appear if Trump wins? What if Biden wins? There remains the issues which the protesters insist to be at the core of the looting, burning and rioting: systemic racial inequality and oppressive police forces. Then there's the COVID crisis. Like the old Memorex audio tape commercials, people are asking, "is it real or is it a scam-demic?" Cases are up in some places, down in others. Vaccines look promising one day, not so hot the next, and who's going to take them when they do become available? There are other treatments available, and, by the time a safe vaccine is developed, the coronavirus may have run its course, mutating into something more like the common flu than the Black Plague. Will we have a second wave of the virus, and will states decide to shut down again or "tough it out" this time? Are schools open, closed, virtual? And is virtual learning as good, if not better, or worse, than traditional classroom instruction? The politicians in Washington seem reluctant to pass another stimulus bill prior to the election, but will they continue to dither over details afterward? Is the economy good, bad, worse, better, the same, and how does it matter? Are jobs coming back or have many gone away permanently? While these are just top of mind issues presently, there are more underneath and over the top. It's well known that stock markets despise uncertainty, though they've shown a great resilience over the past six months, though much of the rise in stocks can be directly attributed to the Federal Reserve, which has had the money spigots open to full volume. To be fair, while stock markets loath questioning times, traders love the volatility, as adroit stock adherents are able to make positions and trades based on momentum, sentiment, money flows, political events, and just about anything other than fundamental analysis. So, will stocks continue to rise back toward record highs or will they gravitate to the depths of the February-March crash? Getting that equation right could mean the difference between making one's way to Easy Street or wholesale wealth destruction. There are admittedly more variables than answers, and while the squeamish will settle for somewhere in between a rally and a crash, that's not a coherent strategy for making hay, or money. About the best the high-minded can come up with these days is a "it depends..." analysis, which leaves everybody right where they are most uncomfortable, in the dark. Volatility remains elevated. Bank stocks are currently reporting third quarter earnings and they're all over the map. JP Morgan beat by a lot, Citi, by a little, Bank of America, which reported prior to the Wednesday open, beat on the bottom line, earning 51 cents per share, but misfired on the top, as net income fell to $4.9 billion, from $5.8 billion and 56 cents a share, in the year-ago period. Goldman Sachs smashed expectations, with profits for the three months ending in September pegged at $9.68 per share, more than double the $4.79 posted over the same period last year and well ahead of the Street consensus forecast of $5.57 per share. Goldman, like JP Morgan and Citi, slashed its provisions for credit losses to just $278 million. Bank of America raised theirs to $1.39 billion from $779 million in the prior quarter. These credit loss provisions are tiny, considering the depth and scope of the coronavirus crisis. Apparently, banks don't see much risk associated with overdue rents, unpaid mortgages, credit card and auto loan payments that have been deferred until a later date, and student loans which have been put on hold. Either that, or they're just not realizing the losses now and more reserves will be set aside in future quarters. They may even believe their own narrative that the stock market is actually a leading indicator and it's forecasting a brighter future. A rosy outlook may be well and good, but investors aren't buying it. All the bank stocks were lower on Tuesday, and they're looking for a repeat performance Wednesday. Bank shares were hit hard in the February-March crash and most have not returned to levels prior to that. In fact, the banks with high retail exposure - Bank of America, Citi, and Wells Fargo - are much closer to the March lows than the prior, February highs. Wells Fargo is actually trading below its March 23 low of 25.25. It closed Tuesday at 24.74 and this morning posted its first profitable quarter of the last three, earning 42 cents a share in the third quarter, two cents below forecasts. It is selling off in pre-market trading. The airlines are kaput. Delta (DAL) posted a $5.4 billion loss in the third quarter, following an even bigger second quarter loss. United Airlines (UAL), which showed a $9.31 per share loss in the second quarter, reports after the closing bell. The estimate is for -$7.44. Ubelieveably, the airline stocks are slowly rising as hope for another government bailout is also. You might as well throw darts at a page of stock quotes amid all the confusion and cross-currents. Staying out of the markets seems an advisable strategy - one that is a standard for CNBC's Jim Cramer during earnings seasons - until election day. But, what happens then?

At the Close, Tuesday, October 13, 2020:

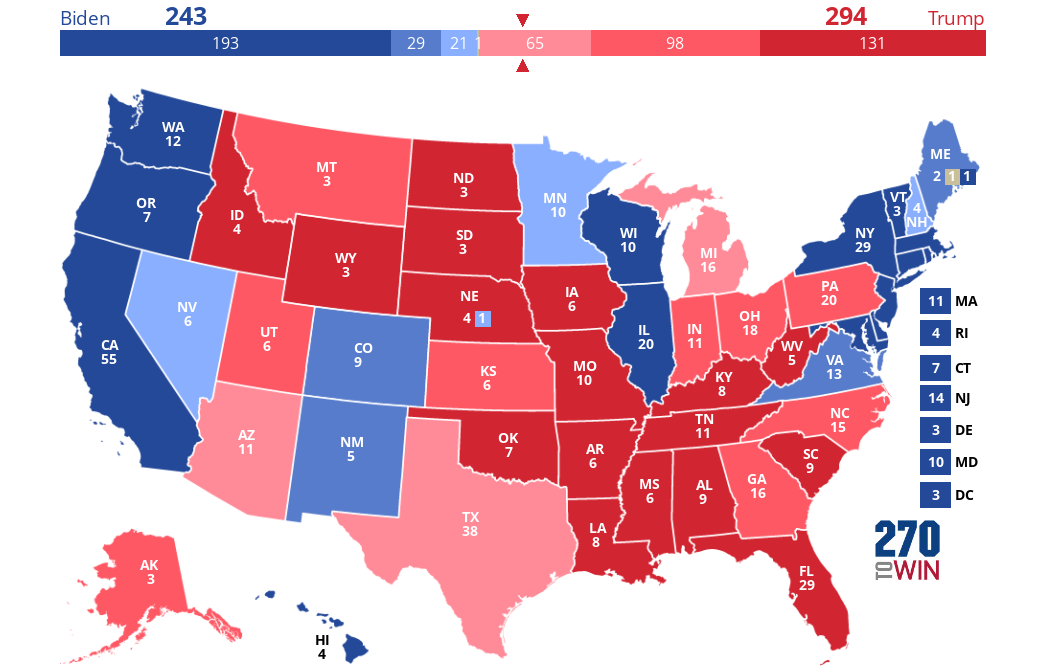

Tuesday, October 13, 2020, 8:45 am ET Coming out strong on the first day of third quarter earnings releases, BlackRock (BLK) and JP Morgan Chase (JMP) led the charge toward new stock market highs, both reporting top and bottom line earnings beats for the period ended September 30. BlackRock (BLK) stock was surging Tuesday morning in pre-market trading, up 25.65 points (4.17%) to 640.51 as of 7:35 am ET. The world's largest asset manager, largest US landlord, and designated bond buyer for the Federal Reserve reported better-than-expected earnings. Third-quarter earnings grew 29% to $9.22 a share, up from $7.15 a share a year earlier. Analysts were looking for the company to post earnings per share of $7.77, but the company benefitted from additional fee income and a increase in assets under management (AUM), now pegged at $7.81 trillion, up from the $7.32 trillion in the second quarter and $6.96 trillion a year earlier. Revenue grew 18% to $4.37 billion, topping the FactSet total revenue consensus of $3.94 billion. Also reporting prior to the opening bell, JP Morgan said earnings for the three months ending in September were $9.4 billion, or $2.92 per share, up 9% from the same period last year and well ahead of consensus forecast of $2.22 per share. Stunning was the revelation that JP Morgan's credit loss provision for the quarter rose by a mere $611 million, a minuscule figure compared to the massive $10.5 billion booked over the three months ending in June. Expectations were for the largest US bank by assets to set aside somewhere in the range of $1.8 billion to as high as $6 billion. Shares of the bank's stock were sharply higher in pre-market trading, coming on the heels of a major upswing Monday. JPM was a point higher on Monday and it looks to add to those gains when regular trading resumes on Tuesday. While BlackRock has put in an impressive run this year, with shares up 22.3% since December 31, 2019, JP Morgan has not done quite as well. Its price was slashed in the February-March crash, though it has regained some of those losses. Still, Jamie Dimon's firm is down 26.5% year to date. Monday's rally took the major indices a step closer to all-time highs. At Monday's peak, the Dow Jones Industrial Average was within 50 points of 29,000, a level it's pierced only once since the March lows (September 2, 29,100.50), The all-time high of 21,511.42 (February 12) once agin appears to be within range, less than three percent off that target. The NASDAQ is within 1 1/2% of its record close of 12,056.44 from September 2nd of this year. Also making its record close on 9/2 was the S&P 500 when it settled out at 3,580.84. It too is less than 1 1/2% from achieving another record high. The NYSE Composite, which, like the Dow, has lagged the other two indices, needs to gain another six percent to overtake its February 12 record close of 14,136.98. If earnings for other major corporations show as well as the two financial behemoths which reported Tuesday, record highs could be a shoo-in prior to the November 3 election, a big plus for President Trump, as he seeks a second term. With stocks soaring and the threat of another round of lockdowns becoming less and less likely, it's going to be difficult for challenger Joe Biden to make a case for his Democrat agenda, which includes a nationwide mask mandate and up to a three-month economic lockdown. The polls employed by the mainstream media have Biden leading comfortably nationwide and in the electoral college, though other indicators and polls less publicized have Trump winning handily. A repeat of the on-air crying and teeth-gnashing by left-leaning TV anchors and reporters is a real possibility.

At the Close, Monday, October 12, 2020:

Sunday, October 11, 2020, 9:56 am ET President Trump, slightly overweight and in his 70s, catches COVID-19, goes to hospital for a few days, is virus-free in just over a week. That's a close summary for the news for the week. Everybody can go back to sleep now. Nothing to see here. Move along. There are some observations from outside the mainstream that indicate the coronavirus "pandemic" crisis is fading into the background of the presidential election. Notably, various college football games were quite well-attended. For instance, the nationally-televised #7 Miami at #1 Clemson game had 18,885 fans in attendance. #2 Alabama at Ole Miss was attended by 14,419. #4 Florida lost at #21 Texas A&M, 41-38, as seen by 24,709 in the stands. The list goes on and on, despite restrictions on attendance. Most games were only allowed 20-30% capacity. Apparently, football fans aren't very fearful of COVID-19. It's highly probable that had the authorities allowed the colleges to sell as many tickets as they liked, the stands would have been packed full, but then we'd have to endure the endless fear-mongering from the control media about a "super-spreader" event. Being that it's October, third quarter corporate earnings results will begin to pour in beginning next week. Up first are banks and airlines with JP Morgan Chase (JPM), Citi (C), BlackRock (BLK) and Delta Airlines (DAL) reporting Tuesday. Bank of America (BAC), Goldman Sachs (GS), US Bancorp (USB), Wells Fargo (WFC), PNC (PNC), and United Airlines (UAL) are on deck for Wednesday. Thursday, Morgan Stanley (MS) reports, and on Friday, Ally Financial (ALLY), BNY Mellon (BK), and Citizens (CFG) open their books. Banking stocks are likely to report large trading profits and expanded loan loss or bad credit reserves, while the airline stocks should post incredible losses as they were not allowed to perform any major cost-cutting through layoffs until October 1, via agreement for bailouts issued thought the CARES Act. Airline traffic has been a trickle of what is normally was, thanks to the coronavirus and government restrictions on travel. An aside to the airlines and bank stocks, the US congress and the president have failed to reach agreement on a second round of stimulus, including more money for the airlines and $1200 checks to most adult Americans. Despite the deadlock on a stimulus deal being constant since July, stocks apparently pinned hopes on one emerging from the DC morass. Thus far, they have been disappointed, though one could hardly suspect that considering the outsized gains put up over the past two weeks. All the majors were up more than three percent on the week, with the NASDAQ surging ahead by 4.5%. Some media outlets touted that stock gains were due to investors eyeing a Joe Biden "blue wave" victory for the Democrats come November 3, as if the prospect of increased free money to the masses along with higher corporate taxes and tax hikes on people earning over $400,000 a year - as Biden has promised - is somehow a good thing. The mainstream polls keep putting Biden well ahead of President Trump, though most Americans are aware that the polls are fatally flawed, as evidenced the last time anybody was nearly a "lock" in 2016, when Hillary Clinton was supposed to win in a landslide. We all know what happened then. Thus far, the pollsters haven't mended their methodologies to fall in line with reality. Polling and predictions have become a massive con game and propaganda ploy by the deep state, but, unless the pollsters show Trump making headway over the next three weeks, they're likely to be exposed as frauds again. The pollsters also aren't cognizant of the idea that by showing Biden with a comfortable lead, many Democrat voters may eschew the process altogether, figuring it's in the bag for their man. That may be a part of the plan, however, as the Democrat National Committee (DNC) can then claim low voter turnout as a proximate cause for the demise of their candidates. As backup, they have millions of mail-in votes by which to contest election night results, which also appears to be part of the plan to rid Washington of Mr. Trump and his deep-state-draining entourage. A Trump-Pence victory seems more and more likely with each passing day and each fake news story fed to the largely "not buying it" public. Treasury yields rose substantially over the course of the week, reaching what may turn out to be something of a new norm for long-dated securities. The 10-year note yielded 0.79% at the close of business Friday, up from 0.70% a week ago. Yield on the 30-year was also ahead, by 10 basis points, to 1.58%. Short-dated maturities remained more or less anchored to the zero-bound. Oil rebounded sharply off an October 2nd bottom at $37.05 for a barrel of WTI crude, bouncing as high as $41.19 on Thursday before settling out at $40.60 Friday. The gains can be tied neatly to Hurricane Delta, the massive category 3 storm that came ashore at Southwestern Louisiana, the same area devastated by Hurricane Laura just a week weeks ago. The storm caused extensive damage, left 700,000 homes and businesses without power and caused the shutdown of oil production in the Gulf of Mexico. Most ports and refineries were closed in advance of the storm and will be slowly reopening in the coming week. Getting back to anything resembling "normal" in the area is likely to take months. Precious metals had a roller coaster of a week, but ended positive thanks to intense buying on Friday. Gold was $1899.84 an ounce at the previous Friday (October 2) close, dipped as low as $1878.18 on Tuesday, but closed out the week at $1930.40. Silver engaged in a similar pattern, closing out the prior week at $23.74, dipping down to $23.07 on Tuesday, but rallying the rest of the week to close at $25.15. Here are the latest real sales numbers on common gold and silver items sold on eBay (numismatics excluded, shipping - often free - included):

Item: Low / High / Average / Median Premiums for physical precious metals remain at extremes, though Friday's gains in the spot and futures markets began to bring the paper and physical worlds closer together. Chartists are looking to call the past 2 1/2 weeks a near-term bottom, setting up another major move to the upside for both gold and silver.

At the Close, Friday, October 9, 2020:

For the Week:

|

|

Click the map to create your own at

Click the map to create your own at