| MONEY |

| HOME | PRICE GUIDE | STORE | BLOGS | SPORTS | BUSINESS | NEWS/UPDATES | WILD SIDE | CONTACT | ARCHIVES |

Downtown Magazine appreciates reader support. If you find the information here helpful, please consider a contribution to the cause for honest money and honest journalism.

Weekly People's Gold and Silver Prices

Single Ounce Silver Market Price Benchmark

Money Daily has been providing business and financial market news, views, and coverage on a nearly continuous basis since 2006. Complete archives are available at moneydaily.blogspot.com.

PRIOR COVERAGE:

8/8-8/14/2021

|

Friday, August 20, 2021, 9:26 am ET At some point, you're unable to separate truth from satire. In the manic world that has befallen the planet, our aristocratic overlords, media numbskulls, Big Pharma, and the gang of usual tyrannical suspects try desperately to make the plebes believe their lies are truth and that all is well under the magnanimous leadership of Joe Biden and the infallible congress (RINOS included as a major part of the problem). If you think it was strange that all of the major equity markets in the world, except those in the United States, were down between 1.5 and 2.5% on Thursday, but the US managed to toe the UNCH line, you've got your eyes open at least and maybe your ears. You probably think that redneck in the truck on the steps of the Library of Congress, claiming he had a bomb, was an FBI false flag gone horribly wrong. According to those crack reporters at Yahoo! News (this is at least the third time we've warned about trusting news organizations that have an exclamation point in their name), he was a Deranged MAGA Supporter... It was a poorly-executed, rigged attempt at shifting the narrative away from ________________ (take your pick: Afghanistan, Delta, stock market, housing starts) that failed horribly. Notice how quickly the story disappeared from the headlines. Big Fail, like just about everything else in the make-believe real world of TV, Wall Street, Washington, DC. Meanwhile, the rest of the planet continues to melt down. Thursday's PPT (Plunge Protection Team) managed to keep stocks from self-immolation because that would be bad. Some people might think about selling their stocks and buying gold or silver or just holding cash. Some people did actually go out and buy Bitcoin, which ramped nicely overnight above $47,000. The people promoting Bitcoin and any other cryptocurrencies are (with a few exceptions) the same people who pushed Enron shares, or who thought Bear Stearns and Lehman Brothers were solid companies. Bitcoin might be an easy way to rack up some gains, but, long term, it's doomed. Governments around the world will regulate and legislate it out of existence eventually. For now, the Wall Street wonderful are herding the unsuspecting masses into the crypto camp, for better or worse. The brokers make commissions on both ends of the trade. Keep that in mind. There was a time when people doubted the existence of the so-called "Plunge Protection Team." That was back in the days before the GFC, but then people started finding out how the President's Working Group on Financial Markets was created in 1988 by President Reagan in response to the Black Monday crash of 1987. Anyways, the PPT is old hat. Wall Street has computer algorithms that can control much of the trading, plus dark pools, HFTs, and all sorts of other spoofing and bid-rigging tricks to keep markets from doing what they would normally. So, crash averted for a day, maybe a week, maybe longer. After the GFC of 2007-09, there have been a multitude of crashes and corrections averted by the government and their banking operatives, the Federal Reserve. Make no doubt about it though. The world is in a world of hurt. Hong Kong's Hang Seng sank into a bear market on Friday, closing at 24,849.72, -466.61 (-1.84%). It officially entered bear territory (-20%) when it broke below 24,946.69. Japan's NIKKEI, ever the leading indicator, fall further into correction, heading for bear badlands. It was down another 268, to 27,013.25. Back in February it was 30,714.52. It's been falling ever since. So, there you have it. Karma will send whatever is ailing China and Hong Kong and the Pacific Rim to Europe and America (Canada, too). Approaching the New York open, European stocks have shed some of their losses on the day and US futures have been in rally mode since early this morning. This being Friday, the Dow needs to rally 621 points today to avoid its second straight losing week. The NASDAQ is down 281 through Thursday's close. A red finish to the week would be the third straight weekly decline for the NAZ, and its fifth in the last seven. Only needing a 62-point gain on Friday, the S&P 500 has been damaged the least this week, but, like the Dow, could be headed for its second straight weekly loss. So, are you still buying the dip, or, like dying folks, "getting your affairs in order?"

At the Close, Thursday, August 19, 2021:

Thursday, August 19, 2021, 9:15 am ET "Nero fiddled while Rome burned." This well-known idiom of Western culture can easily be applied to modern events. Beginning with the rout and disorder in Afghanistan, as the American empire crumbles before our eyes, Joe Biden drools into his tapioca pudding, the US congress is away on vacation, Google, Facebook, and Twitter banish the truth, the media lies and lies and lies some more, and people are told to step into line, take another shot, and another, and another... Overnight - actually, early morning in America - Toyota sent the global economic miasma into a further state of spasm by announcing that it would cut production of autos in September by 40% from its prior outlook. The cut will reduce Toyota's global production for September from 900,000 automobiles to 500,000, a 40% reduction. With that, and on top of the unfolding disaster in Afghanistan, fear-mongering spreading globally over Delta variants of some virus, a bad miss on July retail sales, Wednesday's FOMC financial false flag over tapering its asset purchases from the release of July's meeting, a seven percent decline in housing starts, two straight days of losses in US equity markets, the bad news is piling up, investors are panicked, and the beginning of the end is at hand. Ignore the warnings at one's own peril, but Rome is indeed burning. There aren't going to be any more stimulus checks coming, rents and mortgages cannot be whisked off the income statements by moratoriums forever, people refusing to work today will be begging for jobs tomorrow when the bonus unemployment funds expire. There are so many problems facing the economy, society, and the existing, useless political structure that stocks cannot continue to play make-believe with their fake fiat dollars much longer. Everybody knows this is coming, just like everybody knows Trump won; it's just that some people can't come to grips with reality until they are forced to do so. Fiddling away, the feckless cretins who unashamedly call themselves "people's "representatives" are sunning back in their home states, or, more likely, on some distant beaches, having stolen out of town leaving a $1 trillion infrastructure bill, a $3.5 trillion reconciliation budget, and the US Treasury operating under "extraordinary measures" without an increase or suspension of the debt ceiling, up in the air. Joe Biden, Kamala Harris and their cohorts in the congress have shown America and the world what failed leadership looks like. We are about to discover the nasty underside of its effects, and, from preliminary views, it's not looking very pretty. The world has been through 18 months of sheer lunacy from political pretenders, financial fraudsters, medial malingerers, and medical malpractitioners. It's all coming to a head. To those who forgot or weren't awake (or still in high school) during the last crisis in 2007-2009, it should serve as ample warning that seriously bad financial crises often begin to manifest themselves in August. In terms of the GFC, the warning shots were fired in August, 2007, but the crash didn't occur until October, 2008 and the bottom didn't happen until March, 2009. Those mindful of history may want to prepare for five or more years of sadness, grief, and financial repression, because this is likely to the proverbial "Big One." Cans can't be kicked down dusty roads forever. There are always, eventually consequences. The road ends or the can fills with detritus or both. On July 19, 2007, the Dow Jones Industrial Average closed at 14,000.41, an all-time high. By August 16, it closed at 12,845.78. Though the Dow would eventually regain its balance an make fresh records in October, the stage had been set, the candle burning at both ends. The Dow slid sideways, briefly trading in the 13,000s, but by November it fell below that into the 12,000s, and by June, 2008, was down in the 11,000s and 10,000s. October's crash took it down to 8,175.77 (October 27, 2008). Eventually, as CNBC's Mark Haines famously called the bottom, the Dow closed at 6,547.05 on March 9. It took nearly four more years - February, 2013 - for the Dow to surpass the highs of October 2007. In retrospect, the 5 1/2-year roller coaster ride was a remarkably short time. Essentially, everything since 2009 has been vacuous, manufactured hot air, courtesy of unlimited credit, stock buybacks and conjuring currency out of thin air. Now, less than a half hour until the opening bell, another 348,000 individuals have reportedly signed up for initial unemployment benefits, sending stock futures off session lows but only slightly. Dow futures are down nearly 300 points, S&P's off by 30. Japan's Nikkei, which has been a useful leading indicator for many months, fell to the lowest point of 2021, at 27,281.17. It has been declining since February and is now down for the year. In Hong Kong, the Hang Seng lost 550 points, or two percent. Stocks in Europe are uniformly down between 1.75 and 2.60 percent, France's CAC-30 leading the way, down 2.53%. Welcome to the pain clinic. Pay no attention to that violin music in the background.

At the Close, Wednesday, August 18, 2021:

Wednesday, August 18, 2021, 7:25 am ET Events unfolding in Kabul, Afghanistan were unmistakably bad for US foreign policy. There for the entire world to see was US exceptionalism reduced to chaos and the blabbering of an old man at a podium, blaming everybody but his own administration. For Americans it was disheartening. For the rest of the world, maybe a breath of fresh reality. For Wall Street, disdain, and a black eye. Not helping matters any was the July report from the Commerce Department that showed retail sales off by 1.1% last month. Economists polled by Reuters had forecast retail sales slipping 0.3%. Sales increased 15.8% compared to July last year, but that was during the heart of the virus crisis, so those numbers don't count. Cross them out like you would a bad race by a horse on the racing form. Put a line through it, forget it. That's how the system rolls now. Just cross out any bad data like it never existed. While the federal government seems almost certainly to have reached peak stupidity, it's also quite possible that stock markets have reached peak valuation. It looks to be all downhill from here, as everything that's been faked for the past 18 months begins to fall apart. Reports coming in from France indicate that most businesses are ignoring government directives to require vaccine passports from customers. The French are very good at civil disobedience. Americans will find out they they too can thwart the government's efforts to enslave and segregate them when similar restrictions begin to be implemented in New York, Los Angeles, San Francisco and other "blue" enclaves of hypocrisy. There aren't just "pockets" of resistance in America. There are entire states full of resisters, potential protesters, and civil disobeyers. Whether or not the officials representing "us" were elected, they don't have the privilege of running roughshod over the constitution or people's rights and freedoms. Getting them to understand this very basic principle of democracy and constitutional republicanism is going to take some time and a large effort, but there's 330 million people in this country and probably more than half of them don't approve of what's been happening to their towns, cities, and country. Americans are sick of the vaccine pushers, the lying media, the phony government, the one-sided narratives, the censorship, the assaults on our freedoms and intelligence. Here comes the ugly push back. Feel free to join in at any point. It's only just getting started.

At the Close, Tuesday, August 17, 2021:

Tuesday, August 17, 2021, 8:45 am ET Overshadowed by the United States' poorly-planned hasty retreat from Afghanistan, stocks spent the bulk of Monday's session making up ground after initially large losses. By 10:30 am ET, the Dow Jones Industrial Average was down 300 points, the NASDAQ down 200, and the S&P 500 had shed some 30 points. Once the algos were adjusted to reflect the new reality of life after 20 years of war in Afghanistan, all indices rose together, producing, by day's end, reasonable gains on the Dow and S&P, and small losses for the broader NASDAQ and NYSE Composite indices. Coordination of markets in the face of disturbing news - a phenomenon occurring with greater frequency this century and especially so since the 2008-09 market collapse - has to be viewed in greater context than simple one-off, one-day relativism. With Americans and native Afghanis attempting to flee the country on the pretext of a failed military and political excursion into nation-building, the Afghanistan experience is going to spawn repercussions beyond its borders, not just in the renewed threat of terrorism, but in all aspects of social and financial life. The after-effects are not likely to be easily identified initially, but the downside of losing a protracted war against a hopelessly outnumbered, though spirited counter-insurgency, and the haphazard manner of departure will be subtle, but at the same time, an indelible stain upon the proponents of militarized capitalism and forced repression. By leaving Afghanistan to the very foes it sought so ardently to defeat - the Taliban - the United States, complete with unelected president and a pistol-whipped congress has been exposed as worse than a paper tiger. Paper tyrant may be a more appropriate moniker for the world's glowering reserve-currency menace. The rest of the world will increasingly show distrust towards the United States, and for good reason: the Afghanistan experience cements the notion that the former beacon of freedom has been reduced to a candle flame's level of liberty for all. The United States freed nobody, protected nobody, nor aided anybody in Afghanistan other than its inner circle of connivers, self-dealers and political hacks. It bullied a poor nation over a generation for no other reason than the promotion of a mythical "War on Terror," which can now align itself with America's other great war failures, the War on Poverty and the War on Drugs. Under the current leadership, the United States has positioned itself to lose the current wars in which it is engaged, the self-imposed War on Virus and the less-understood wars on privacy, free speech, citizenship, intelligence, morality, and decency. Afghanistan, a threat to virtually nobody, provided the plotters inside and outside the Pentagon with a petri dish for asymmetrical warfare and the federal government with a convenient slush fund for all manner of covert operations, diversions, and distractions. If images of the general chaos in Kabul - Afghanis clinging to departing airplanes and the newly-empowered Taliban patrolling the streets - tells anything, it is that the United States has reached the end of its dominance and the world had best prepare for a period of multi-polarization, without a guiding light, a moral compass, or a determined purpose. Until the United States fixes its own problems, the rest of the world cannot rely upon it to fix anything.

At the Close, Monday, August 16, 2021: Sunday, August 15, 2021, 12:15 pm ET

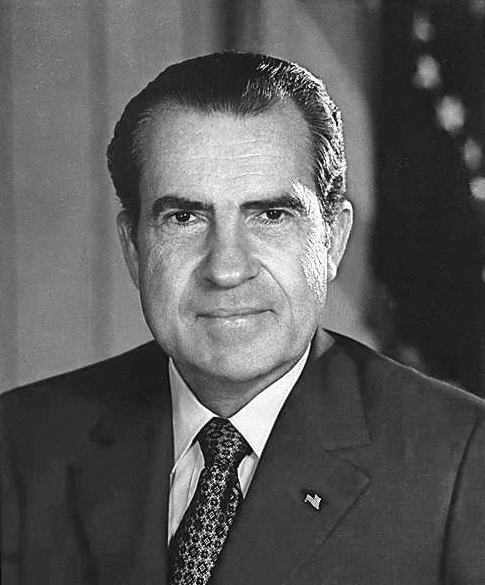

I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States. With those words, 50 years ago today, then-president Richard M. Nixon closed the gold window and ended the 1944 Bretton Woods fixed currency exchange rate agreement that had been the cornerstone of international finance since it became operational in 1958. Known forever more as the "Nixon Shock," the August 15, 1971 nationally-televised address to the nation radically changed the structure of international finance and trade. The United State, a powerhouse following World War II, went from being a creditor nation to eventually the world's greatest debtor nation, from an industrial giant to a to a global bully of financialization. Currencies, which used to be backed by gold or silver, or both, became tokens of diminishing purchasing power as industry moved from West to East and free-floating currencies fueled inflation on a global basis. When Nixon closed the gold window, his use of the word "temporarily" was misplaced at best, disingenuous at worst. Not an economist, Nixon could hardly have perceived what lay ahead for the United States and the world at large. 50 years hence, the United States remains the world's greatest financial power, though its might is largely the result of the coordination of a conglomerate of central banks, from the ECB to the Bank of England, to the Bank of Japan. The era of unsound money backed by "faith and credit" has been a boon to some, a bane to many more. Wealth inequality has reached its highest level in the modern world. Prosperity seems to have gone from achievable to merely a notion, reachable by few. The rich have become super rich while the poor have become a permanent welfare class. Half a century has commenced since the historic night of August 15, 1971. What the next fifty years will bring appears to be more perilous with every passing day.

Predictably, the Sunday TV news propaganda parade made no mention of the Nixon speech, focused instead on events in Afghanistan and the virus spread in the United States. It's perhaps fitting that the self-annointed voices of truth completely misconstrue or overlook the words of philosopher and Harvard professor George Santayana... "Those who cannot remember the past are condemned to repeat it." To those of us who believe that history is worth remembering, Money Daily is pleased to to present the complete televised Nixon address in it's entirety.

Marshall Gittler, Head of Investment Research at BDSwiss Group, offers his opinion and some nice charts at NASDAQ.com on the "Nixon Shock." Here is the Fed's view and summation, by Sandra Kollen Ghizoni, Federal Reserve Bank of Atlanta. Danny Bradlow provides insight into how Nixon's actions affected the IMF, South Africa and Africa as a whole at Investing.com. With that abundant history forever in the rear-view mirror, here's a brief summary of the week just past and a look ahead. Stocks gained across the board over the course of the week, with the Dow Jones Industrials leading the major indices and the NASDAQ just barely squeezing out a gain. Investors were somewhat relieved with Wednesday's CPI figures for July, which showed inflation slowing a bit from its previous gallop in April, May and June. July's reading of +0.5% was in line with analyst estimates, and down from the unrevised +0.9% reported for June, which was the highest month-over-month reading in 13 years. Year-over-year, the CPI made a new 30-year high at +5.4%. Thursday's Producer Price Index (PPI) offered a slightly different perspective for investors when it came in hot at 1.0% for July. Since producer prices almost always are reflected in final goods' prices months down the road, the surprise reading sent shivers down more than a few spines, suggesting that the headline inflation in CPI may have taken what amounted to a brief vacation and that more consumer price hikes are just around the corner. Inflation fears largely drove treasury yields at the long end of the curve, with the 10-year hiking to 1.36% and the 30-year to 2.03% on Thursday only to be tamped (maybe tampered) down to 1.29% and 1.94%, respectively, on Friday, right about at the levels they ended the prior week. Large single-day moves in yields such as those from Friday used to be a big deal, but they've become more normative recently and seem to be occurring with regularity primarily on Mondays and Friday. The phenomenon is either indicative of the Fed exerting yield curve control or some heavy hitters pushing and pulling the market around. Whatever the case, it appears suspicious in a market as gargantuan as the treasury complex. See for yourself. Oil prices continued to trend under pressure, as they have all of August, falling to a low of $66.48/barrel on Monday, recovering through the week to close at $68.44. The recent level is just above a support area in the $62-66 range, and well off the 3-year high of $75.23, from July 1 of this year, coincidentally right before the long Independence Day weekend. Faux president Joe Biden made headlines this week when he publicly called on OPEC to boost oil production to bring the price down. His remarks spurred a gush of criticism, especially from US energy producers and officials in oil-producing states, such as Texas Governor Greg Abbott and Oklahoma Governor Kevin Stitt. Biden shut down the Keystone Pipeline and suspended new leasing for fossil fuel production on federal lands and waters his first day in office, harming US energy producers and putting the United States at the mercy of foreign elements. Under presidents Obama and Trump, the United States became the world's leading producer of oil and natural gas, but Biden's policies have reversed that effort towards energy independence as gas prices remain high, averaging $3.18 a gallon nationally according to AAA, up a full dollar from where they were a year ago. Biden's rambling policy directives have been widely criticized during his brief stay at the White House. His latest remarks have angered energy proponents across the political spectrum, from environmentalists to big oil executives. While there was just a trifling of pain in the oil patch, precious metals were being roundly mistreated by operatives at the LBMA and in the COMEX futures markets. The smackdown which began on Friday of the prior week (August 6), resumed in earnest Monday, taking gold down to $1726.50 and silver to $23.27. Silver fell even further,, dropping down to $23.12 on Thursday before advancing to $23.78 to close out the week. Gold recovered to $1778.20 by Friday, but the damage had been done. Dealer prices are well below where they were a year ago, when gold made an all-time high over $2000 per ounce and silver was approaching $30 an ounce. The pricing schemes at the high volume end of the market have produced some of the desired effect on retail prices though demand remains strong and premiums high. Even with spot silver below $24, it's difficult - though becoming more common - to find small quantities (1-10 ounces) below $30. With the rumor mill at full throttle, suggesting that traditional gold investments are being replaced with parlays into Bitcoin and cryptocurrencies. Whether or not that's factual is widely debated, though the falling price of gold seems to suggest that at least some supporters of bullion have shifted their focus to other alternatives. Here are the latest prices for common one ounce gold and silver items sold on eBay (numismatics excluded, shipping - often free - included):

Item: Low / High / Average / Median The Single Ounce Silver Market Price Benchmark (SOSMPB) settled at $39.92, a decline of 86 cents from last week's price of $40.78. This marks the fifth straight week that the SOSMPB has dropped in price, from a high of $42.84 on July 11 and the first time it's fallen below $40/ounce since January 31 ($37.60). Bitcoin made a fresh three-month high early Satruday morning at $48,176, but since has backed off to just under $46,000. The rally since July 20 has been typical Bitcoin, rising from just below $30,000 in the course of less than a month, a gain of more than 50%. It's been easy money for the smart set, with a good deal of confidence restored to the crypto community. Adherents to the cryptocurrency convention are sticking with it while the no-coiners insist the entire space is just another bubble manifestation. One thing is certain: traders can make or lose a lot of money in a hurry betting on on against cryptos. Rolling through the dog days of August, the week ahead looks like more of the same, though without the antics of congress for a change, as the Senate finally got around to passing the $1 trillion infrastructure bill over to the House of Representatives and took initial steps toward the $3.5 trillion budget reconciliation which House Speaker Nancy Pelosi has vowed must be approved by both the House and Senate prior to the infrastructure bill. Congressional committees will have until September 15 to craft the various sections of the sprawling budget bill, expected to be ready days before the House reconvenes from its August recess on September 20, though House Majority Leader Steny Hoyer said the chamber would return August 23, though because of proxy voting, not all members will physically be in the nation's capitol. The Senate, which delayed its own recess by nearly two weeks, will return on September 13 to gein tackling the thorny issues of the budget. While Americans get a break from the Washington whiners, the threat of a government shutdown over failure to pass or suspend the debt ceiling looms ominously, though Treasury Secretary Janet Yellen has assured the politicians that there's ample funds for the government to meet its obligations into October. It would be unwise for congress to dally on the debt ceiling, as they have learned from past experience, though none seem to be in any kind of hurry to take up the matter. That said, Wall Street will be looking for more clues on where the economy is headed from economic reports in the coming week. Monday features the Empire State (NY) manufacturing index prior to the opening bell (8:30 am ET). Here's a brief look at the major data events calendar:

TUESDAY, 8/17 Earnings season winds down, though it has been stellar, with more than 90% of companies reporting beating estimates. Some of the bigger retail names report second quarter results this week, including Wal-Mart (WMT) and Home Depot (HD) Tuesday morning; Target (TGT), Lowe's (LOW) and TJX Companies (TJX), Wednesday AM; and, Macy's (M), Kohl's (KSS), Estee Lauder (EL), and BJ's Wholesale (BJ) Thursday, before the bell. Happy trading. That's a WEEKEND WRAP.

At the Close, Friday, August 13, 2021:

For the Week:

All information relating to the content of magazines presented in the Collectible Magazine Back Issue Price Guide has been independently sourced from published works and is protected under the copyright laws of the United States of America. All pages on this web site, including descriptions and details are copyright 1999-2026 Downtown Magazine Inc., Collectible Magazine Back Issue Price Guide. All rights reserved.

|

|