| MONEY |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | NEWS/UPDATES | WILD SIDE | CONTACT | ARCHIVES |

Downtown Magazine appreciates reader support. If you find the information here helpful, please consider a contribution to the cause for honest money and honest journalism.

Weekly People's Gold and Silver Prices

Single Ounce Silver Market Price Benchmark

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

5/1-5/7/2022

|

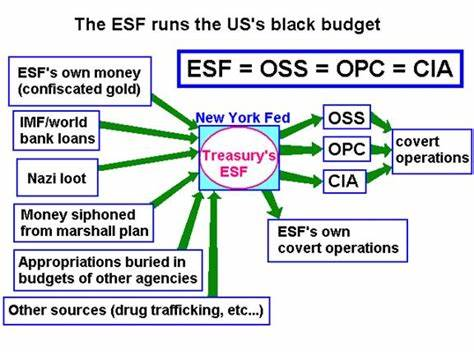

Friday, May 13, 2022, 9:14 am ET Nothing is as it seems. Everything is fake. Eyes gloss over every time the fake president stumbles to the podium to give a fake speech, written by fake staffers, delivered in a fake White House studio. Fake, fake, fake. How about those gas prices? Do you see stations running out of gas? No. There's plenty of gas. Always has been. So, why is the price $4.35 a gallon? It could just as easily be $3.15, or $9.25. There's no shortage. There is a surplus of oil company executives cashing in their vested stock for millions of dollars, however. Stocks seem to be doin OK one day, then not so good the next. Why? Why don't they just go straight up or straight down, or, if companies are actually worth their share prices, nowhere at all? If you owned a company, wouldn't you have a pretty good idea of what it's worth, day-to-day? Shares fell pretty darn hard on Thursday, but, for those who look only at the closing prices, failure to see the intraday activity could be fatal to economic health. The S&P bottomed out at 3859 on Thursday. The Dow was down more than 600 points at about 3:00 pm ET, at 31,228, but ended the day down just a shade more than 100 points. Happy faces on NBC, CBS, etc. The NASDAQ, a complete disaster area, was down 243 points, at 11,221, but closed up 6.73 points. Wow, how fake is that? Each of those intraday lows were the lowest for each index this year, and the lowest dating back about 14 months. For the Dow Industrials, back on February 24, a bottom was struck at 32,272.64. That day, the Dow was down more than 860 points, but ended he session with a gain of 92 points. Remarkable. The last time the Dow was at these levels was March, 2021. The S&P is no slouch in the fakery department. It's closed lower five of the last six sessions, and is on track for a sixth straight weekly loss. That -5.10 loss from Thursday comes straight from theatre of the absurd, as the SPX was down by 76 points with less than an hour left in the session. Regardless, the S&P is at levels last seen in March 2021. It has set 52-week lows in each of its last four sessions. As for the NASDAQ, well, tech isn't what it used to be... or, for those who remember the dotcom but of 2000, maybe it is. One has to go back to November of 2020 to match these NASDAQ levels. But, remember, it closed with a gain on Thursday. Smile. It's all good. Brandon's got this. Even with Thursday's fake rallies and Friday's futures pointing to a radically higher open, stocks will have to really run up the fake flags to avoid another losing week - the sixth straight for the NASDAQ and S&P 500, and a seventh straight for the Dow. At the close Thursday, the NASDAQ is down 773.70 on the week; the S&P is down 193.26 (4.36%), and the Dow has shed a whopping 1169.07 points. Apparently, there's reason for optimism. Asian stocks were up mightily overnight, with the NIKKEI up 678 points (+2.64%) and the Hang Seng (Hong Kong) up 518 (+2.68%). European indices are all surging by close to two percent gains... all of them. It almost seems to be coordinated, and, it probably is. Everybody knows that the Bank of Japan is a major buyer and holder of NIKKEI stocks, just as the ECB regularly trades on the DAX, the CAC, and in other equity markets across the continents. The Anglos are more discreet. The Bank of England has no distinct policy concerning stock purchases or holdings, and in the US, it's either the NY Fed's trading desk, the President's Working Group on Financial Markets (AKA, the Plunge Protection Team), or the gaunt, feckless manipulators at the Exchange Stabilization Fund (ESF). Think about that last one a minute. The Exchange Stabilization Fund. It's name alone reeks of market manipulation. Here's the internet definition:

The Exchange Stabilization Fund (ESF) is an emergency reserve fund of the United States Treasury Department, normally used for foreign exchange intervention. This arrangement (as opposed to having the central bank intervene directly) allows the US government to influence currency exchange rates without directly affecting domestic money supply. Check out this cool chart, courtesy of forbittenknowledgetv.net It's sad and funny at the same time, because the associated video is "unavailable."

Julia Louis Dreyfuss explains:

At the Close, Thursday, May 12, 2022:

Thursday, May 12, 2022, 9:15 am ET This is what happens when people with reasonable expectations of fairness allow elections to be stolen, corruption rewarded, truth to be censored. America and the rest of the world is living (barely) through what is soon to become the Greatest Depression. The financial, societal, and political carnage will put the 1930s to shame. Every day, by design, politicians, central bankers, and deep state operatives conspire to defraud and decimate the common people of the world. In the United States, the media shields the truth and lies to the people about what's happening in the rest of the world. It's all a part of the sick, self-interested lifestyles created post-2000 for the American public to suffer. What's occurring today is the end result of financialization and the economic meltdown from 2008 that was papered over (counterfeited) by the Federal Reserve. Stocks gained dramatically; home prices rose to unimagined levels, and now, food and energy inflation threatens to eviscerate the wealth of the nation. It's all going according to plan by the insiders who stole the 2020 presidential election and probably half of the House and Senate elections as well. Not that it matters if one is pro-Democrat or Republican. They're all part of the same team, their goals being more for them and less for you. They're winning, big time. Let's review: The powers of the government have destroyed cryptocurrencies. Bitcoin dropped to as low as $25,401 overnight. A stablecoin, TerraUSD (UST) is labeled the culprit, failing to meet its 1:1 peg to the US dollar. Not only that, but Coinbase, one of the world's largest crypto exchanges, with 98 million customers, saw its stock trading down 60% over the last five days. Shares of Coinbase (COIN) are down more than 85% from their all-time highs of 2021. In its earnings report, the company reported a loss of $1.98 a share, compared with an expected profit of 17 cents, and sparked panic by disclosing that, if Coinbase goes bankrupt, customer deposits are not protected. This is what happens when idiots bent on making dollar wealth instead of bitcoin wealth allow their exchanges to be regulated by the enemy, in this case, US regulators. Brian Armstrong, shaved-headed CEO of Coinbase, should be immediately fired, then tried for conspiracy to commit fraud with the rest of the Coinbase executives. Thus, crypto is dead. Most of the 16,000 alt-coins were garbage to begin with. Only Bitcoin had any promise of value, and it is being decimated. If you're holding any cryptos today, YOU MUST SELL THEM IMMEDIATELY. Your alternative is the US dollar, itself not a very stable currency, with sanctions against countries that produce essential commodities like oil, wheat, natural gas, fertilizer, and inflation at the "official" rate of 8.3%. US stocks were battered again on Wednesday. Year-to-date, the Dow Industrials are down 13%, the S&P 500 off 18%, and NASDAQ down 28%. Some morons, like perma-bull Gregory Mannarino and his purported 200,000 followers, claim that the recent downturn is nothing more than a technical correction. Mannarino is currently suffering through the third phase of grief, bargaining, telling his followers that there is no bear market yet, but a collapse is assured at some future date. Instead of going short, playing puts or getting out completely, Mannarino has advised viewers to accept and readjust. He's still touting cryptocurrencies, gold, and silver as escape mechanisms from the coming catastrophic collapse of all fiat currencies. Meanwhile, stocks, cryptos, gold, and silver have all trended lower. What Mannarino fails to understand - beyond his tacit denial of a bear market - is that there are no safe havens and being 100% in cash is probably the best option. The five stages of grief are explained in detail here. [PDF] Holdings of gold or silver in one's possession should remain in safe keeping. Buying at current price levels is financial suicide. Everything will price lower, including food and energy, when it becomes clear that the current economic recession is a much greater force than consumer price inflation. Demand destruction is well underway. Layoffs from major business concerns are months away, though some companies in the financial sphere - especially in the mortgage business - have started letting employees go. Prices will be slashed because money will be scarce. One only needs patience and a keen eye for bargains. Adjusting one's expectations is also a key to surviving the current and future environment. Beyond the obvious implications of financial armageddon, there's also various "conspiracy theories" about the New World Order, Klaus Schwab's Great Reset, and the supposed disinformation over complications from vaccines. There is little doubt that some powerful people would like to see the world's population slashed by 20, 40, maybe 70 percent. Evil exists. Your job is to identify it, avoid it, and, eventually, conquer it, not an easy task. Just for the heck of it, yesterday, May 11, was the 51st day the S&P 500 closed in negative territory this year versus 38 days with gains. Yes, the bears are winning, 51-38. Imagine, or maybe you're one of the lucky ones with $1,000,000 in a 401k or other retirement plan. If you passively tagged the S&P, your million is now $820,000. Now, you could take it all out of the market, pay a 10% penalty and maybe another 15-20% in capital gains taxes, so, you don't. Your financial advisor is probably telling you to re-allocate or diversify. It won't matter. You'll lose more as everything goes to finance hell. You could have sold everything in January at a 10% loss and had 15 months before having to pay taxes, but you didn't. When you're down 30-40% later this year, you'll probably panic and sell then. Bigger losses. You're so screwed. And that, my friends, is all part of the plan.

At the Close, Wednesday, May 11, 2022:

Wednesday, May 11, 2022, 9:20 am ET Stocks bounced, dead-cat style, on Tuesday following Monday's rout, but relented midday, giving back earlier gains. While the Dow and NYSE Composite posted losses, the NASDAQ and S&P sported gains at the close. Volatility was still apparent, with the VIX remaining above 30 as traders and speculators remained cautious ahead of Wednesday's CPI release. As it turned out, those harboring a degree of fear and anxiety were proven right when April CPI - the key measure of US inflation - came in hotter than expected, with a year-over-year increase of 8.3% and core inflation - all items less food and energy - at 6.2%. Expectations were for gains of 8.1% and 6.0%, respectively. Reaction to the headline numbers was immediate and pronounced. Dow Futures, which had been hovering around +300 earlier in the morning, fell to -189 within 20 minutes of the data release and drifted even lower (-240) as the cash market open approached. S&P and NASDAQ futures fell in similar fashion, setting Wall Street up for a very dour opening bell. The month-to-month increase was just 0.3%, a significant decline from the 1.2 rise in March, but it as the YOY readings that spooked the street. Bright spots in the report were sparse, with the broad energy gauge down 2.7% for the month, along with used cars and trucks (-0.4) and apparel (-0.9%), but they were overshadowed by the gain in food, which was up 0.9% in April and are 9.4% higher than last year. Among the standouts were piped utility service (natural gas), which gained 3.1% over the course of the month, new vehicles (+1.1%), and transportation services (+3.1), as airline and car rental prices surged higher. The numbers show no signs of abating any time soon. Even though energy prices were down in April, they'll likely shoot back up in the may reading, as gas prices at the pump are reaching or have already breached record-setting levels in most of the 50 US states. With inflation somewhat out of the hands of regulators, what may be worrying investor types is continuation of the Fed's planned rate increases, set for back-to-back 50 basis point hikes at the June and July FOMC meetings. Given that first quarter GDP already posted a negative number, showing contraction in the general economy, the combined 1.00% increase in the federal funds rate will occur prior to second quarter GDP results being released. Another negative GDP print for the second quarter would put the country firmly in a recession just as the Fed applies the brakes to the economy, a policy mistake without equal in modern times. Prior to the CPI release, markets were looking at a session of gains, though the reality of persistent high inflation dashed those hopes, setting up another day of widespread losses across all asset classes. Welcome to Joe Biden's new world, green climate change economy. Eat bugs.

At the Close, Tuesday, May 10, 2022:

Tuesday, May 10, 2022, 7:40 am ET Editor's Note: Apologies to our 17 readers and countless financial professionals who vainly try to dismiss the accuracy of Money Daily. Due to a complete internet outage, Money Daily was unable to publish two daily posts, from Friday, May 6, and Sunday, May 8. The service provider was generally lax about restoring service. There's no way to apologize for greed and/or laziness. Stocks continue their descent into market hell. After Thursday's (May 5) monstrosity, the major indices suffered minor losses on Friday, but the start of the new week saw retail investors dumping everything. It appears that the Fed's policy error (raising rates while entering a recession) has not been lost on Joe and Jane Winebox, who are anxious about what used to be their retirement fund turn into a declining store of value amidst rampaging inflation. Their cousins, Joe and Jane Sixpack, are too poor to own stocks or even contemplate retirement. Food stamps and Social Security are their last, best hopes. It pays to disregard hopeful commercials of retirees jogging through forests and mountains or running a vineyard and wine business in their golden years. A retirement of substance is a phenomenon of recent vintage, begun in the aftermath of World War II when Americans were afforded the luxury of having the world's reserve currency and unmatched prosperity while the rest of the world was either rebuilding from the war or emerging from abject poverty. Retirement for the privileged class of Greatest Generation and Baby Boomer high achievers is no longer attainable. It's a myth for most. For the better part of the last 5000 years of civilized societies, the average person could reasonably be expected to begin working for tidy wages at an early age, often under 14, and continue until he or she keeled over. The good life was reserved for the rich and powerful. Thus, as the American experiment is shredded for the millennials and beyond, hope for a brighter future has been dashed. The Federal Reserve and their associated central banks around the world have tethered their fates to fiat currencies, backed by nothing more than greed, avarice, and the gullibility of the working classes to accept sheets of paper emblazoned with presidents or world figures as payment for their labor. It's never worked. It isn't working now and won't work in the future. Only hard money, backed by silver or gold or another scarce, tangible commodity is worthwhile. The fiat era is coming to a quick conclusion. Within the next four to six years, dollars, yen, euros, pounds, et. al., will be as worthless as other papers such as wall, crepe, or toilet. The policy error of the Federal Reserve is something of a misnomer in that it's not an error at all. The assembled central bank top echelon know exactly what they're doing, dismantling a Ponzi scheme that has run its course. Every industrialized nation - from Japan, to France, to the United States and Germany - owns debt at levels that have become unpayable and a burden upon the citizenry. Worse yet, these great nations own each other's debt, laughably holding the trash in their central banks as reserve assets. The US holds yen, and euros, the EU holds pounds, dollars, etc. Japan, the worst of the bunch and surely the first which will fail, holds a couple trillion worth of dollar debt, some in euros, and a little gold. The Japanese economy is such a twisted, tortured mess that the Bank of Japan (BoJ) is a major investor in most of the nation's corporations, many of which are insolvent or near to be. The United States isn't much different, other than the way in which it hides the truth. Not only is the federal government $30 trillion in debt, the assets held by the Federal Reserve are valued at over $9 trillion, when in fact they are worth maybe 50% of that. The Fed holds various government bills, notes, and bonds, in addition to enormous holdings of mortgage-backed securities (MBS, packaged mortgages), most of which will eventually hit the market at levels well below par value. This incestuous global relationship between sovereign governments and central banks cannot continue fooling people for much longer. The only thing holding together the global economy is normalcy bias. People just don't have any alternative to fiat currencies. Thus, the general citizenry will be ravaged by inflation and recession at pretty much the same time. Investors, whether they be of the fixed income or risk asset variety, will feel the intensity of currency collapse as there is no place to turn. Stocks are being savaged, bonds and fixed income aren't keeping pace with inflation, cryptocurrencies are fading fast while gold and silver are pummeled on a regular basis. There is no safe haven, by design. Everybody is going broke at once. Comparisons to the stock market crash of 1929 are appropriate, despite the lack of suddenness that characterized the start of the great depression. While stocks continue their decline and the bond market is blown to pieces by the Fed's tampering - first with ZIRP and QE, now with inflation and recession - the slow burn may possibly be more painful in the longer scheme. It's the difference between having an arm or leg severed or watching it slowly disintegrate via infection. The acute pain of amputation may be preferable to the agony of withering atrophy for most, but, today, in our no-pain, everybody-gets-a-participation-trophy world, amputation of your assets isn't on the menu. You must suffer the slow death. There will be survivors. Those who never had much to begin with, the resourceful poor, will suffer the least and survive the best. As it is, they already know how to live without luxury. Their expectations are low. If stocks lose 60-70-80 percent of their value, it means little to them other than they may lose the shitty job they've slaved at for years, never making enough to save more than a pittance. To them, the new world will look very much like the old one, except that there will be more people at their level than before. The poor will teach the formerly-well-to-do how to cook, salvage, scrounge, save. They may not know a whit about investing, but they know plenty about living and keeping expectations at realistic levels. There's plenty for many to learn.

At the Close, Monday, May 9, 2022:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|

|